Rand Extends Decline to Touch 5-Year Low on South African PMI

This article by Robert Brand for Bloomberg may be of interest to subscribers. Here is a section:

"While the stronger-than-expected growth in real retail trade sales in November is encouraging, we warn that this is unlikely to have sustained into year end," Schultz said in an e-mail. "Slowing household credit extension, depressed consumer confidence, high consumer debt levels and a still elevated domestic inflation environment continue to weigh on consumers' ability and willingness to spend aggressively."

Mining output slipped to 5.1 percent in the same month from growth of 23 percent in October, data showed yesterday.

Foreign investors were net buyers of South African debt for a second day yesterday, purchasing 398 million rand ($37 million) of securities, according to JSE Ltd. data. Foreigners purchased a net 1.35 billion rand of equities, the data show.

South Africa has a number of attractive characteristics from the perspective of an investor but suffers from a governance deficit which will need to improve if the currency¡¯s slide is to be reversed.

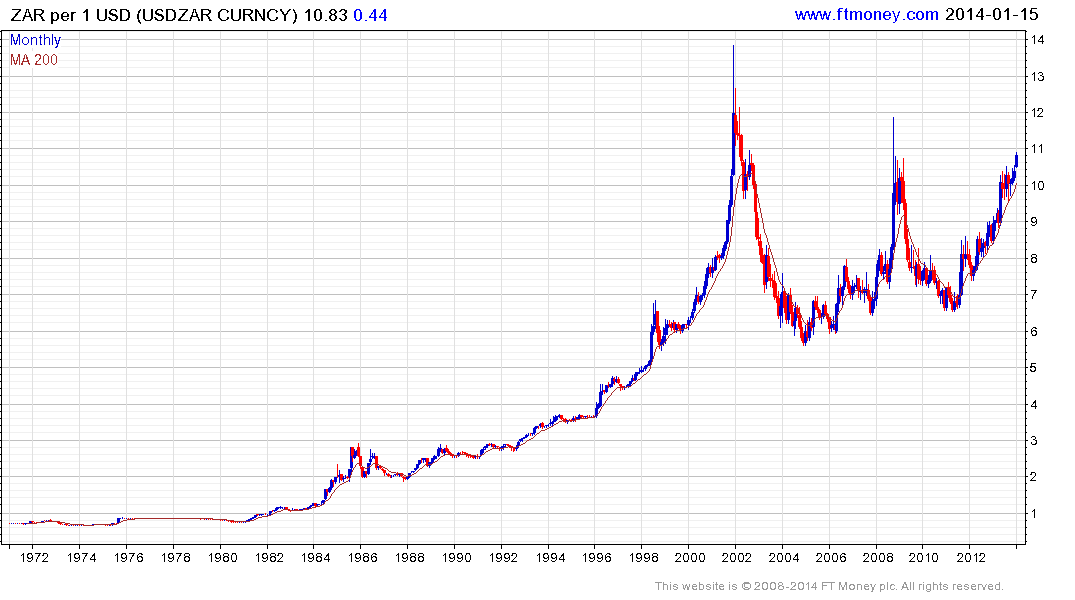

The US Dollar has been trending consistently higher against the South African Rand since 2011 and has returned to retest spike peaks above ZAR10 posted in 2008 and 2001. The Dollar¡¯s steady appreciation compared to what represented panicky advances previously suggests demand for the Greenback is better supported on this occasion. A break in the progression of higher reaction lows, currently ZAR10 would be required to question the Dollar¡¯s medium-term upside potential.

Back to top