Precious Metals 2018 Forecast Silver

Thanks to a subscriber for this report from ScotiaBank focusing on silver which may be of interest. Here is a section:

Silver’s uses can be broken down into three main categories - industry, luxury goods (jewellery & silverware) and investments (bars, coins and ETFs). The ETF aspect of demand can be a major swing factor in Silver’s supply and demand balance because when ETF redemptions outpace buying, ETFs become a factor of supply and not demand. In 2017, total demand for Silver is forecast to be 33,090 tonnes; taking into account ETF demand and de-hedging, this is down 5.2 percent compared with 2016. As the chart below shows, demand for bars and coins shrank considerably in 2016 and that trend has continued this year, with sales of 1oz American Eagles at 16,938,500oz in the January to October period, down 50.7% from 34,500,500oz in the same period in 2016. In 2016, Silver’s use in electrical and electronic applications reasserted itself as the single biggest sector for fabrication demand.

Despite the global economy starting to recover in early 2016, as seen in the rebound in the global composite PMI to 53.4 in December 2016 from a low of 50.6 in February 2016, total physical Silver demand (excluding ETF purchases) did not recover in 2016. Indeed, the only area of growth was from the solar energy/photovoltaic industry. This suggests that it was the turn round in fund and investor interest that led to the rebound in prices. ETF investors bought 1,435 tonnes of Silver in 2016 and the net long fund position (NLFP) on Comex climbed to 58,911 contracts from 20,704 contracts at the end of 2015.

Here is a link to the full report.

Silver is often described as high beta gold and is best bought following reaction. The most react of these was in December when it tested the lower side of a more than yearlong range. It is now in the middle of that congestion area with the upper side somewhere in the region of $18.60.

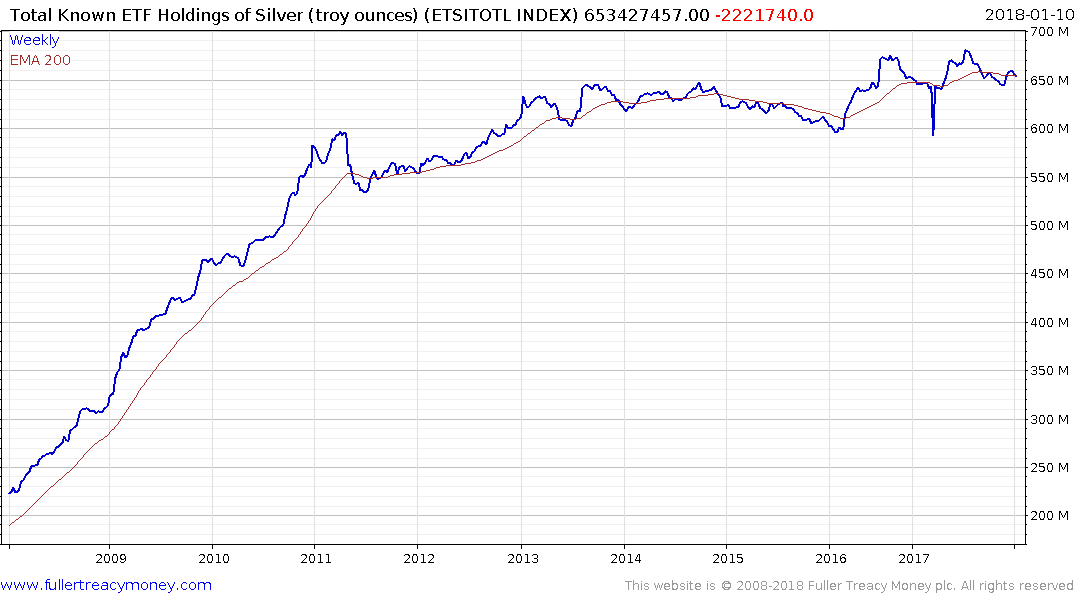

ETF Holdings of Silver picked up in early 2016 and have remained largely stagnant since so it is something of a stretch to conclude they are responsible for the recent uptick in interest for silver and the other precious metals.

Rather the deteriorating outlook for sovereign bonds with strong commonality across Treasuries, Bunds, Gilts etc. suggest investors are beginning to price in the potential that central banks may be caught behind the curve in managing inflationary expectations.

