Powering the EV growth

Thanks to a subscriber for this report from Deutsche Bank which may be of interest. Here is a section:

Promising outlook for lithium; initiating coverage on Tianqi with a Buy

Rapid commercial EV sales in China triggered the lithium carbonate price to jump 160% in the past six months. We believe the momentum of strong EV sales, especially commercial EV, will continue driving lithium demand in the coming years. In the EV/battery supply chain, we believe lithium is in a sweet spot, enjoying a tight demand/supply balance and favorable industry structure with the top four suppliers controlling c.86% of global supply. Tianqi is global No.3 lithium supplier and will likely be the major beneficiary of the favourable trend. We thus initiate coverage of Tianqi with a Buy.Strong EV sales will to drive demand for lithium batteries

In 2015, China sold 172,641 units of commercial EV, implying six-fold growth. We believe double-digit growth for commercial EV in China will likely continue as: 1) subsidies remain meaningful in absolute terms, 2) the subsidy policy now covers the whole country and more types of commercial EVs, and 3) the EV penetration for public buses has reached the critical scale to pull the sales momentum. We believe passenger EVs’ growth will also be strong in the coming five years, due to the government’s supportive policies. We believe overall Chinese EV sales (commercial plus passengers) will grow at 42% in 2016 and 30% in the next two years, and will drive lithium demand to post a 7-8% CAGR in the coming years.Lithium as the upstream of EV/battery supply chain might be a sweet spot

Our investigation into the EV/battery supply chain suggests that lithium should be the sweet spot of the whole supply chain. Mid-stream producers might be facing technological uncertainty and aggressive capacity expansion. Downstream producers will need to continue to cut the cost of batteries and EVs to ensure greater end-customer adoptions. Only upstream lithium producers will fully benefit from this trend, regardless of technology options. Meanwhile, the supply increase process of upstream players has been very slow. We also see c. 86% of market supply controlled by the top four suppliers as a major positive for lithium producers. Market concentration should sustain the lithium up cycle longer.

Here is a link to the full report.

From early in the last decade David characterised the developing bullish case for commodities as Supply Inelasticity Meets Rising Demand. The emergence of China onto the global market was creating outsized demand growth for industrial resources and companies were inhibited in their ability to increase supply following a generational long bear market. They invested hundreds of billions in increasing supply while China’s demand growth has tapered off leading to prices falling back to earth.

Lithium prices are not liquid but they have been inert for three years suggesting the relatively high price environment has not acted as a headwind for demand. With so much of global supply concentrated in the hands of only four companies their decisions on when to increase supply are likely to have a significant influence on the supply inelasticity argument as it pertains to lithium.

