Private Lenders See Bank Woes Pushing Borrowers to Direct Loans

This article from Bloomberg may be of interest to subscribers. Here is a section:

“As we keep on telling our LPs, we are not alternative anymore,” said Lockhead. “Every deal that gets done, private credit is in the mix.”

Regulatory arbitrage is one of the commonest ways new financial sector solutions thrive. For example, Alibaba circumvented China’s wide difference between the lending and deposit rate by going direct to consumers via the internet and created Ant Financial. When regulators felt threatened by the company they move to contain its growth.

The fintech sector is attempting to carve a piece out of traditional banking operations by going online and direct to consumer via mobile apps. Companies like Block and PayPal avoid banking regulation but offer credit services in the same ways as credit card companies.

The cryptocurrency sector is primarily aimed at further disrupting the payments and international transfer market.

Private lending and private equity more generally thrived in a falling interest rate environment because asset prices of all varieties rose. Active markets were created in everything from businesses to fine wine and whiskey.

I’m reminded of Warren Buffett’s ratio “"Price is what you pay, value is what you get." The obvious best time to buy is following a period of stress, that is when the potential for longer-term gains is highest. It’s also the time when unconventional assets are most attractive because they offer diversification.

The challenge for “alternatives” is they are no longer niche investments. Private lending is a major part of several firms’ business models. At a minimum that suggests the expected returns from the sector will be lower in future. The primary bull case is interest rates collapse as deflation takes hold and yield return to sub-1% levels. That’s a big ask.

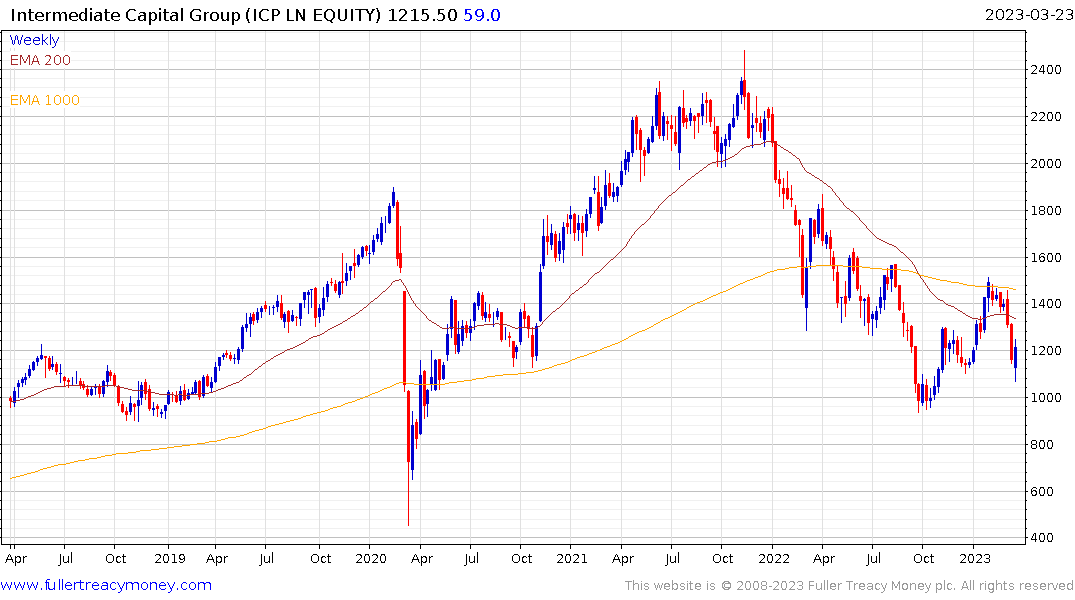

UK listed Intermediate Capital Group is attempting to put in a higher reaction lows as it rebounds from the Monday low. The 1000p level needs to hold if support building is to be given the benefit of the doubt.

Brookfield Corp is short-term oversold but remains in a consistent medium-term downtrend.

Brookfield Corp is short-term oversold but remains in a consistent medium-term downtrend.