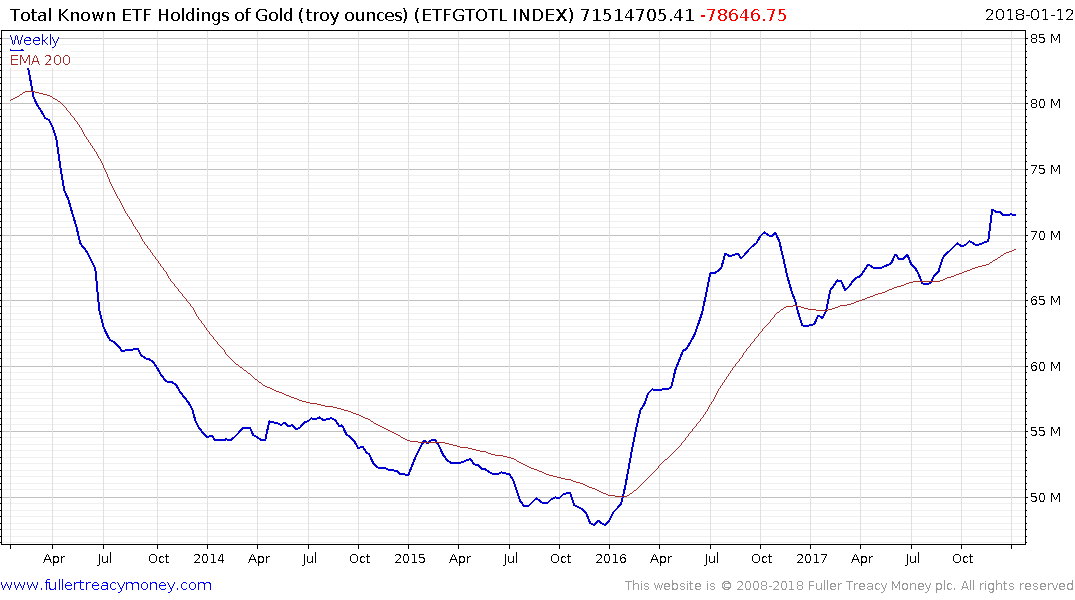

Total ETF Holdings of Gold are potentially more of an influence on the market for precious metals. The measure has been ranging with an upward bias for much of the last 18 months and it is now testing the recovery highs. It is updated with a 24-hour lag so it will be worth monitoring on Monday to see if it gives a lead indicator for a breakout on the gold price.

Platinum surmounted the psychological $1000 level today for the first time since September and will need to hold this area during any consolidation if the benefit of the doubt is to continue to be given the recovery.

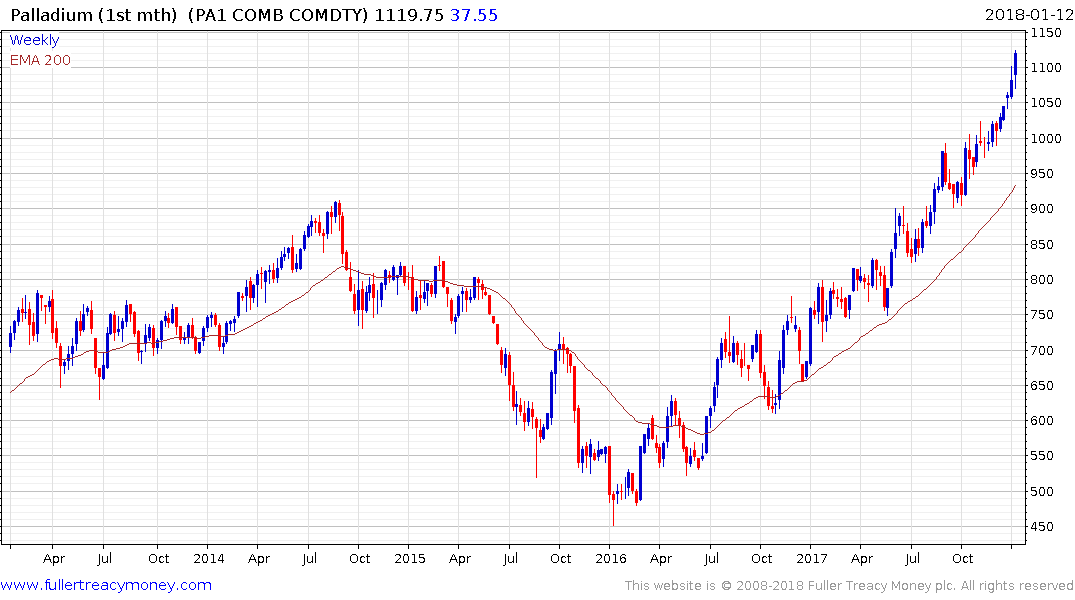

The pace of palladium’s advance is picking up and a sustained move below $1075 would be required to check momentum.