RBI Chief Sees Room to Cut India Rates as Virus Dents Growth

This article by Stephanie Flanders for Bloomberg may be of interest to subscribers. Here is a section:

Speaking in an interview with Bloomberg News in Mumbai just hours before finance ministers and central bank chiefs from the G-7 economies were scheduled to discuss policy options, Shaktikanta Das said “there is a strong reason for coordinated policy action.” For India, options include a rate cut and supporting the market through liquidity measures, he said.

Inflation, which had kept the central bank from easing since December, is expected to moderate, he said in an interview at the RBI’s headquarters. He argued the bank’s flexible inflation-targeting framework allows the central bank to look through recent price pressures and loosen policy.

“We’re ready for a response should the situation warrant,” Das said in a meeting room decorated with framed portraits of his predecessors. “I think the G-7 countries are having a conference. And going forward, in the near future, I do expect some discussion through video conference or telephone conference among the central banks of the large economies, including India.”

The challenge the RBI faces is in how to lend assistance to the economy while tempering inflation and encouraging foreign investors to remain in the market. The low oil price should weigh on inflation but the coronavirus’ potential impact on India’s underdeveloped medical system is weighing on the currency.

The Dollar broke higher against the Rupee yesterday and followed through on the upside today. A clear downward dynamic is going to be required to begin to question Dollar dominance.

Meanwhile the Nifty Index has found short-term support in the region of 11,000 to hold its sequence higher reaction lows. However, the loss of momentum over the last two years and sequence of failed upside breaks is a warning investor appetite for Indian stocks may be waning.

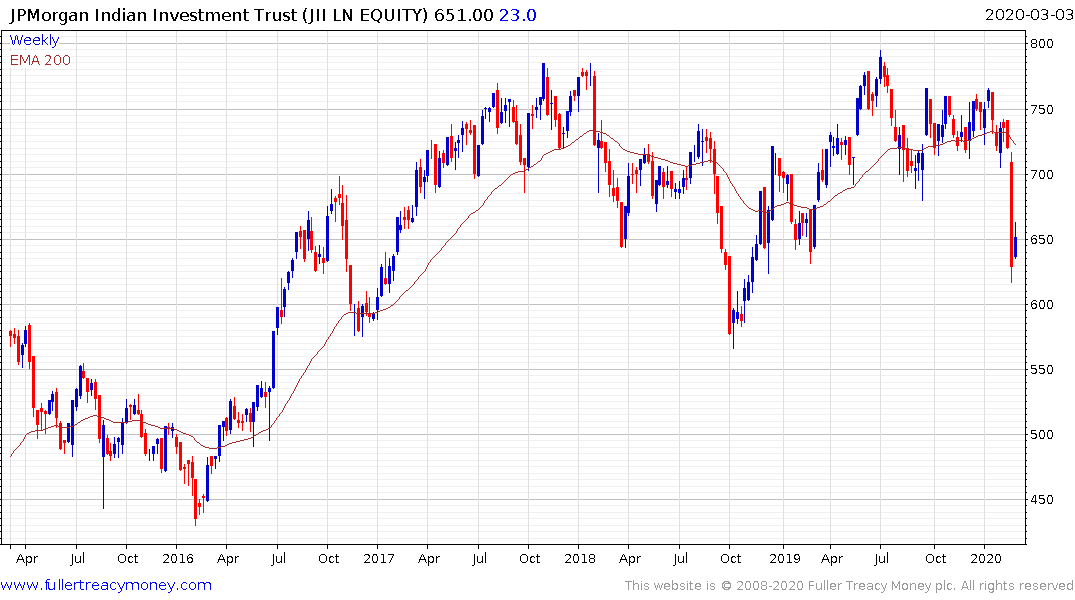

The JPMorgan India Trust has been ranging in a volatile manner for three years and is back testing the lower boundary. It needs to hold the 600p level if support building is to be given the benefit of the doubt.