5 Junior Gold Miners Trading at Less Than $110 Per Ounce

This article from SmallCapPower.com may be of interest to subscribers. Here is a section:

A gold producer is often valued based on the Net Asset Value of its operations. In other words, an investor needs to value the company’s assets (reserves) and subtract its liabilities. Its future resource production is estimated based on current reserve levels, and it is used in accordance with projected gold prices to calculate future cash flows. With the current price of gold trading at the US$1,200 an ounce level, it is relatively hard to understand why certain companies trade at $100/ounce. Regardless, the five gold juniors on this list are being valued by the market at a substantial discount to its ounces in ground.

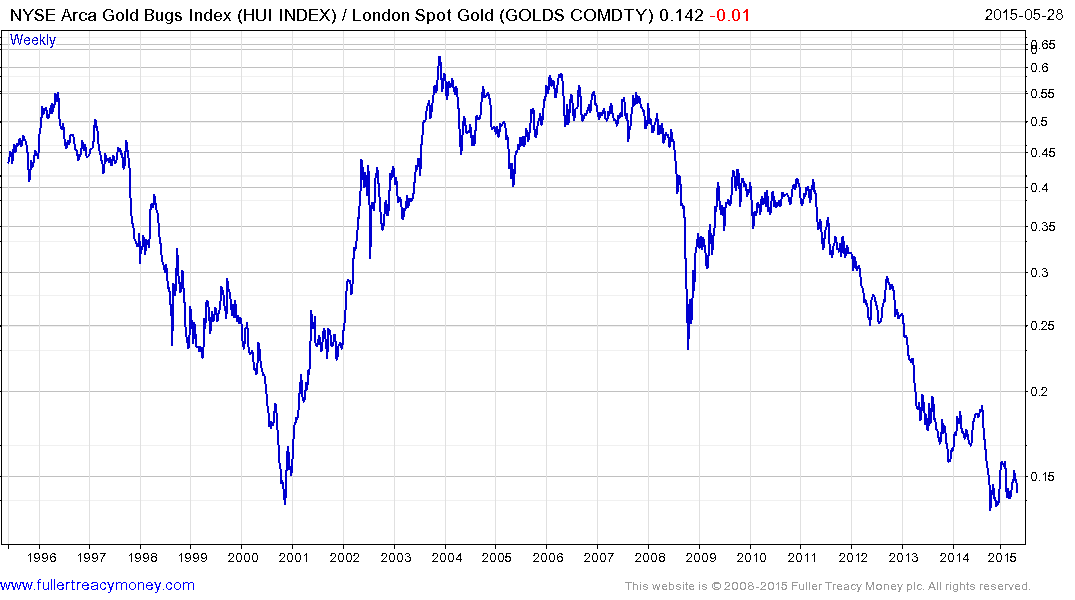

Gold miners are back trading at their lowest level relative to the gold price since 2001 which is an interesting situation. Looking at the above title one could be tempted to see value which is a view I am sympathetic with. However for this ratio to reverse what has been a major downtrend investors will need to see evidence that gold is going to hold the current range. Only then will they conclude gold miners represent a high beta play. In other words just because the above miners are trading at $110 per ounce does not mean that number won’t rise if gold prices fall.

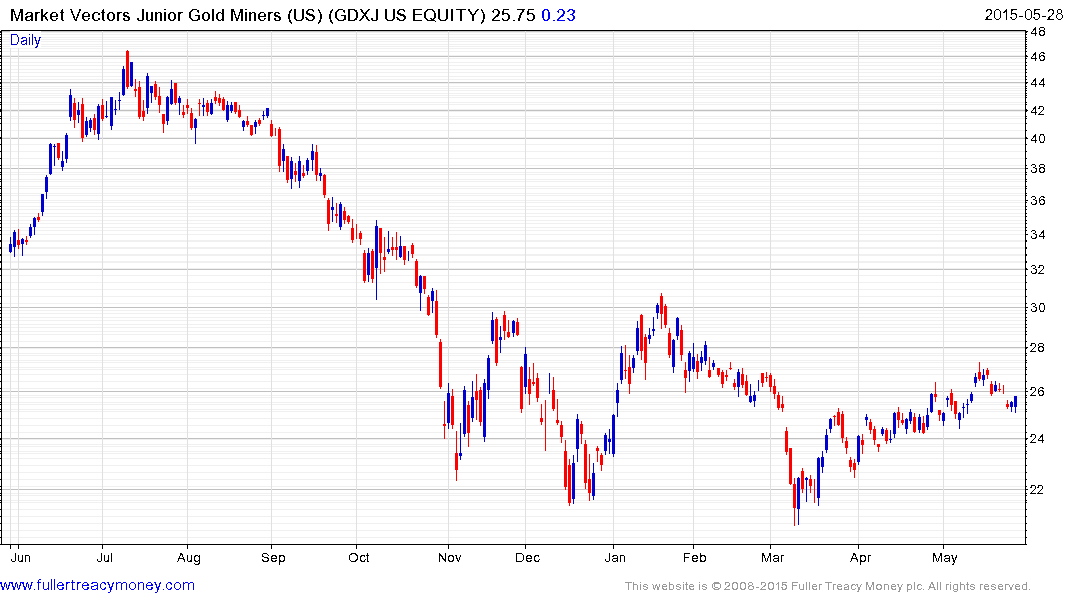

The Market Vectors Junior Gold Miners ETF has been ranging above $22 since November and has held a progression of higher reaction lows since March. A sustained move above $30 would begin to signal a return to demand dominance beyond the short term.