Rare Platinum Discount to Gold Inspires Bulls Seeing Slump End

This article by Ranjeetha Pakiam and Eddie van der Walt for Bloomberg may be of interest to subscribers. Here is a section:

“It all depends upon whether one believes that the VW scandal marks the beginning of the death of diesel or if the eventual outcome will be a lot less radical for platinum autocatalyst demand,” Philip Klapwijk, managing director of Precious Metals Insights Ltd., said by e-mail. “Arguably the bad news is already in the platinum price.”

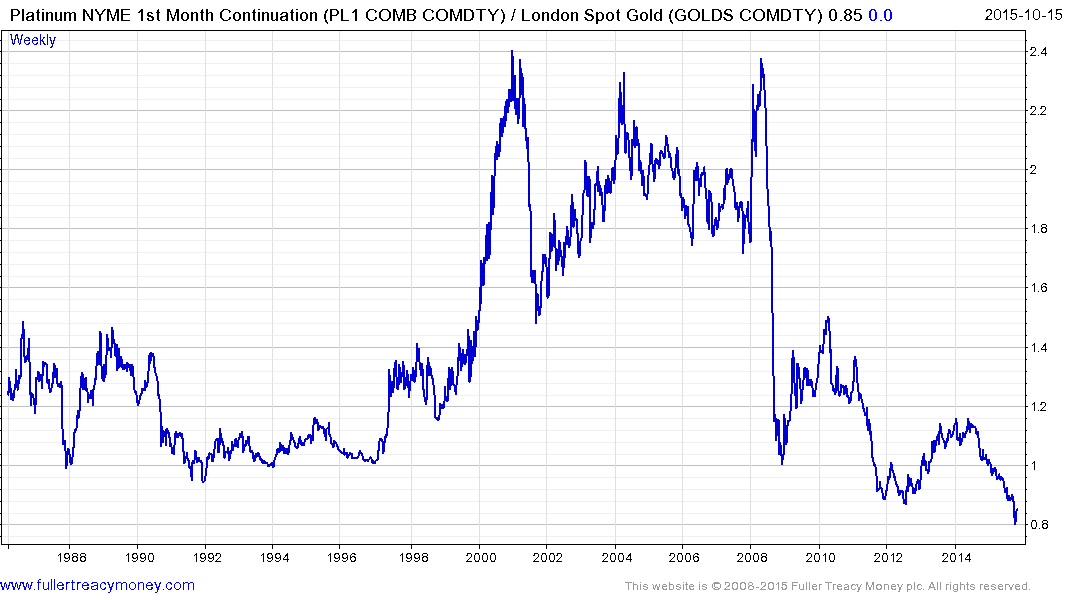

Platinum slumped as low as $892.50 an ounce on Oct. 2, only enough to buy 0.7924 of an ounce of gold, data compiled by Bloomberg show. That day, the ratio of gold to platinum reached a record 1.26. The drop in platinum will attract interest from financial traders and spur jewelry demand, Ole Hansen, an analyst at Saxo Bank, said by phone.

Gold may stay weak into next year as economic prospects improve and the Federal Reserve increases interest rates from near zero, dulling bullion’s appeal as a safe haven, according to Singapore-based Oversea-Chinese Banking Corp. The yellow metal will average $950 an ounce in the fourth quarter of 2016 while platinum is seen at $905, said Barnabas Gan, the most accurate gold forecaster based on data compiled by Bloomberg.

The estimates are subject to revision if the Fed doesn’t raise rates this year, he said.

Platinum has been rallying the past two weeks, trading Thursday at $1,004.80. In a Bloomberg survey of analysts, platinum was forecast to reach $1,150 next year, and will extend that gain over the following three years to $1,400 in 2019.

"Platinum is at unsustainable low levels relative to gold, relative to vehicle sales in Europe and relative to the trends we’re seeing in jewelry demand in China," Mike McGlone, director of research at ETF Securities LLC, said by phone from New York.