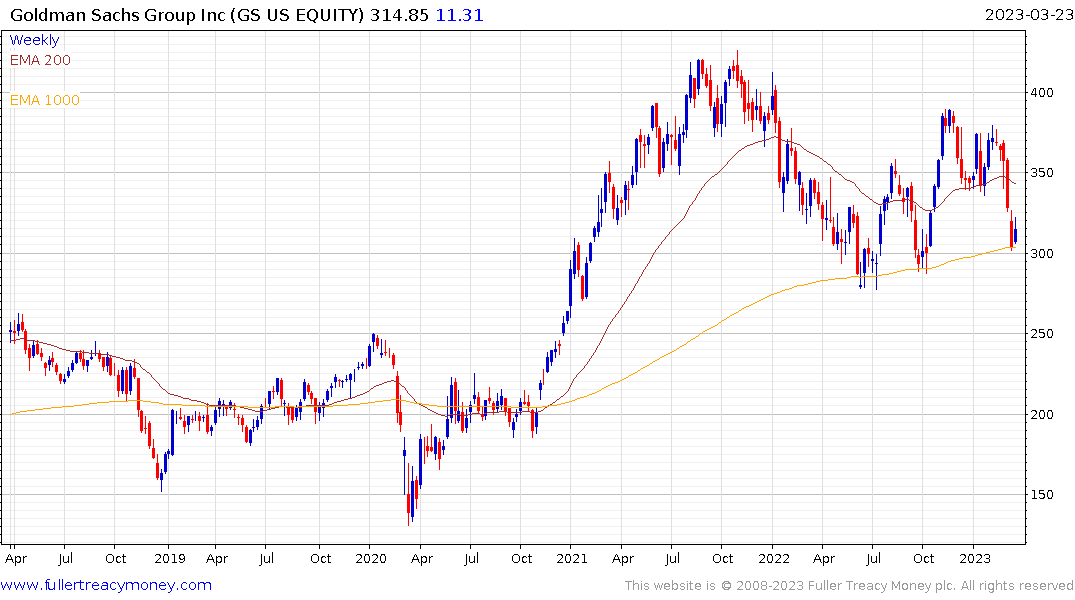

Goldman Sachs is short-term oversold and steadying in the region of the 1000-day MA. The $300 area needs to hold is support building is to be given the benefit of the doubt.

Goldman Sachs is short-term oversold and steadying in the region of the 1000-day MA. The $300 area needs to hold is support building is to be given the benefit of the doubt.

I remain of the view that private equity and commercial real estate are the epicentres of risk in this market environment.

Regulatory arbitrage is also a factor in the current troubled experienced by US regional banks because they fall under a less strict regime than larger banks.

This report from SSRN may also be of interest.

We provide a simple analysis of U.S. banks’ asset exposure to a recent rise in the interest rates with implications for financial stability. The U.S. banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets. We show that these losses, combined with a large share of uninsured deposits at some U.S. banks can impair their stability. Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to even insured depositors, with 9 potentially $300 billion of insured deposits at risk. If uninsured deposit withdrawals cause even small fire sales, substantially more banks are at risk. Overall, these calculations suggest that recent declines in bank asset values significantly increased the fragility of the US banking system to uninsured depositors runs (summarized in Table 1).

There are several medium-run regulatory responses one can consider to an uninsured deposit crisis. One is to expand even more complex banking regulation on how banks account for mark to market losses. However, such rules and regulation, implemented by myriad of regulators with overlapping jurisdictions might not address the core issue at hand consistently (Agarwal et al. 2014). 10 Alternatively, banks could face stricter capital requirement, which would bring their capital ratios closer to less regulated lenders, as documented in Jiang et al (2020). Discussions of this nature remind us of the heated debate that occurred after the 2007 financial crisis, which many might argue did not result in sufficient progress on bank capital requirements (see Admati et al. 2013, 2014 and 2018).

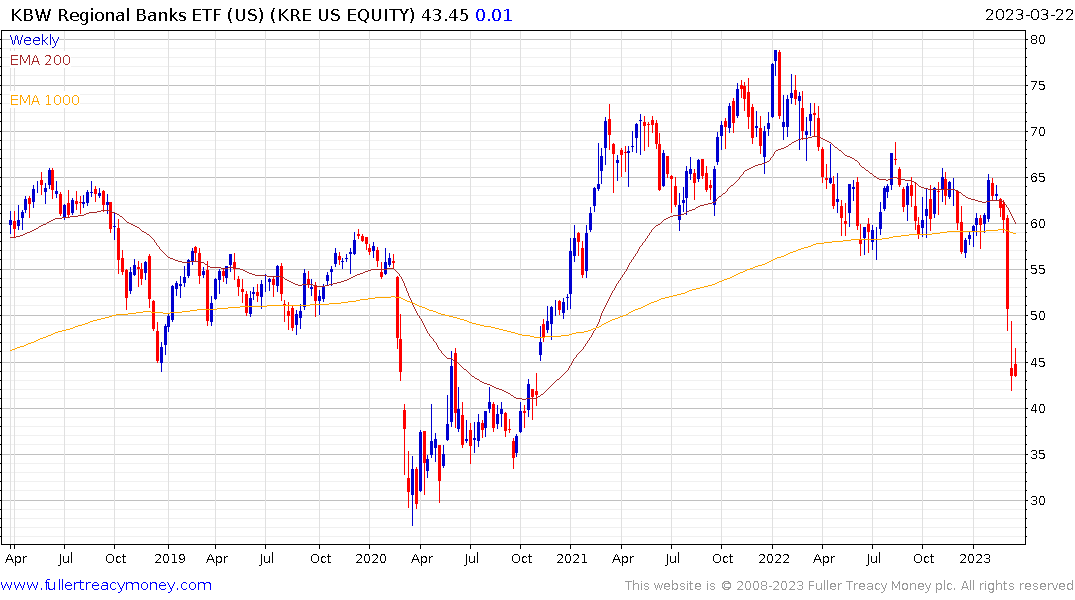

Janet Yellen’s testimony yesterday where she was less than enthusiastic for guaranteeing all deposits understandably continues to put downward pressure on the regional banks sector.

Janet Yellen’s testimony yesterday where she was less than enthusiastic for guaranteeing all deposits understandably continues to put downward pressure on the regional banks sector.