RBA Highlights Ukraine War Risks to Outlook as Key Rate Held

This article from Bloomberg may be of interest. Here is a section:

The Reserve Bank of Australia said it will remain “patient” as it assesses risks stemming from Russia’s invasion of Ukraine and the resulting jolt to energy prices.

The central bank -- as expected -- kept its cash rate at a record low 0.1% on Tuesday, Governor Philip Lowe said in a post-meeting statement. He reiterated that while inflation has picked up, it’s “too early to conclude” that it’s sustainably within the RBA’s 2-3% target.

“The war in Ukraine is a major new source of uncertainty,” Lowe said. “Inflation in parts of the world has increased sharply due to large increases in energy prices and disruptions to supply chains at a time of strong demand.”

The RBA is the first central bank to cite the war in Ukraine as a rationale for holding off on raising rates. The market was not expecting a rise this month in any case but the thorny issue of the war is likely to play a role in future decisions. The RBA is unlikely to be the only central bank faced with this conundrum. We will hear from Jay Powell twice this week when he testifies before Congress. The ECB is a lot closer to the action, and European businesses do a lot more trade with Russia than the USA or Australia.

The Australian Dollar has the benefit of commodity exports as it pauses in the region of the January peak. The Euro hit a near reaction low against the Dollar today.

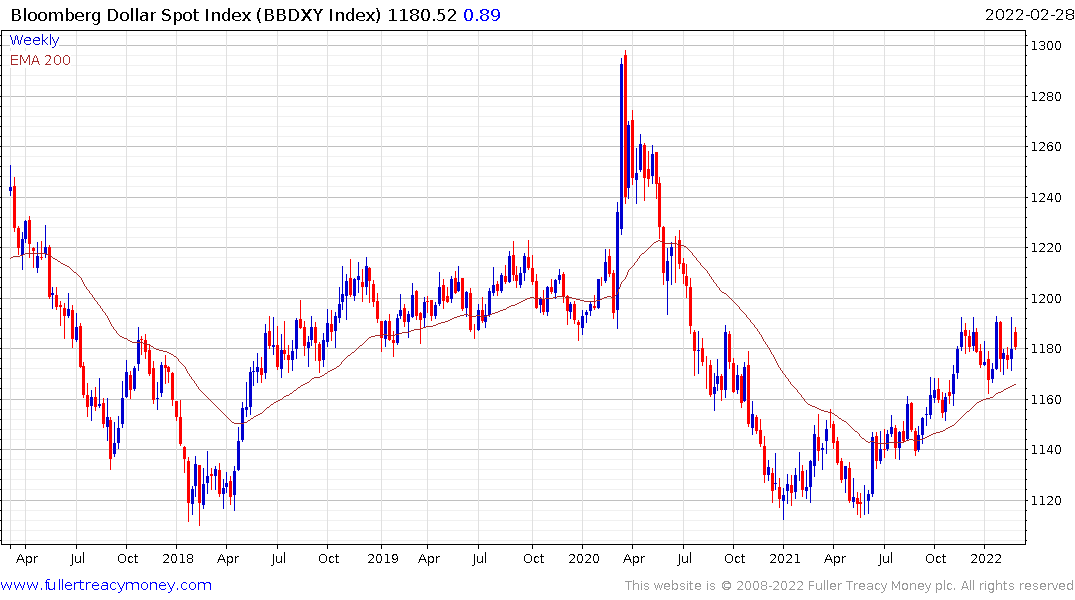

The Bloomberg Dollar Index has been consolidating mostly below the November peak but is likely to continue to firm as investors seek the relative safety of the primary reserve currency.