Predicting Equity Returns with Inflation

This article from Research Affiliates may be of interest to subscribers. Here is a section:

In this article, we document that two derived US inflation variables—inflation cycles and inflation surprises—have been robust predictors of US equity returns. We demonstrate that this predictability translates into new sources of alpha that investors can seek to harvest. In particular, we highlight the signals’ ability to perform during the worst times in the stock market without missing upside opportunities.

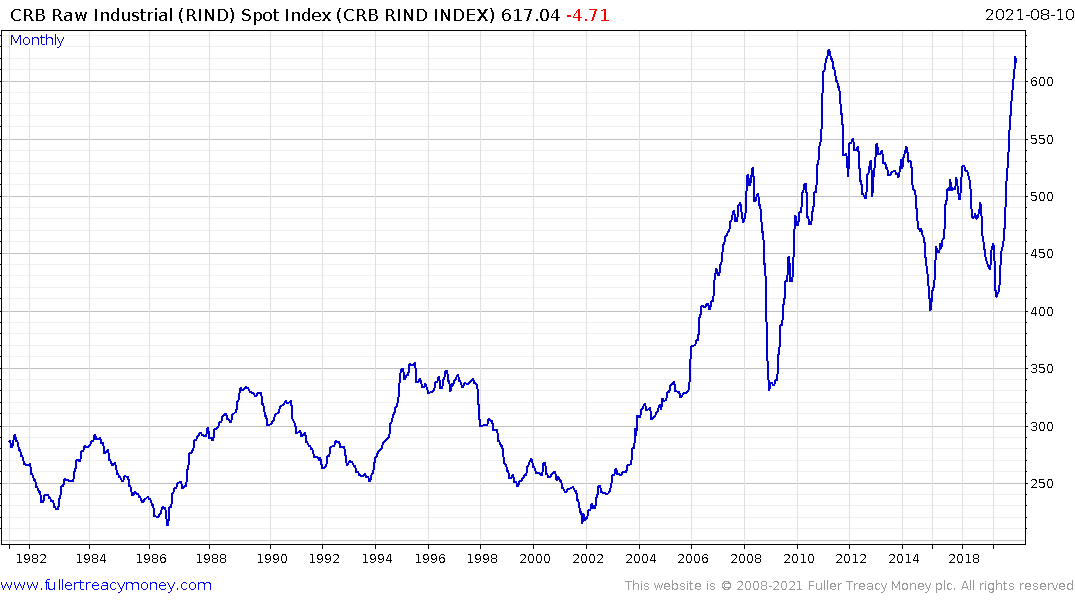

The tail-hedging properties derived from inflation signals are particularly desirable. Hedging positive inflation shocks can be costly when inflation is low.9 For example, strategic allocations to alternative assets, such as commodities, or absolute return strategies as a way to protect against inflation have not all fared well in recent years, with commodity indices down more than 30% versus their 2011 levels. As a result, many asset owners may not be able to stay the course if inflation fails to materialize in the medium term. We find that inflation signals can provide a new tool for investors who wish to hedge their portfolios against inflationary and deflationary risks.

“The tail-hedging properties derived from inflation signals are particularly desirable.”

For forty years inflation is the dog that refused to bite. There have been several occasions when it looked inevitable profligate spending, overly generous social programs, supply disruptions, commodity and property booms and busts would break the trend of disinflation but they never did.

There is no doubt that hedging against inflationary pressure can protect a portfolio against underperformance when inflation does breakout. The challenge is for decades it has paid to ignore the risk and bet on the bond and equity bull markets persisting.

Perhaps that is the biggest challenge from inflation. Equity returns tend to do well in the early stage of an inflationary cycle but that advantage fades as price pressures intensify. For bonds there is no good news.

The best hedge for portfolios over the last forty years has been private equity in all its forms. These assets have benefitted enormously from the pace of innovation and abundant credit which has kept getting cheaper. That has allowed valuations to soar. The challenge for the sector in an inflationary environment is investors will need to be much more judicious about what they invest in if they are to hedge their exposure.

I’ve seen more than a few people talking about an everything bubble. It certainly seems that way but commodities, Europe, Japan and most emerging markets are not in a bubble.

