Private market transaction prices down -10%

This blog post from Forge may be of interest so subscribers. Here is a section:

In February, we reported that seller interest outpaced buyer interest on the Forge platform as the broader market downturn led more employees to inquire about selling their vested equity.

These trends now show up in completed transactions. On average, prices in February fell –10% for companies that traded on Forge Markets in both Q4 2021 and February 2022.2 Meanwhile, the Renaissance IPO ETF, which holds many of the newest public tech companies, lost –28.4% from the beginning of October through the end of February.3

Although some softening has started to appear in the private market, the overall picture does not suggest overreaction. Decreasing prices may be new territory for some pre-IPO shareholders, but they seem to be proceeding cautiously. For investors, more sellers participating in the private market may yield a better opportunity to land shares of pre-IPO companies at favorable prices.

Since the 2009 lows, the value of private companies has surged as successive waves of new money chased the promise of outsized returns. The persistence of the low interest rate environment and central bank willingness to increase money supply have been central factors in supporting valuations.

The upward acceleration in yields has forced private investors to take a haircut as the rising discount rate is incorporated into valuations. For unprofitable, and often pre-revenue, companies the cost and availability of cheap credit is essential to their existence. As yields rise it is reasonable to expect speculative companies to perform poorly.

This article from Axios focusing on Instacart’s reduced valuation may also be of interest. Here is a section:

Details: Instacart is hoping that this move will help both with employment recruitment and retention. On that latter point, don't be surprised if recent Instacart hires get accelerated refresh grants at the lower price.

History: Instacart has raised around $2.7 billion, most recently in March 2021. Major backers include Andreessen Horowitz, D1 Capital Partners, Sequoia Capital, Fidelity and T. Rowe Price.

The bigger picture for Instacart is whether it can survive in an inflationary environment. Paying a company to deliver your groceries was considered a necessity by some during the lockdown phase of the pandemic. It is going to be a lot harder to justify that kind of expense as grocery prices rise.

At the other end of the scale Domino’s is offering a $3 “tip” if you pick up your order yourself. Instacart is already loss making, dealing with rising transportation costs is not going to improve their margin without raising prices. That’s a dangerous catch-22 and suggests the announced effort to attract talent is an obfuscation at best.

This article arguing gasoline prices are not as high as they used to be when adjusted for wages or inflation assumes everyone’s wages went up over that timeframe which ignores both the thin margins may companies and consumers run on.

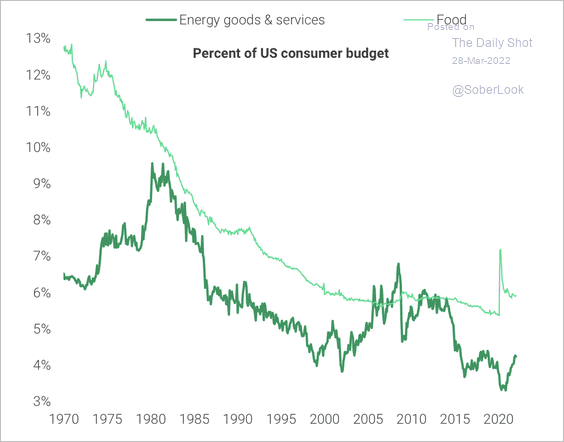

This graphic highlighting the percentage of consumer spending on food and energy relative to the 1970s ignores the fact people have a lot more demands on their cashflow today than 50 years ago. Mobile phone, Microsoft, cable/streaming, broadband, cyber and insurance premiums were either non-existent or much lower back then. This suggests inflation-adjusted market comparisons need to be looked at with a degree of caution.

Publicly traded DoorDash posted an upside weekly key reversal two weeks ago and broke the four-month downtrend. That suggests at least a near-term low has been found but the valuation is subject to forward guidance for 2023 being sustained. That’s a significant uncertainty in a rising rates environment.

Delivery Hero has a falling wedge characteristic which often precedes a rebound, but nothing has happened to suggest a new uptrend is imminent.

Uber continues to trend lower.

It is reasonable to assume some delivery companies will survive but realizable market is shrinking so some will cease to exist in their current forms.

Back to top