Quantitative Easing Is not Working, BlackRock Peter Fisher Says

This article by Alexandra Scaggs for Bloomberg may be of interest to subscribers. Here is a section:

BlackRock’s Peter Fisher says that central- bank bond-buying programs aren’t working.

Quantitative easing is supposed to push investors into riskier assets, Fisher, senior director of the BlackRock Investment Institute and a former undersecretary of the U.S. Treasury and executive vice president of the Federal Reserve Bank of New York, said in a Bloomberg Television interview.

“It isn’t working,” Fisher said. “Mostly, it drives up the price of the low-risk assets, as we’ve seen in Europe today.”The European Central Bank, which meets Thursday, has said it will begin monthly purchases of 60 billion euros ($67 billion) of bonds this month. Government bonds in many European countries have rallied before the purchases, with about $1.9 trillion of sovereign debt trading with negative yields.

The Federal Reserve’s bond-buying program, which wound down last year, wasn’t much more successful, he said.

“It didn’t really work here, it worked at the margin as a little chase for yield,” he said. “People want to hoard the best assets.”

The risk of deflation in Europe may mean that a rate increase from the Fed won’t dent the prices of longer-term Treasuries, Fisher said.

Quantitative easing has worked if one measures the response of risk assets such as equities to massive infusions of liquidity. A great deal of anxiety is currently being expressed at the elevation of stock markets but there is no sign that the flow of liquidity is being inhibited by central bank action.

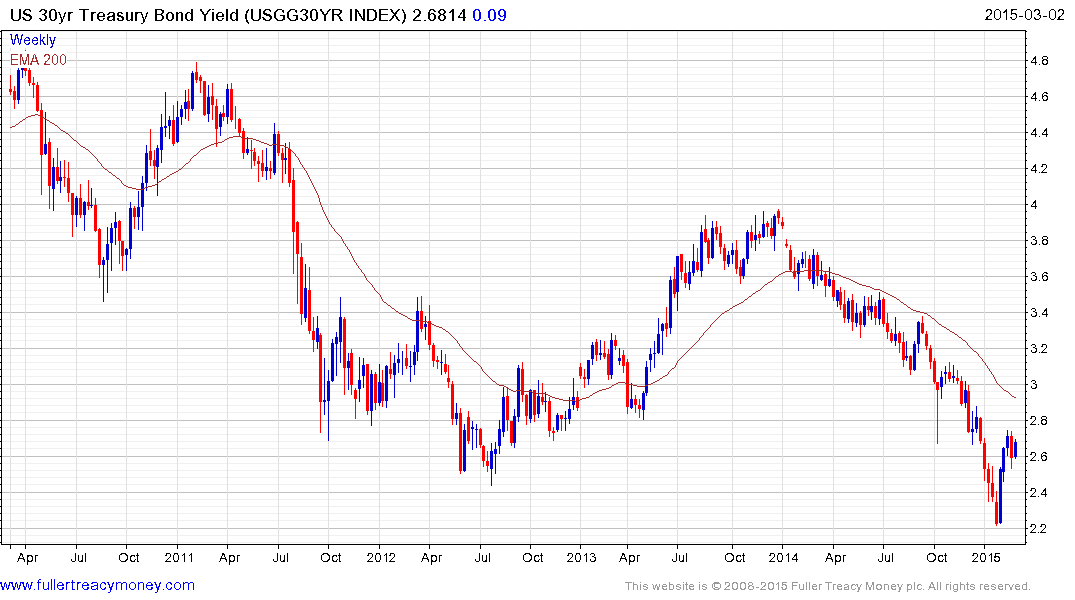

US 30-year Treasury yields hit new all-time lows last month and continue to close the overextension relative to the 200-day MA.

