Protectionism Risks? What's Next?

Thanks to a subscriber for this report from Morgan Stanley which may be of interest to subscribers. Here is a section:

Here is a link to the full report and here is a section from it:

This is a very measured report which I think is underplaying the short-term volatility tariffs are likely to provoke. Bilateral trade between the USA and China is substantial and US companies have invested considerable resources in developing customer bases in China. They are far from immune from Chinese retaliatory measures which over the course of the medium-term will likely be ironed out but probably not before there is some pain felt on both sides.

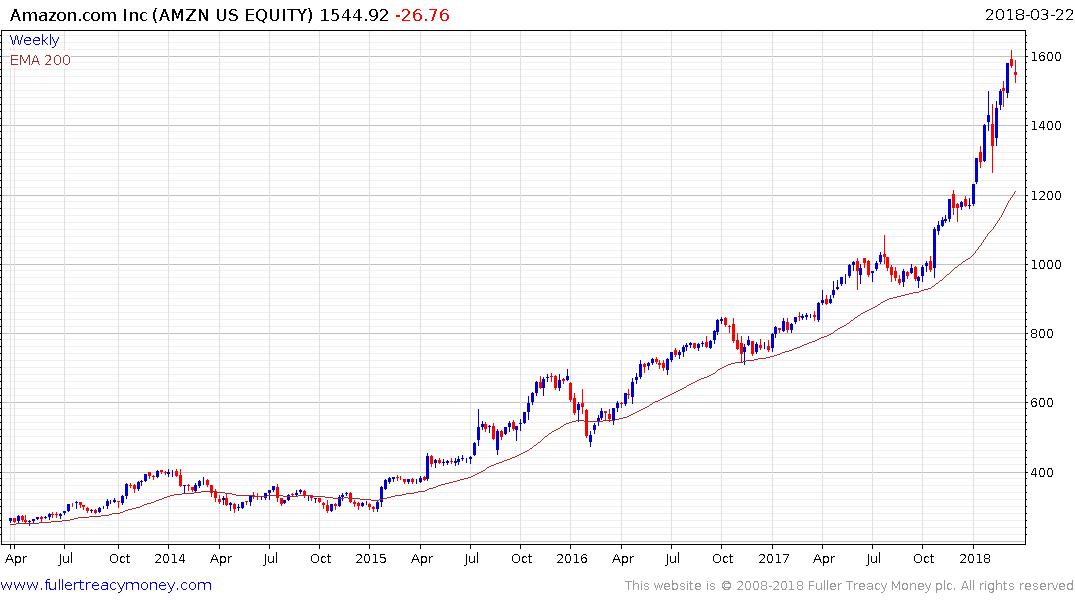

Amazon, Google, Facebook and Netflix are relatively immune to Chinese tariffs since they do not have operations in the country. However, that does not negate the fact that Amazon and Netflix are really quite overextended relative to their respective trend means.

