Report from Sydney and Singapore

It’s great to be back at my desk following a busy 10 days with two Chart Seminars, a Global Strategy Session and talks to the Australian Technical Analysis Association and Technical Analysis Society of Singapore. These events were a great opportunity to meet subscribers, discuss markets, opportunities, risks and receive feedback on the new site and Chart Library.

Most of the issues subscribers raised were with regard to using the site on a tablet or smart phone. I have relayed all of these issues to our programming team and work has begun on enhancing the look and feel of the site on mobile devices. It is also worth highlighting that the site will work best in Google Chrome because it is a Java based browser. We are aware of issues with various versions of Internet Explorer and are working on them.

What both chart seminars had in common was that most delegates were interested in the currency markets. At the Singapore event we looked at our first equity on the second data since just about everyone was interested in the recent volatility in regional currency markets. From a casual perusal of long-term currency charts we can discern that the consistent appreciation of Asian currencies over the last decade has given way to an inconsistent loss of momentum suggesting the Dollar is basing.

In Australia, the relative attraction of bank shares has been bolstered by the fact that their yields are highly attractive for local investors who can avail of full franking but also by the fact that government bond yields pale in comparison. Reversions towards the 200-day MA continue to be regarded as buying opportunities by investors and most rallied last week from that area. Commonwealth Bank of Australia is a reasonably good barometer with a gross yield of 6.84%. A sustained move below the 200-day MA would be required to begin to question investor confidence in the share.

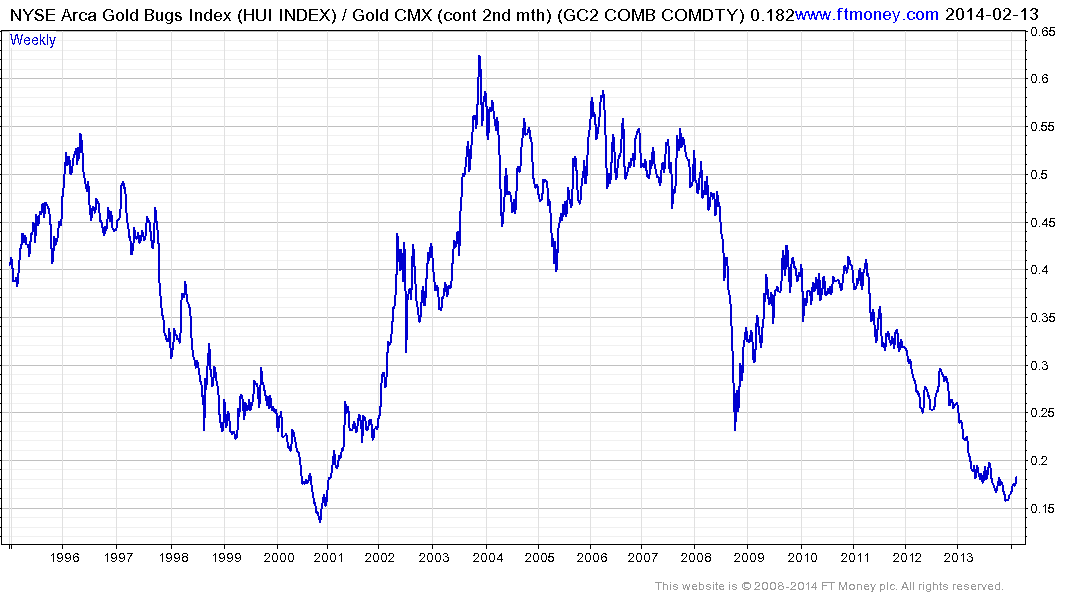

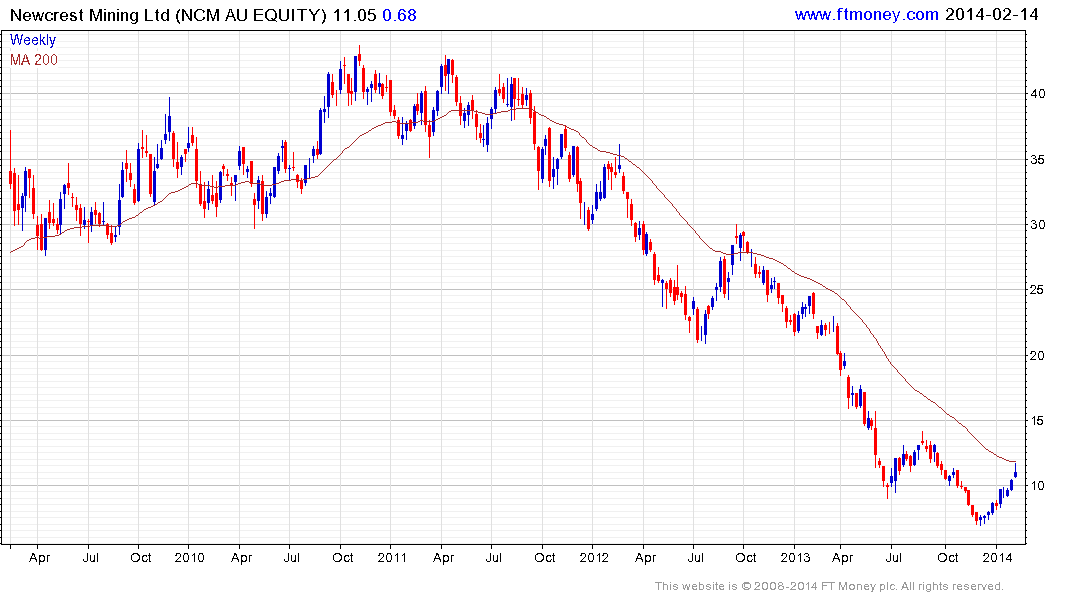

With gold steadying above $1200 the relative attraction of gold shares was also a topic of conversation at both seminars. Newcrest has rallied to close its overextension relative to the 200-day MA over the last two months and recovery potential will be more convincing once it finds support above the December low following the next pullback.

As a nickel and tin producer Metals X has benefitted from Indonesia’s decision to ban ore exports. The share broke out of twenty-month base in late January.

I’ll share some additional highlights next week.