Pound's Longest Drop in 3 Years Defies Signs That Foretold Gains

This article by Lukanyo Mnyanda for Bloomberg may be of interest to subscribers. Here is a section:

Sterling has taken quite a hefty whack,” said Steve Barrow, head of Group-of-10 strategy at Standard Bank Group Ltd. in London, who still sees the pound gaining about 10 percent versus the euro in the next two years as U.K. growth outpaces its neighbors.

“The generally bullish mood after the elections meant the majority of traders and investors were positioned that way,” he said. “And when things didn’t turn out necessarily so good, we’ve seen some position squaring.”

Weekly Slide

The pound slipped 0.3 percent to 73.15 pence per euro as of 12:15 p.m. London time, headed for a 0.6 percent weekly drop. It’s already weaker than the 71 pence strategists predicted for the end of this quarter in a June 30 Bloomberg survey. Barrow now forecasts an advance to about 65 pence.

It still costs more to protect against the pound gaining versus the euro than it does to hedge weakness in the options market, though the premium has shrunk to about the least since May.

The U.K. currency fell 0.2 percent to $1.5228 after tumbling to $1.5214, the lowest level since June 5. The declines suggest sterling is losing its status as the darling of the currency markets amid signs the economy is starting to lose momentum. Reports this week on services, construction and manufacturing all fell short of economists’ forecasts, which may reduce the chance of a boost to official borrowing costs.

The UK economy is still generating growth well in excess of other larger European countries which has helped stoke discussion of an interest rate hike. However the Bank of England is not going to raise rates on its own because of the loss of competitiveness this would represent for the economy which has led to the Pound losing some of its allure.

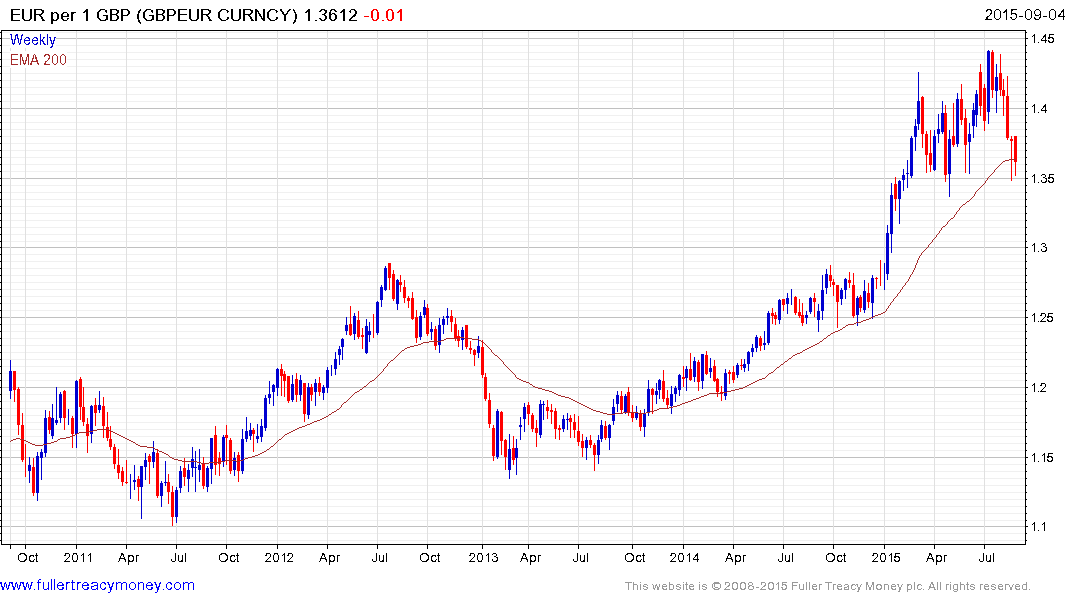

The Pound failed to sustain the move to new highs against the Euro in July and has since returned to test the lower side of the underlying range which also coincides with the region of the 200-day MA. It continues to steady in this region and a sustained move below €1.35 would be required to question medium-term Pound dominance.

Against the US Dollar the $1.50 area has been an area of support for the Pound on a number of occasions since 2010. The rate is currently testing the April lows near the $1.52 area and a clear upward dynamic will be required to question current scope for lower to lateral ranging.