“We’re getting all the signals you would expect to see from a market putting in a bottom.”

The Volkswagen scandal represents a significant blow for diesel as a fuel in passenger vehicles but there is little chance of it being displaced in the haulage sector any time soon. Pulling heavy loads requires torque and diesel engines provide it cheaply. Electric vehicles have the capacity to displace diesel over the medium-term but costs will have to come down substantially first. In the meantime auto-catalyst demand in unlikely to disappear but it will decrease.

.png)

It could be argued that the worst of this news is already in the price. Platinum has now rallied to test the medium-term progression of lower rally highs and is somewhat overbought in the short term. Some consolidation in this area is certainly possible but a sustained move below $900 would be required to question support building.

Relative to gold, platinum has not traded at such a large discount in at least 25 years. The ratio is oversold by any measure so there is ample scope for platinum to continue to outperform.

Gold prices have also rallied impressively over the last couple of weeks and are also now testing the medium-term progression of lower rally highs.

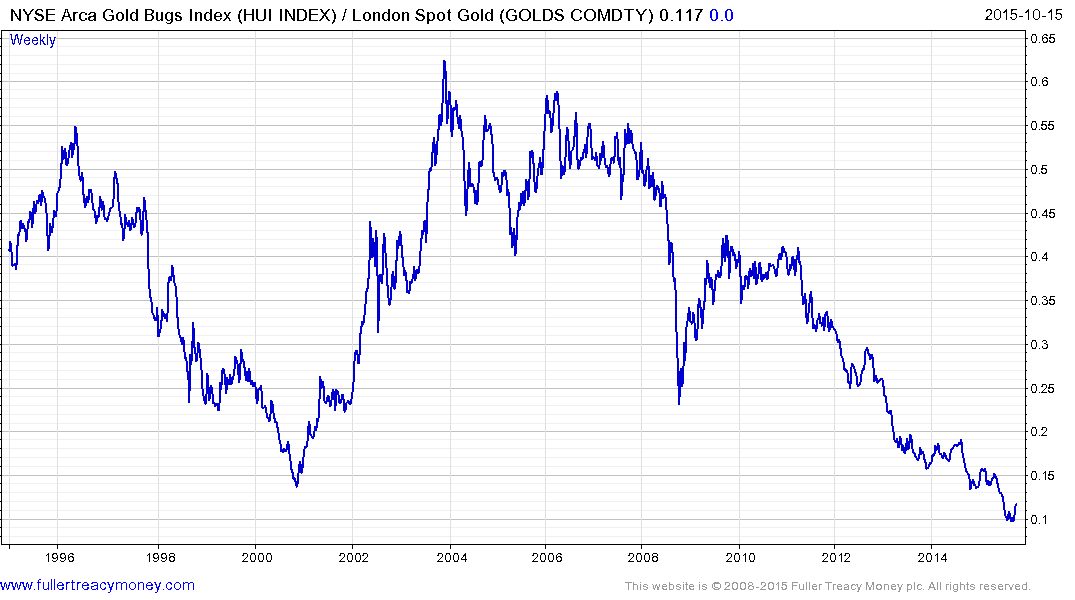

The NYSE Arca Gold BUGS Index is also trading at an historic discount to gold and the ratio is now bouncing.

.png)

In nominal terms the Index has been ranging above the psychological 100 level since July and rallied over the last couple of weeks to test the region of the trend mean. It hasn’t sustained a move above the 200-day MA since 2012 and will need to do so on this occasion to signal a return to demand dominance beyond the short term.

Gold, platinum and gold shares all exhibit similar technical characteristics. Following impressive short-term rallies the prospect of some consolidation is looking increasingly likely. Rather than hypothesise about how high they are likely to go, the more important question is how well they will find support above their respective lows during a pullback. This would suggest investors are not willing to wait to see the lows again and would signal the initial foundation of a new uptrend.

Back to top