Private Equity's Loved Assets Turn Problem Children in Downturn

This article from Bloomberg may be of interest to subscribers. Here is a section:

“In terms of just the macro and company performance, I think it will be much more muted as people capture the inflationary pressures,” he said. “Private equity M&A activity I think will be dampened.”

Concerns around portfolio company performance were not the only challenges up for discussion in the south of France, with private equity firms struggling to secure the debt financing they need to do big deals and juice returns and facing more competition when raising funds.

The chief economist at German insurer Allianz SE, Ludovic Subran, said the industry had “nowhere to hide” when markets turned last year. “The private equity world has not been immune or has not defied gravity,” he said.

Banks pulling back from lending on buyouts was described as a “new reality” by Francois Jerphagnon, head of Ardian Expansion, in an interview with Bloomberg TV. This will open up an opportunity for private credit funds to step in, others said.

“There is much more interest in private credit and infrastructure where you do have that hedge against inflation and that hedge against rising rates,” said Richards at Pantheon.

Blackstone’s Eapen said private credit providers are in “the middle of a golden age” and that last year had been one of his business’s biggest ever for deploying capital.

After the credit crisis, the vindictive wish of anyone who lost money in the crash was for banks to go broke. At the very least everyone concluded they needed to be heavily regulated. Today the burden of regulation is heavy within the banking sector and we are in our 15th year since the crash.

That withdrawal of banks from the lending markets left an opening for funds to step in a provide commercial credit services. That is essentially what private credit is. Funds took over the juiciest/highest return and therefore riskiest part of the commercial lending market.

They also took over the residential mortgage markets. The net effect is non-bank lenders are now a major component of the financial architecture. They are also difficult to monitor because most are not listed.

Rocket Companies (mortgages) is currently pausing in the region of the 200-day MA and remains in a consistent downtrend.

Rocket Companies (mortgages) is currently pausing in the region of the 200-day MA and remains in a consistent downtrend.

Pennymac Financial Services (mortgages is rebounding impressively from the region of its trend mean and avoided much of the 2022 sell-off.

Pennymac Financial Services (mortgages is rebounding impressively from the region of its trend mean and avoided much of the 2022 sell-off.

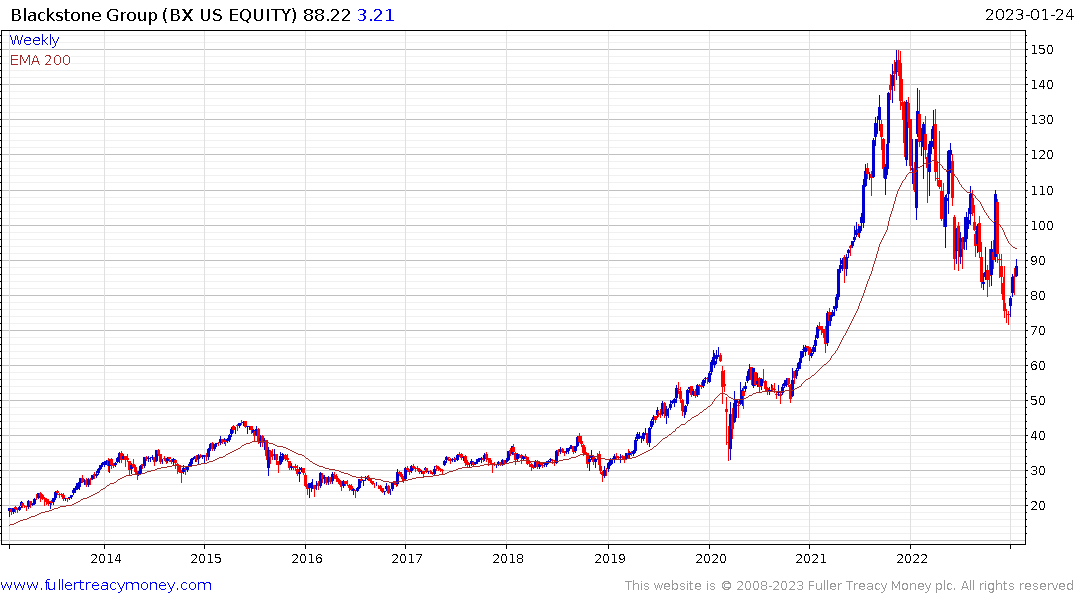

Blackstone remains in a consistent medium-term downtrend.

