Pound Reaches 2016 Peak as Traders Await U.K. Referendum Result

This article by Lukanyo Mnyanda and Netty Ismail for Bloomberg may be of interest to subscribers. Here is a section:

The pound climbed to the strongest level this year as British voters cast their ballots in a referendum on the nation’s European Union membership.

A gauge of sterling advanced for a second day, while the currency headed for its best week since 2009 against the dollar as two polls conducted before Thursday showed a lead for the campaign to keep Britain in the European Union.

Still, a measure of implied overnight price swings versus the dollar climbed to the highest level on record, as traders sought protection from outsized price swings. Voting began at 7 a.m. London time and ends at 10 p.m.

The pound has acted as a barometer of sentiment since the start of the campaign in February, rising or falling depending on which side of the debate was gaining momentum. Sterling has climbed about 8 percent since sliding to a seven-year low of $1.3836 on Feb. 29, about a week after the date of the vote was announced, and has rallied from as low as $1.4013 last week.

The Pound hit a medium-term peak near $1.72 in 2014 and was trading closer to $1.57 when the Conservatives won the election last year. It then trended lower for the remainder of the year before finding support in the region of $1.40 which also represents the lower side of a long-term range.

With a consensus now expecting the Remain campaign to prevail, the Pound has traded up almost 10¢ this week to break back above the 200-day MA for the first time this year. However a better test of renewed demand dominance will be to what extent it can hold the gain next week once the result is known.

The FTSE-100 has also bounced rather emphatically this week and will need to sustain a move above 6500 to confirm a return to demand dominance beyond the short-term.

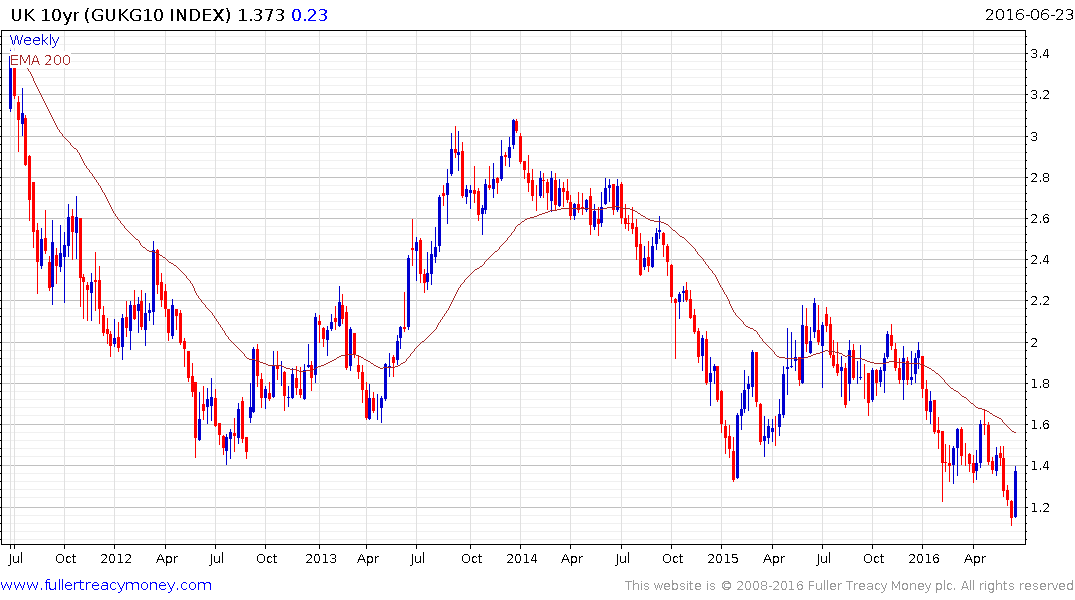

UK Gilt yields continue to unwind the short-term overextension relative the trend mean but a sustained move above 1.55% will be required to signal more than temporary supply dominance.