Pound Jumps to Highest Since Brexit Vote on Hopes of Better Deal

This article by Charlotte Ryan for Bloomberg may be of interest to subscribers. Here is a section:

The pound jumped to the strongest level since the Brexit referendum as Spanish and Dutch finance ministers were said to be working together for a deal that keeps Britain as close to the European Union as possible. Gilts declined.

Sterling rallied as much as 1.1 percent, the biggest intraday gain since mid-September, as the news rekindled optimism about the U.K. having continued access to Europe’s single market. Still, the rally was greeted with caution even by top sterling bulls, who said a more meaningful development is needed to maintain the currency’s strength.

“We’ll need substance in these reports plus a transition deal and positive U.K. data to keep the pound supported here,” said Viraj Patel, a currency strategist at ING Groep NV. “But it means the pound has taken out a really important resistance area and makes our call for $1.40 all the more likely.”

It has been my contention for months that a negotiated settlement remains the most likely outcome from the Brexit talks. That doesn’t mean it is the best solution or indeed the worst just the most likely.

The Brexit referendum passed by a simple majority which left 48% of the population disgruntled. In many other countries a qualified majority would be required for such a momentous decision, but since it was not required for entry there is a rational argument for why it was not required to leave the Union.

Nevertheless, the administration is charged with governing for all the nation’s people and therefore a negotiated settlement remains the most likely scenario. Additionally, the ranks of the members of parliament are stacked with those who voted to stay and since it is these same law makers and bureaucrats who are negotiating the settlement the UK is likely to remain closer to the EU than many might wish.

On the other side of the channel there is obviously an institutional desire to punish the UK for calling the European project into question. However, there are similar, though perhaps not quite so vociferously argued, calls for reform in many European countries. The European Union runs the substantial risk of making the UK a martyr to the cause of independence if the deal it demands is too onerous. Real politik is simple. The UK shares a border and has historic, economic and political ties with Ireland, it is less than two dozen miles from the Eurozone heartland, it is home to the world’s most impressive financial centre and it plays a vital role in NATO. It makes sense to drive a hard bargain with the UK but to make sure there is a bargain.

The Pound hit a new recovery high today against the US Dollar which is as much about Sterling’s strength as it is about the Dollar’s weakness. A break in the progression of higher reaction lows would be required to question medium-term scope for additional upside.

The Euro was also firm as it also broke out to new recovery highs.

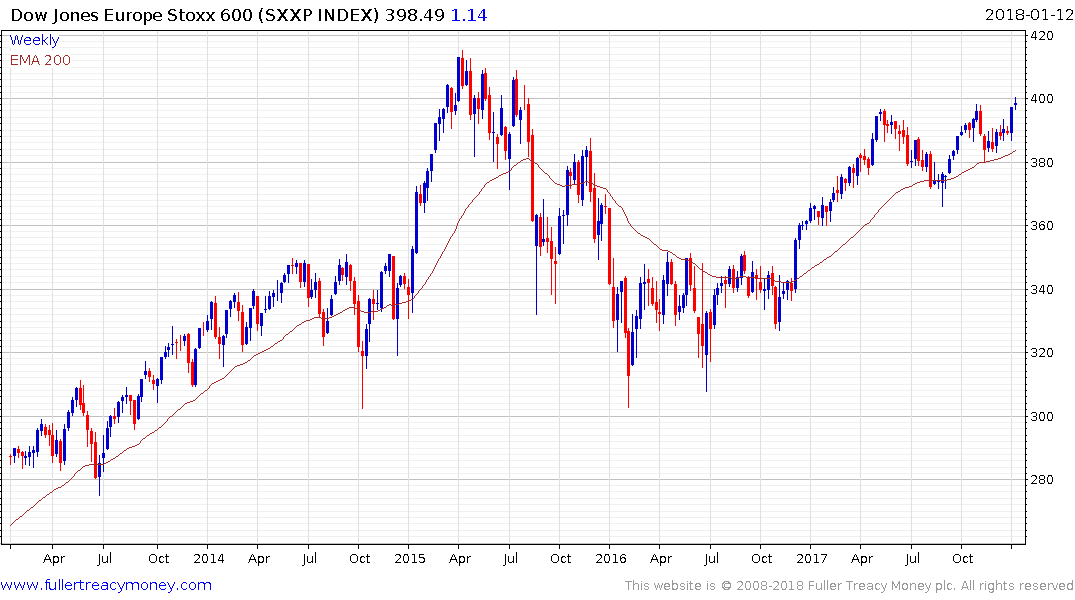

What is particularly interesting is that the majority of European stock market indices were in positive territory. That suggests the narrative have moved on from a reliance on progressively more quantitative easing to a belief in the sustainability of economic expansion.