Review of Australian Shares

The prospect of the RBA cutting interest rates and the additional downward pressure this has put on the Australian Dollar has flattered the ASX but is additionally positive for the financial sector. Additional easing will lend assistance to the property market and therefore demand for loans.

The S&P/ASX Financials Index is outperforming the wider market and broke out of an almost yearlong range this week. The vast majority of constituents have attractive yields and qualify for full franking which boosts the total return even further. Financials have been popular investments among Australian investors over the last four years for just this reason and because the resources sector has been so moribund.

I thought this would be an opportune time to click through the Australian equities section of the Chart Library. I chose to highlight net yields for the below shares because of the differing franking rates available of various securities.

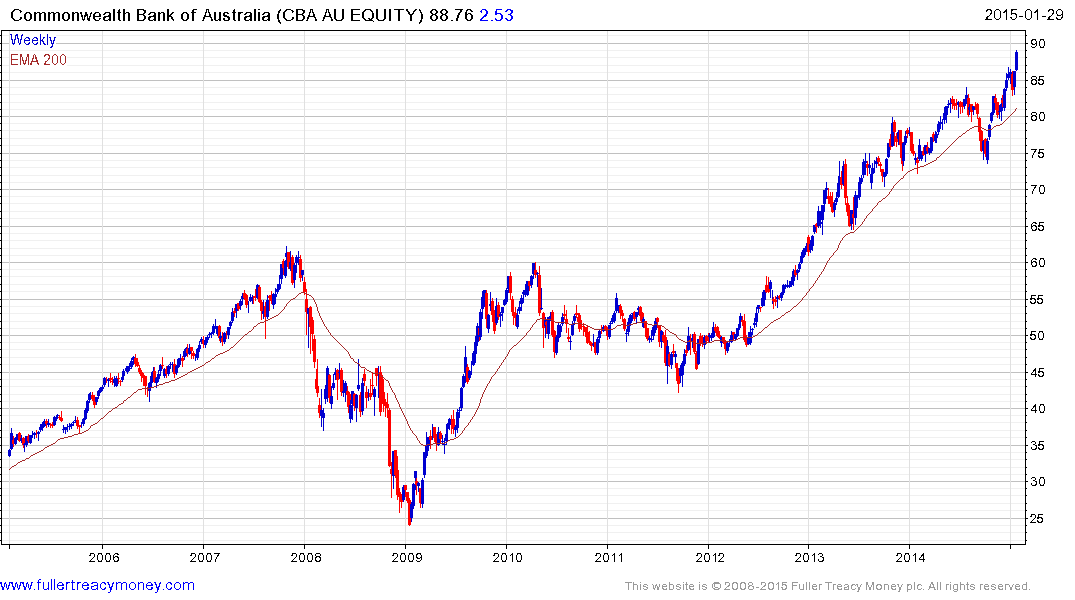

Among the banks Commonwealth Bank of Australia (Est P/E 16.01, DY 4.52% Net) remains a clear outperformer and while somewhat overextended at present a sustained move below the 200-day MA would be required to question the consistency of the medium-term uptrend.