Brookfield is testing its sequence of lower rally highs and the region of the 200-day MA.

Brookfield is testing its sequence of lower rally highs and the region of the 200-day MA.

Bread Financial (store cards) has been steadying in the region of the 2020 low and closed above the 200-day MA today.

Bread Financial (store cards) has been steadying in the region of the 2020 low and closed above the 200-day MA today.

Square’s dalliance with crypto resulted in a steep decline last year but the primary business is buy-now-pay-later and building a financial relationship with a younger generation. The share firming in the region of the seven-month base formation. That helps to highlight the epicentre of risk is not with consumers on this occasion.

Square’s dalliance with crypto resulted in a steep decline last year but the primary business is buy-now-pay-later and building a financial relationship with a younger generation. The share firming in the region of the seven-month base formation. That helps to highlight the epicentre of risk is not with consumers on this occasion.

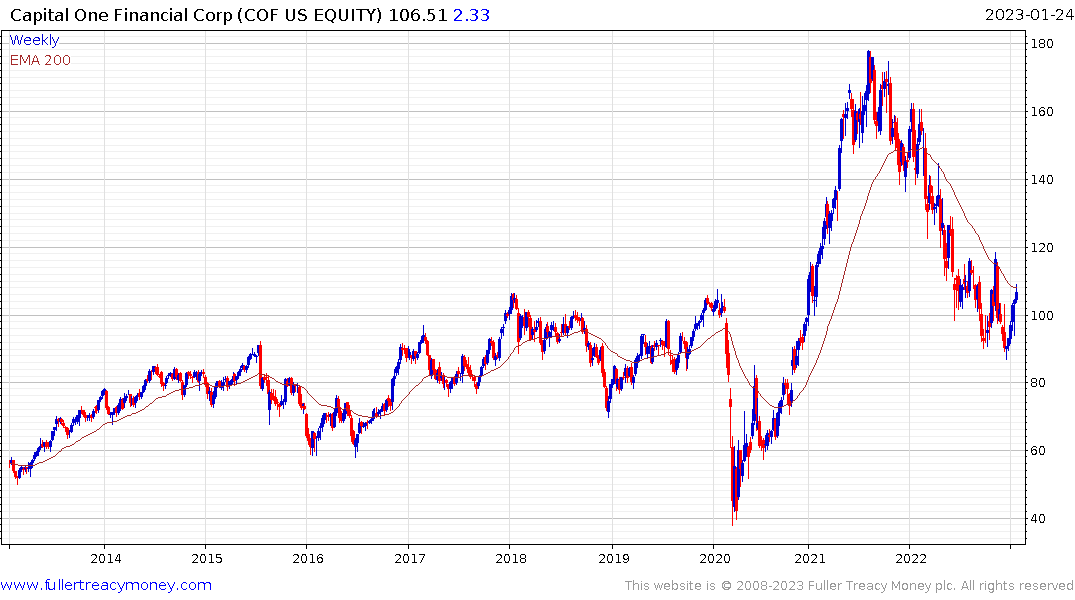

CapitalOne rebounded impressively following its earnings miss on the outsized loan loss provision it has implemented. They are building a buffer against future risk which is being applauded by investors.

CapitalOne rebounded impressively following its earnings miss on the outsized loan loss provision it has implemented. They are building a buffer against future risk which is being applauded by investors.

Meanwhile there is a looming market to market event likely among the unlisted portion of the market. For now, the expectation that interest rates will soon peak and subsequently collapse is support prices. The risk for the hedge fund sector is if bond yields begin to climb again and inflation is already entrenched.

Back to top