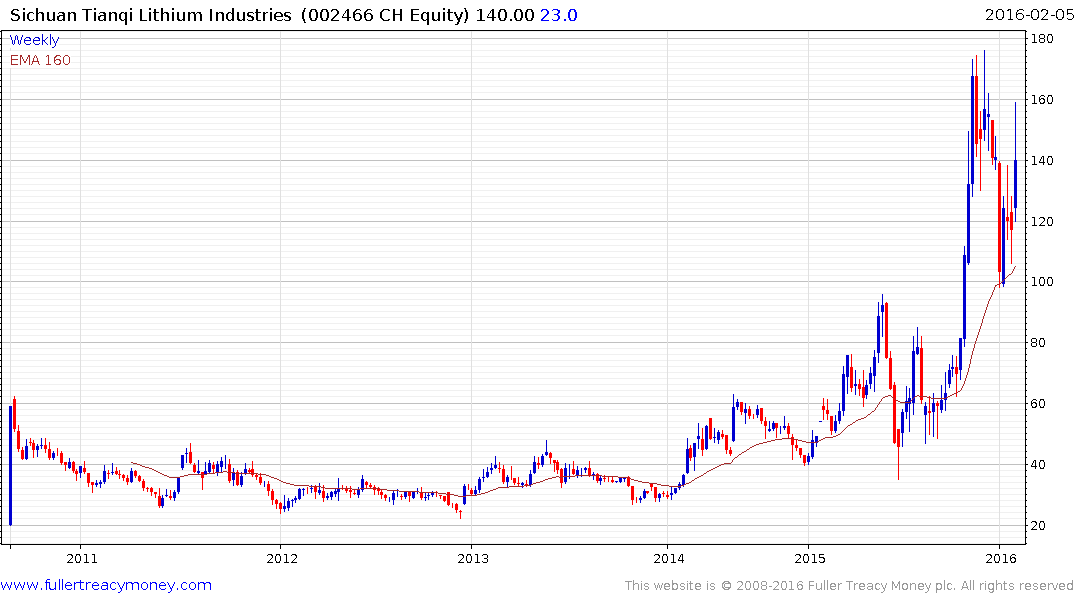

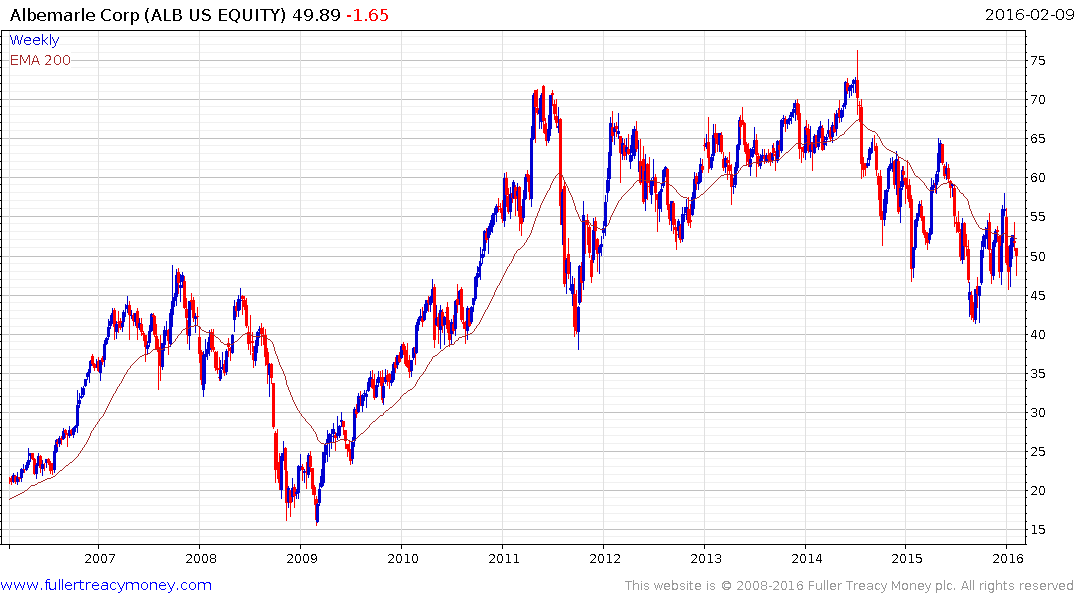

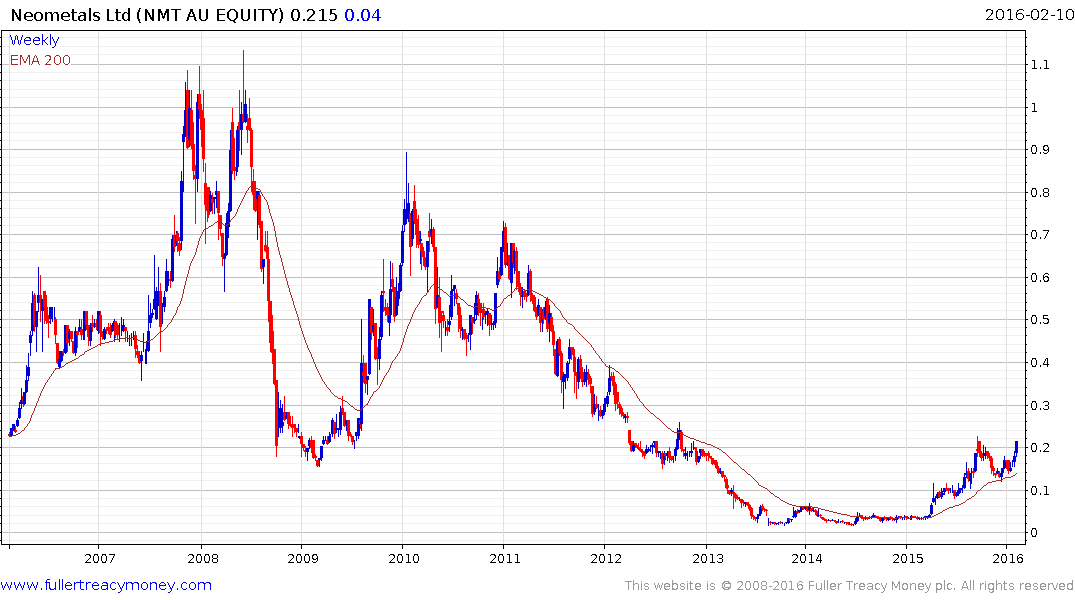

Of the primary lithium miners FMC is primarily a chemicals company with lithium accounting for 6.4% of revenue last year. Chile’s SQM makes most of its money from agricultural chemicals with only 8.2% of revenue from lithium. Albemarle Corp highlights its leading role in lithium on its website but does not separate out the metals contribution to revenue in its balance sheet. Australian listed Orocobre is primarily a Borax miner but its Lithium brine recovery operation opened last year so we can expect that to begin contributing to earnings from the next release in September. Chinese listed Sichuan Tianqi Lithium Industries is the only one of the major suppliers that offers a pureplay on the lithium mining sector at present. All of these companies have expansion plans so demand growth will need to continue on its expected trajectory if the bullish case for miners is to remain credible beyond the short term.

The Chinese market is closed at present for the New Year holiday but the share exhibits impressive relative strength and a sustained move below the trend mean would be required to question medium-term upside potential.

Albemarle has a decade long record of increasing dividends and currently yields 2.20%. The share continues to build support above the lower side of a four-year range and a sustained move below $45 would be required to question potential for additional upside.

Australia listed Neometals (AS120 million market cap) expects to begin production at its lithium mine in Q3 2016. The share remains on a recovery trajectory and a sustained move below the trend mean would be required to question medium-term scope for additional upside.

Back to top