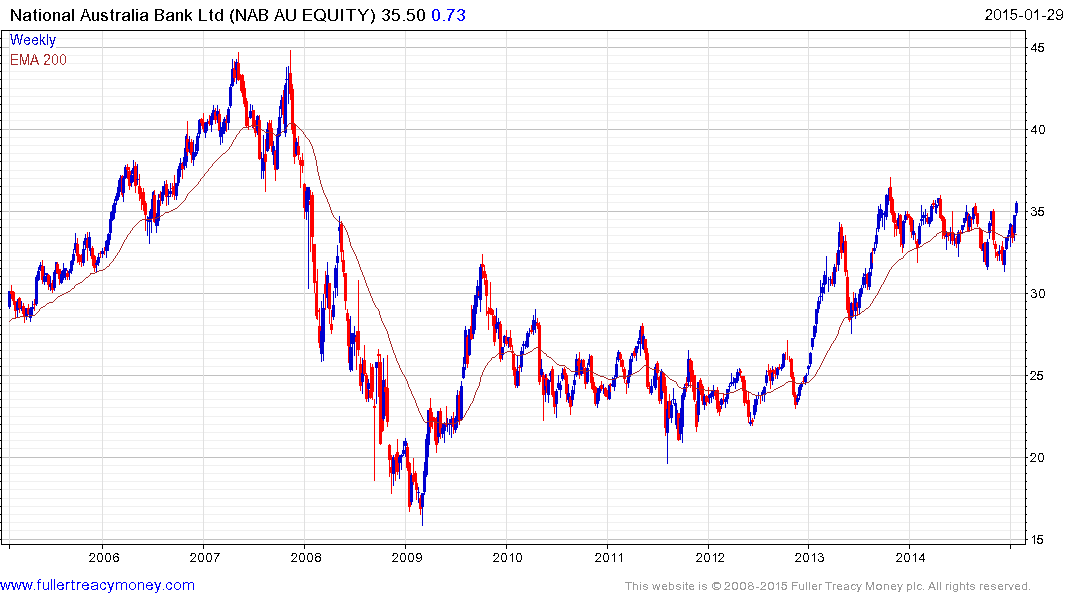

National Australia Bank (Est P/E 12.88, DY 5.58% Net) rallied this week to break a yearlong progression of lower rally highs and a clear downward dynamic would be required to question potential for additional upside.

Among somewhat smaller banks Bendigo & Adelaide Bank (Est P/E 14.33, DY 4.73% Net) remains in a reasonably consistent uptrend and broke out to new recovery highs this week.

Within the asset management sector AMP (Est P/E 16.76, DY 4.14% Net) is testing the upper side of a four-year base and a sustained move above A$6 would reassert medium-term demand dominance.

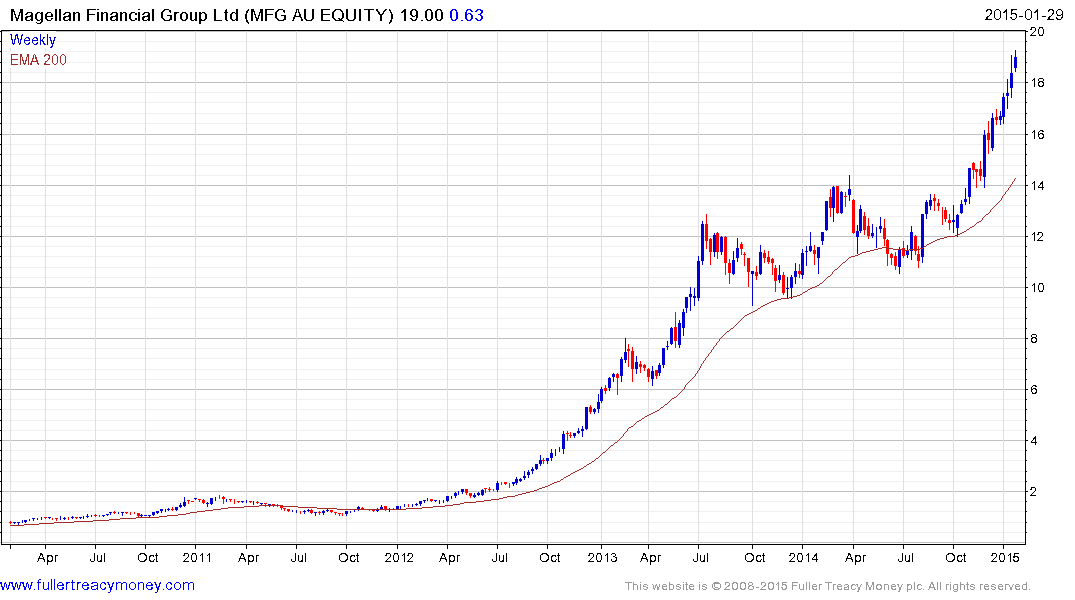

Magellan Financial (Est P/E 23.99, DY 2.02% Net) is accelerating higher and the first clear downward dynamic is likely to signal a peak of medium-term significance. Platinum Asset Management and Tower Ltd are also overbought; at least in the short term.

Elsewhere in the financial sector ASX Ltd (Est P/E 18.64, DY 4.68% Net) is currently rallying to test the upper side of its six-year base.

