Precious Metals: Turning around a historically unprofitable sector

Thanks to a subscriber for this report from RBC Capital Markets which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

Signals are evident that a gold equity sector positive turnaround is in progress. Despite a positive backdrop for gold prices over the past decade, historical profitability generated by the gold equity sector has lagged all other major sectors by a wide margin. While this historical financial performance is disappointing, important positive structural changes have been realized in recent years that have changed the outlook. These include balance sheet repair, improved operating cost structures, a renewed focus upon return of capital to shareholders, and consolidation emerging as a significant theme. We believe these factors materially limit potential downside risks for gold equities and improve gold equity investment prospects from purely a macro trading vehicle to their individual merits.

Qualitative outlook is constructive, quantitative valuation not yet compelling. While gold equity valuation today represents a considerable improvement from the past, the reality is that gold-focused investors have likely become acclimatized to subpar valuations. Following gold equities’ underperformance, we forecast the sector at spot now trades in line with broader generalist investment options on an FCF/EV basis (2020/21E 4.2%/4.7%, vs. S&P500 4.2%/5.0%), although we believe more attractive valuation is a prequalifying condition given historical capital allocation missteps as well as the sector’s higher-volatility, higher-cyclicality, and low asset duration. Nonetheless, current FCF/EV valuation represents a material improvement vs. historical estimates. Recent increased dividend rates by the group are commendable, although gold equities generate half the dividend yield and one quarter the total shareholder yield (i.e. including buybacks) compared to US equities.

The biggest takeaway from this report is RBC, one of Canada’s largest banks, is only now re-assuming coverage of the North American gold mining sector. Nothing signals a prolonged bear market like banks culling trading desks and firing analysts. As prices deteriorate, interest evaporates, liquidity declines and coverage disappears. When a new bullish story evolves it takes time for management teams to warm up to the idea of spending the money necessary to build a business unit to profit from it. The fact more banks are now engaging with the market suggests the sales effort is also going to receive a boost.

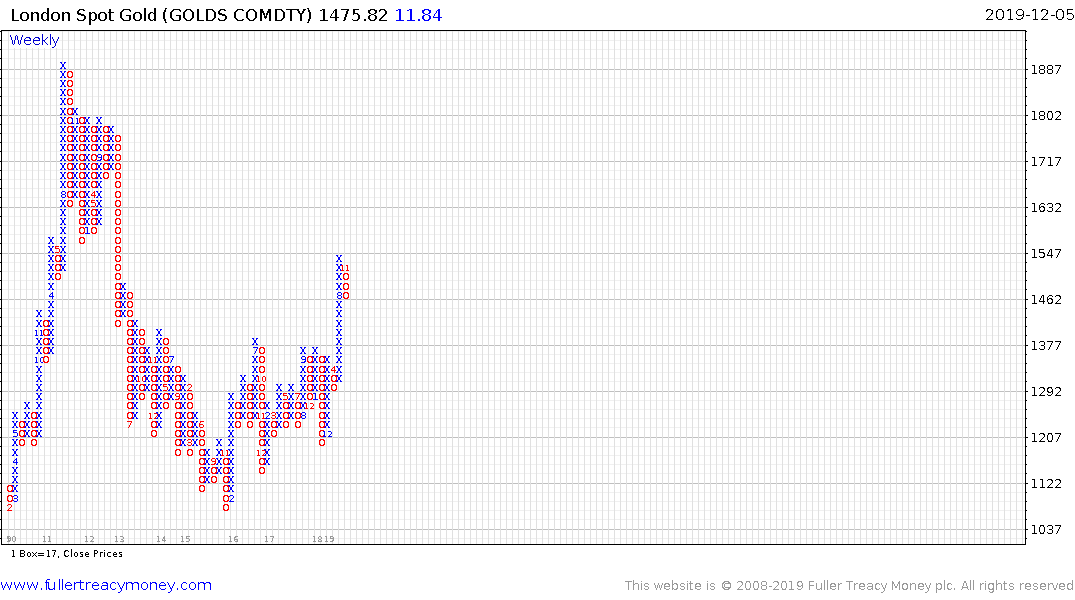

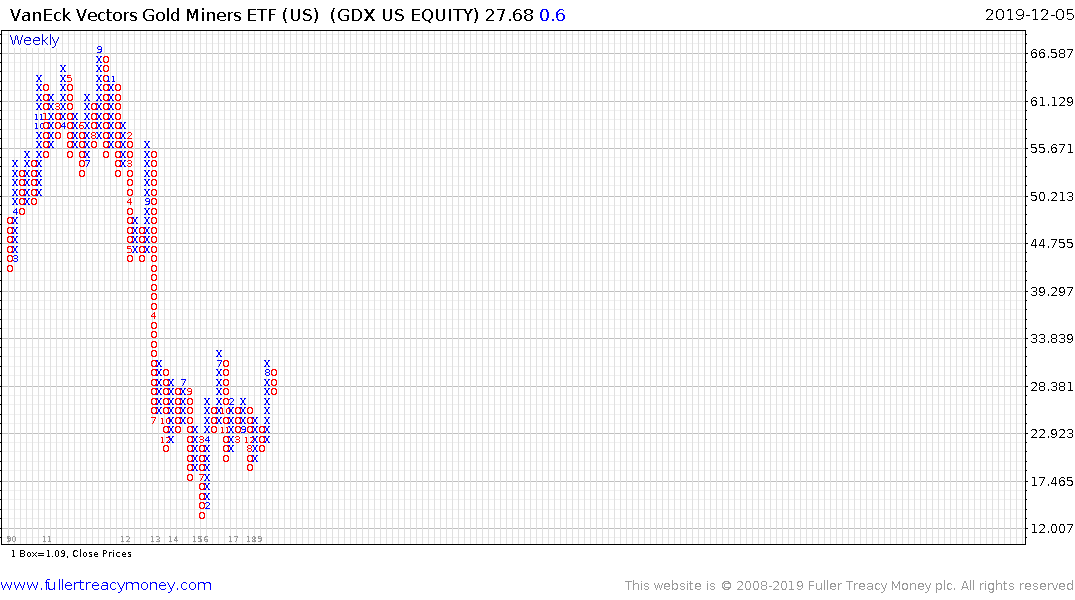

The Van Eck Vectors Gold Miners ETF is firming from its trend mean, having unwound its short-term overbought condition. A sustained move above $30 would complete the base and confirm a return to medium-term demand dominance.

This is the point in the cycle when gold miners tend to do best. Prices have risen meaningfully but management teams still feel chastened after being burned so badly during the bear market. All-in sustaining costs are in the region of $1000 for most miners and in some cases well below that level but expensive expansion plans are still unpopular. That means profits accrue at the bottom line and the shares have potential for dividend growth.