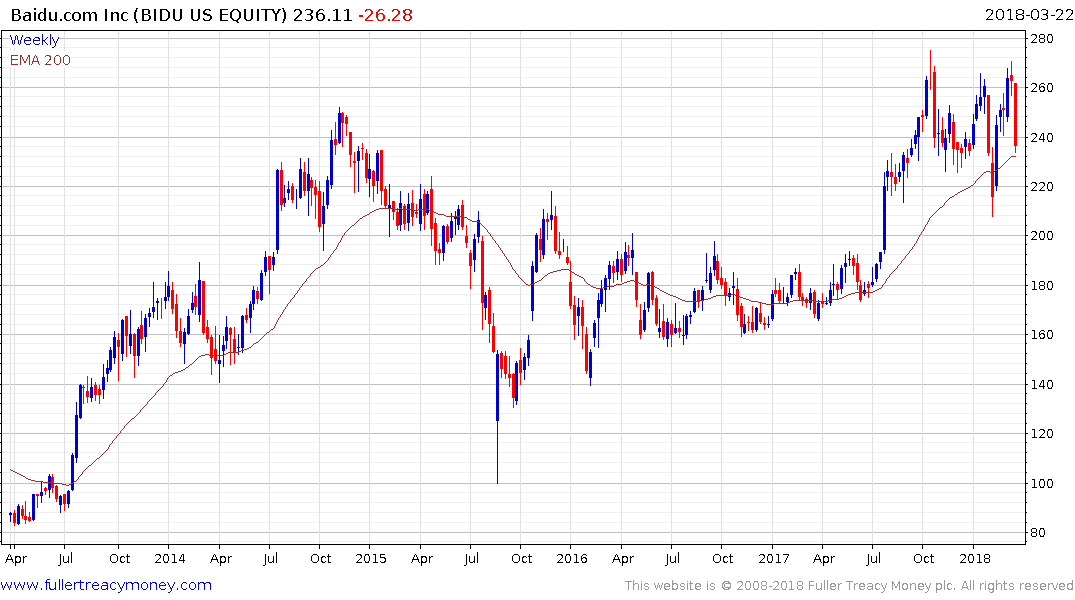

On the other hand, their Chinese copycats Alibaba, Baidu, JD.com, Tencent and are all listed in the USA or in Tencent’s case in Hong Kong. None were immune to selling pressure today.

Apple on the other hand is at some risk of retaliatory measures since it depends on China for a substantial proportion of iPhone demand growth or 19.5% of total revenue. The share has been pulling back since failing to sustain the beak above $180 on the 13th. It was steady in the region of it’s the November through January lows today but has some work to do to question the overall corrective environment.

Soybeans are another potential target for Chinese tariffs.

No sector is more influenced by what China does than the miners. However, it is arguable how much they can limit demand without incurring self-harm. The FTSE-350 Mining Index pulled back today but is still trading in the region of the trend mean and a sustained move below it would be required to question medium-term scope for continued upside.

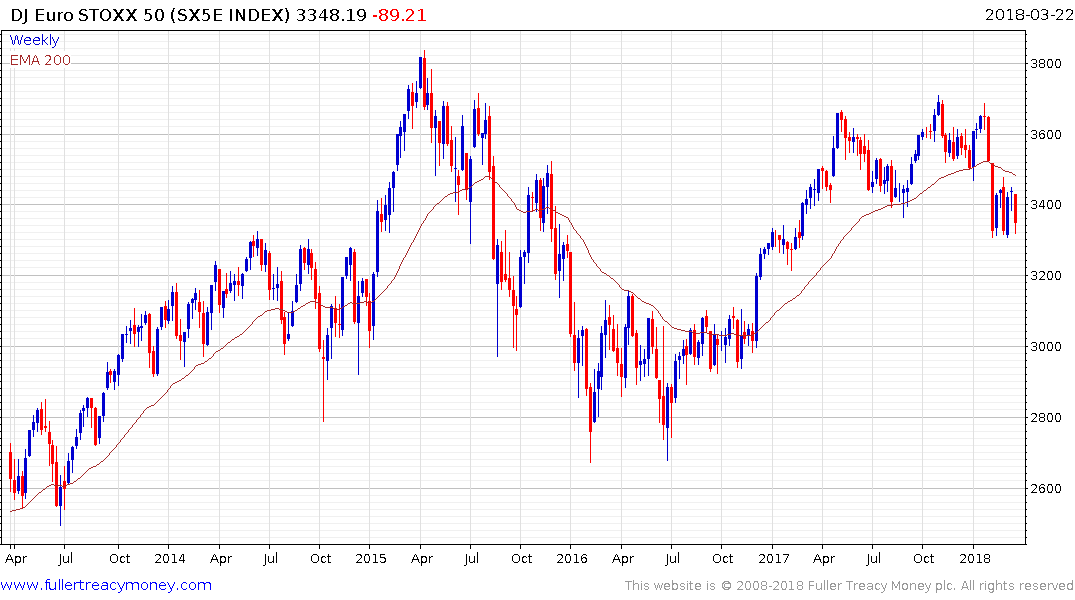

Europe is heavily dependent on the health of the global economy, to support demand for exports, but has been underperforming for months. The Dow Jones Euro STOXX 50 Index pulled back sharply again and paused in the region of the February lows. However, it needs to string together a number of days on the upside to confirm more than short-term support has been found.