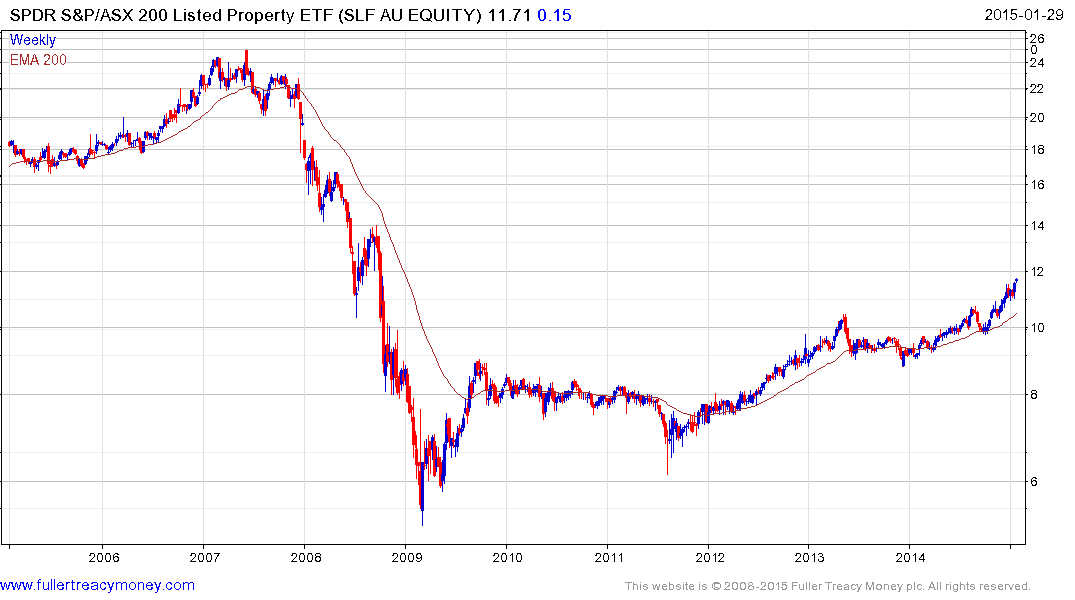

The Australian REITs sector shares a high degree of commonality with that in the UK (reviewed earlier this week). The SPDR S&P/ASX 200 Listed Property Fund ETF has a net yield of 4.79% is somewhat overextended at the present time but continues to hold a progression of higher reaction lows following pullbacks.

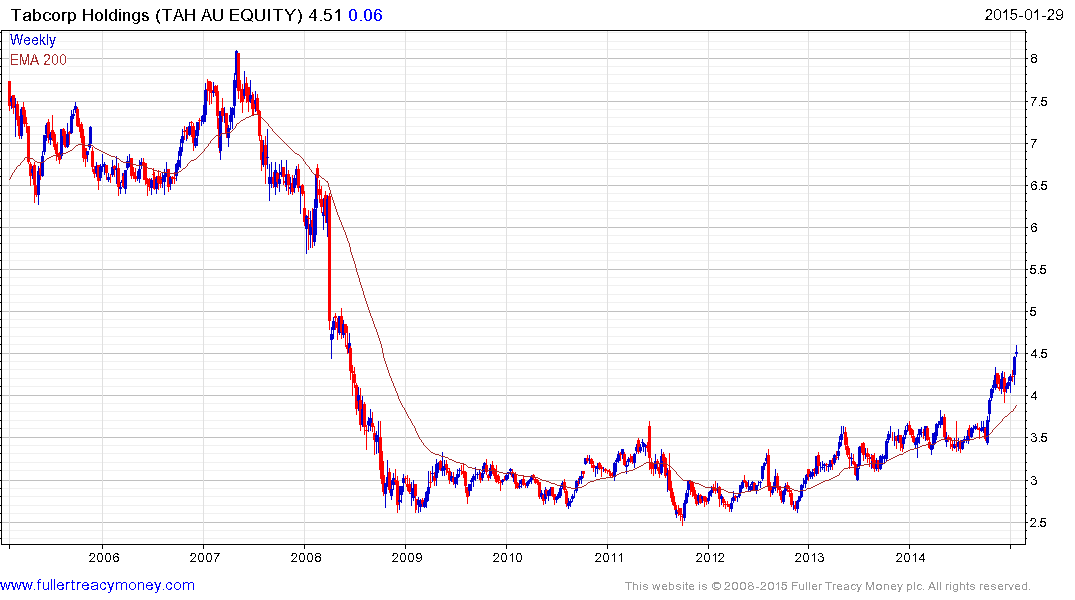

The casino and gaming sector also exhibits a high degree of commonality. Tabcorp (Est P/E 22.27, DY 2.55% Net) completed a six-year base in October and broke out of first step above it last week. A sustained move below A$4 would be required to question medium-term recovery potential. Tatts Group (Est P/E 21.75, DY 3.51% Net) has a similar pattern.

