Randgold riding gold price fall well as it bucks the peer trend

This article by Lawrie Williams for Mineweb may be of interest to subscribers. Here is a section:

Bristow was preceded at the presentation by Randgold Chairman, Chris Coleman, who reminded those present that Randgold was formed almost exactly 20 years ago when the gold price was at a virtual all-time low. The point here being that the current low gold price is not as bad as it was back then, and Randgold has thrived since its very beginnings, in both lower and higher gold price environments.

Bristow continued on the same theme, saying that in terms of the gold price in real terms, Randgold was nearly back where it started! He re-iterated the company has always followed a basic strategy that allowed it to be able to continue to build, while many of its peers were still trying to figure out how to survive in the current gold price environment. “I’ve always tried to do the opposite to the industry and grow in the troughs,” Bristow said to Richard Quest of CNN. Randgold has not wavered from its strategy of only developing good-sized projects offering strong returns at $1000 gold and this policy has held it in good stead.

As far as the Q2 figures were concerned, not surprisingly, Bristow tended to dwell more on the positive aspects of the results. These included a solid all-round performance from its operations, with improvements in grade, throughput and recovery, leading to a new gold production record and a higher profit compared with Q1 in the face of a declining gold price.

Gold miners are now trading at around the same levels relative to the gold price as they did before the commodity bull market. This highlights just how unsuccessful the sector on aggregate has been in controlling cost inflation. However as energy prices pull back and wage inflation moderates, or even contracts, the ability of miners with reasonable debt loads to prosper should improve. This means we can expect some wide variation in returns between miners.

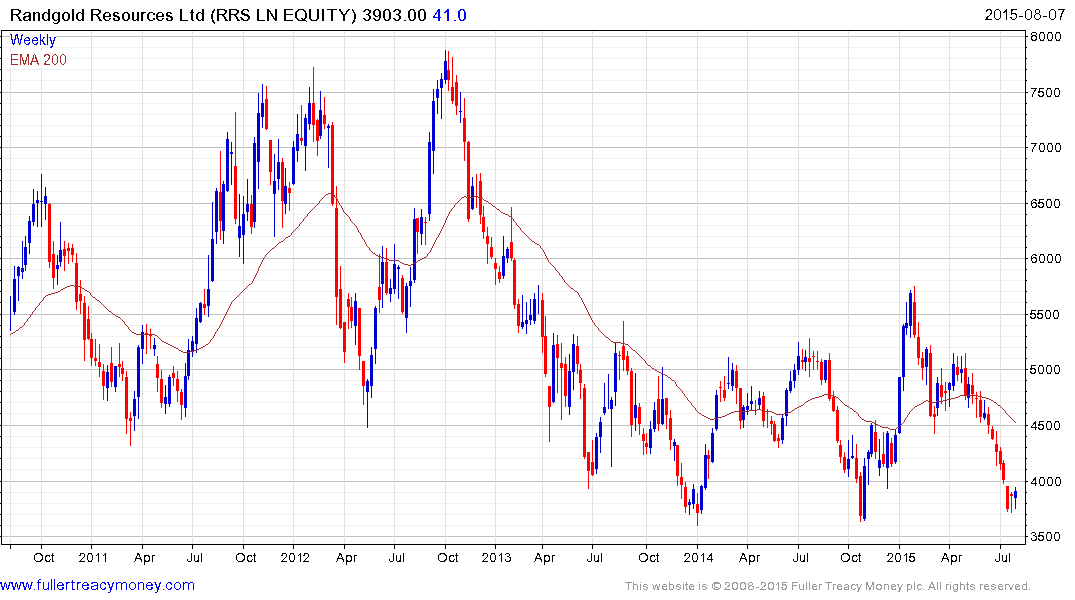

Randgold Resources (Est P/E 24.99, DY 1.03%) has found at least near-term support in the region of the lower side of its two-year range. A sustained move below 3850p would be required to question scope for a reversionary rally back towards the trend mean, currently near 4500p.

Hong Kong listed Zijin Mining (Est P/E 16.74 DY 4.74%) has returned to test the region of the July low and bounced from the region of HK$2. A sustained move below that level would be required to question potential for additional rally.

Sibanye Gold (Est P/E 8.48, DY 8.91%), as a South African gold miner, has been impacted by electricity shortages and the acrimonious relationship with unions. Valuations are much improved but the share has yet to find support despite the short-term oversold condition.

Centerra Gold (Est P/E 19.13, DY 2.42%) continues to hold its medium-term progression of higher reaction lows.