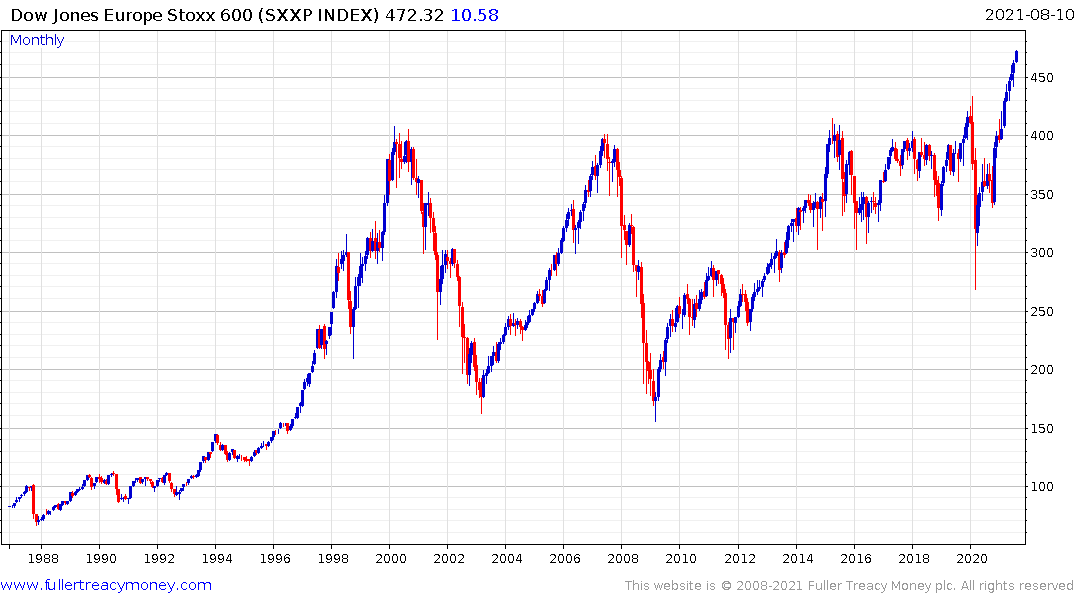

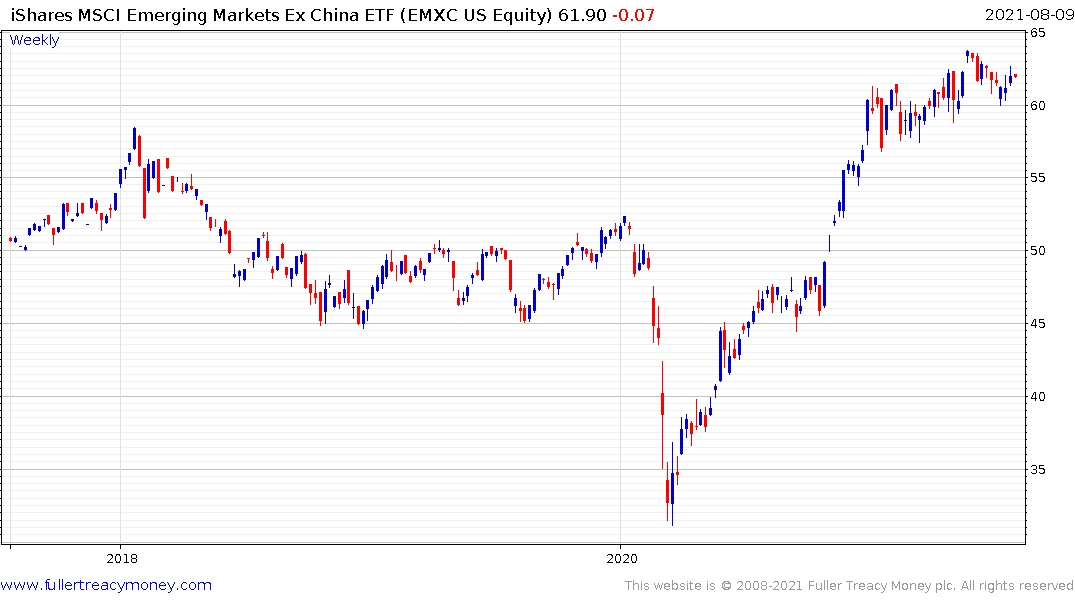

Japan is at record low valuations, Europe is only now breaking out from a 20-year base formation, emerging markets are beginning to emerge from China’s shadow and commodities are trending higher. Sometimes the best hedge is in avoiding the bubbles and to deal with inflation when it is clearly apparent.