Crown Holdings (Est P/E 17.07, DY 2.68% Net) rallied impressively this week to challenge the progression of lower rally highs. A sustained move back above the 200-day MA would signal a return to demand dominance beyond the short term.

.png)

Aristocrat Leisure (Est P/E 21.10, DY 2.26% Net) a manufacturer of gaming machines generates 75% of its revenue from outside Australia. The share remains in a consistent medium-term uptrend and broke out to new recovery highs this week. The company should benefit from a weaker currency but does not qualify for franking because so much of its earnings are generated overseas.

![]()

The resources sector remains under a cloud but there are some bright spots worthy of mention. Low energy prices and a weakening Aussie Dollar have boosted the price of Gold. Today’s $27 decline in US Dollar terms but a relatively unchanged Aussie Dollar price is a good example.

This is acting as a bullish catalyst for a number of producing Australian gold miners many of which have attractive valuations.

Newcrest (Est P/E 30.18, DY N/A) has sustained a rally back above the 200-day MA for the first time since 2011 and a sustained move below the trend mean would be required to question potential for additional upside.

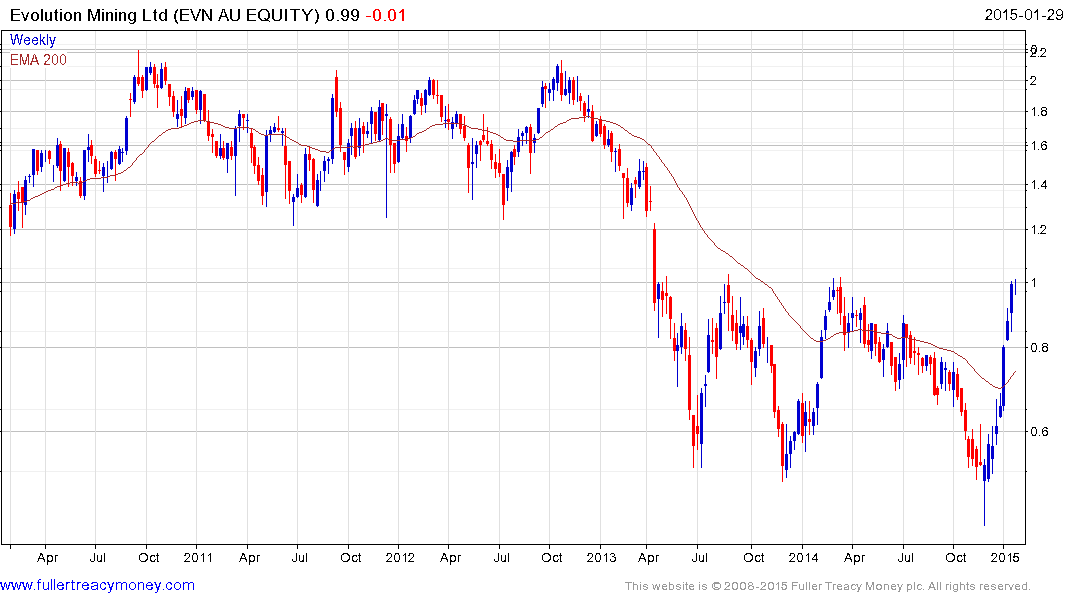

Evolution Mining (Est P/E 9.43, DY 2.02% Net) has rebounded to test the upper side of its 18-month base and while some consolidation in this area is possible, a sustained move below the MA would be required to question medium-term scope for additional upside.