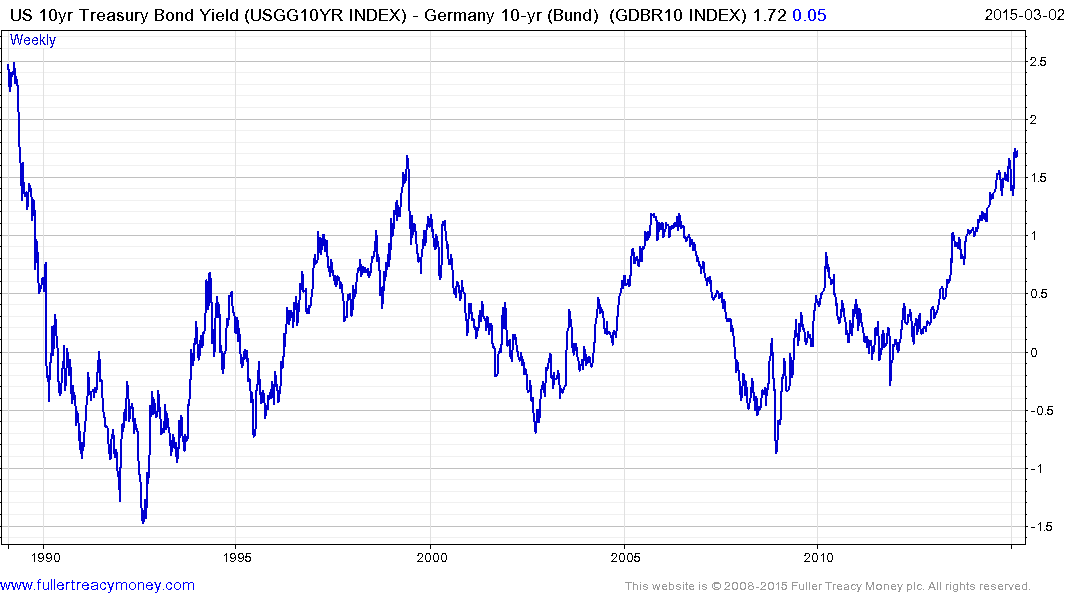

The spread between the US 10-year and the German 10-year has not been this wide since 1989 suggesting investors in government paper will continue to favour Treasuries on a yield to maturity basis.

.png)

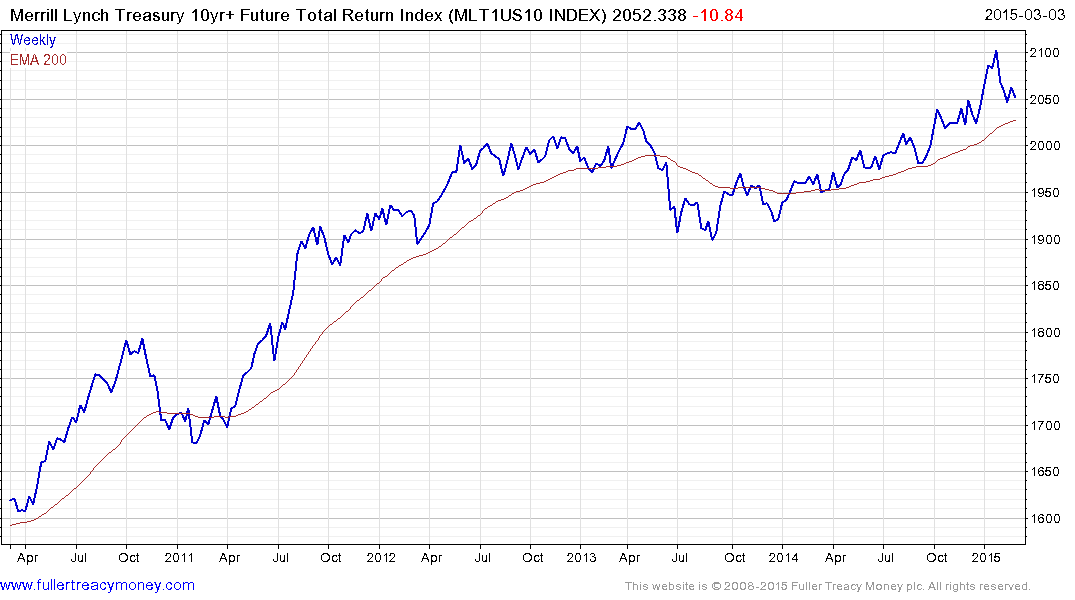

In absolute terms, the 10-year yield would need to sustain a move above the 200-day MA and ideally above the 3% area to confirm medium-term supply dominance.

That kind of move looks like a big ask at this stage which is why the total return chart is probably more instructive. It will need to find support in the region of the 200-day MA if the medium-term uptrend is to continue to be given the benefit of the doubt.

Back to top