Record VIX Bets Keep Surging Amid Wall Street Mixed Signals

This article by Joseph Ciolli and Inyoung Hwang for Bloomberg may be of interest to subscribers. Here is a section:

To Rocky Fishmanof Deutsche Bank, the recent lack of equity volatility has convinced some investors that price swings may return. With the volatility on the VIX itself likely to remain high, he recommends investors buy Standard & Poor’s 500 Index put spreads -- a strategy that involves purchasing and selling bearish contracts on the measure simultaneously.

“Investors don’t believe this low-volatility environment will continue,” said Fishman, an equity derivatives strategist at Deutsche Bank. “Seeing how low the VIX is, it’s an opportunity to buy inexpensive S&P 500 options.”

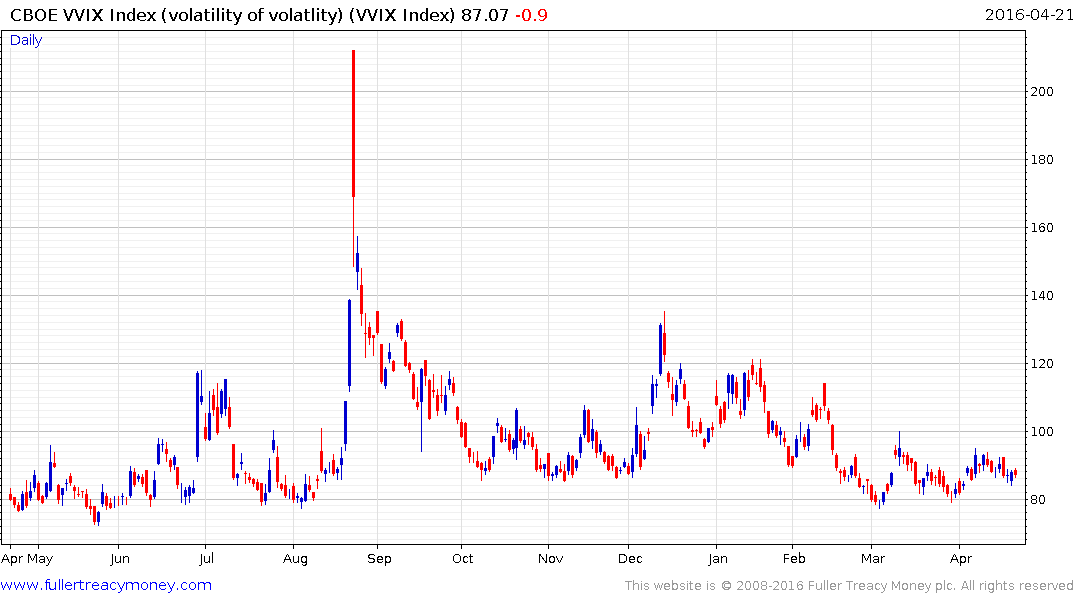

The CBOE VVIX Index has climbed 5 percent this quarter, and its average this year is about 8 percent higher than its historical average, data going back to 2006 show.

There may be another reason that call activity has continued to swell amid the stock rally, according to Deshpande.

Credit investors may be looking to protect recent gains delivered by a 29 percent contraction in the credit spread for investment-grade bonds since Feb. 11. That’s pushed more investors into fixed income trading.

“Credit spreads have rebounded and people are investing in the space again,” Deshpande said. “So they need hedging.”

Following the sharp pullback in January many investors woke up to the idea that hedging was a good idea which probably explains subsequent demand for VIX calls despite the fact equities were rallying and volatility measures contracting. The question now however is that while owning VIX hedges was a losing strategy for the last 10 weeks whether that will remain the case over the next 10 weeks.

The Volatility of the VIX Index (VVIX) has been relatively inert since late January but the lows are rising within its range, albeit modestly. That suggests a move above 100 is looking more likely than not

Earnings this week have not been inspiring with sharp drawdowns today by Kimberly Clark, Microsoft, Alphabet and Netflix. All of these were among the stalwarts of the ally to date so the speed of these declines represents an uptick in single stock volatility which has been absent for the last few months.

Meanwhile the Banks and Resources Sectors were among the best performing on the S&P 500 today not least because they represent relative value and are rallying from oversold conditions. That suggests a rotation is underway.

Next week earnings from Apple, Berkshire Hathaway, Eli Lilly, Lockheed Martin, Boeing, Gilead Sciences among others are expects so there is ample scope for additional single stock volatility.

Back to top