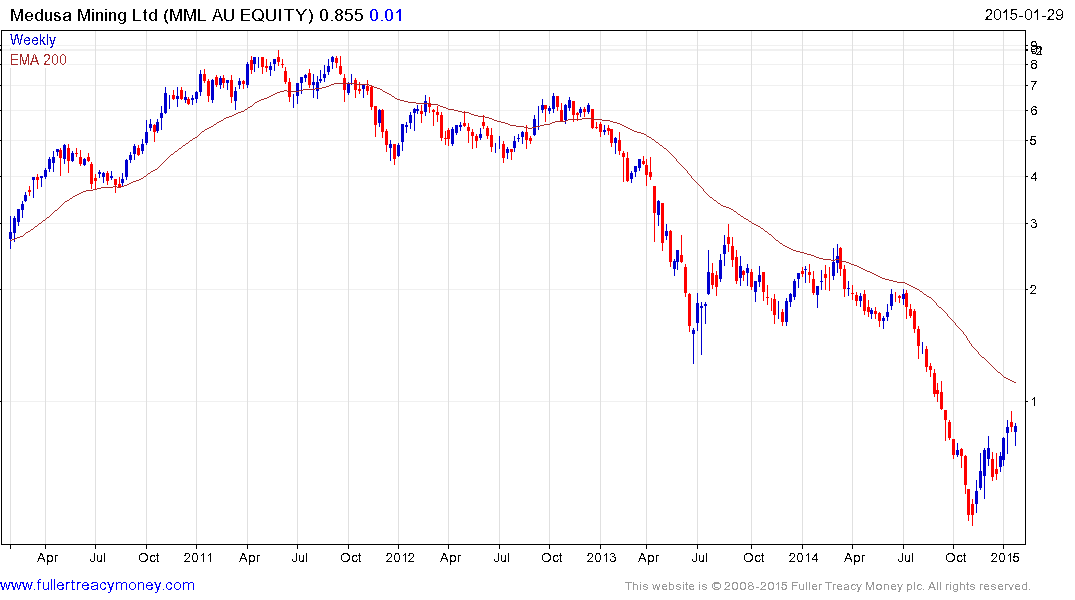

Medusa Mining (Est P/E 3.16, DY N/A) has held a progression of higher reaction lows since finding support in November.

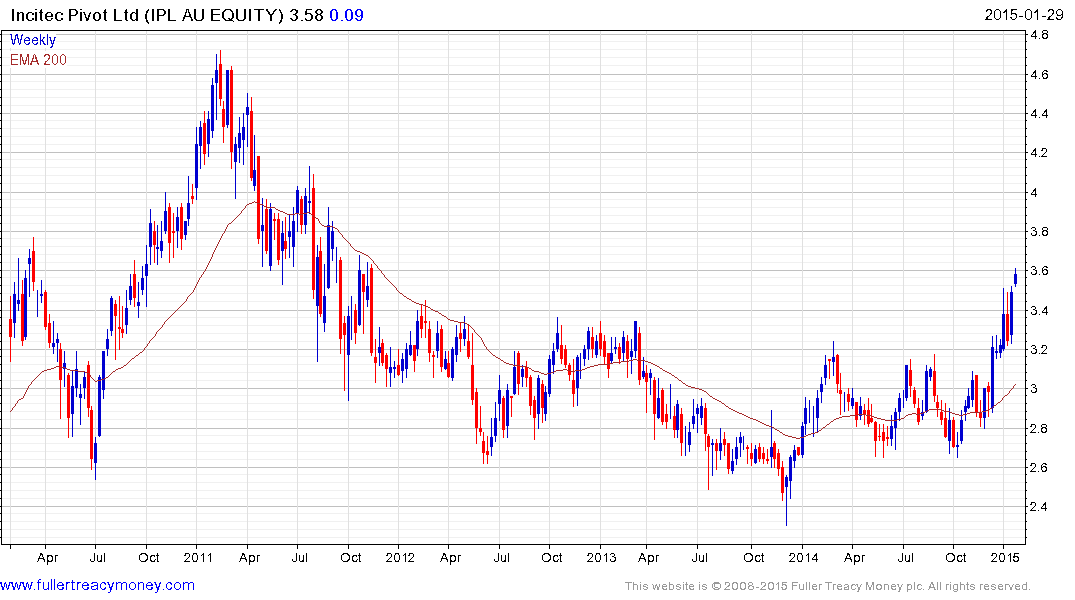

In the agriculture sector fertiliser producer Incitec Pivot (Est P/E 15.36, DY 3.02% Net) completed a two-year base last week.

In the aluminium sector Alumina (Est P/E 71.73, DY N/A) has held a progression of higher reaction lows for more than a year.

Among some of Australia’s leading exporters outside the commodity sector Cochlear (Est P/E 31.29, DY 3.09% Net) has returned to test the upper side of an 8-year range. It is somewhat overbought at present but a clear downward dynamic would be required to question medium-term upside potential.

Both Brambles and Amcor are world leaders in their respective niches of the packaging sector.

Brambles (Est P/E 19.34, DY 2.55% Net) remains in a reasonably consistent uptrend.

Amcor (Est P/E 18.51, DY 3.37% Net) found support last week in the region of the 200-day MA.

Back to top