Autonomies

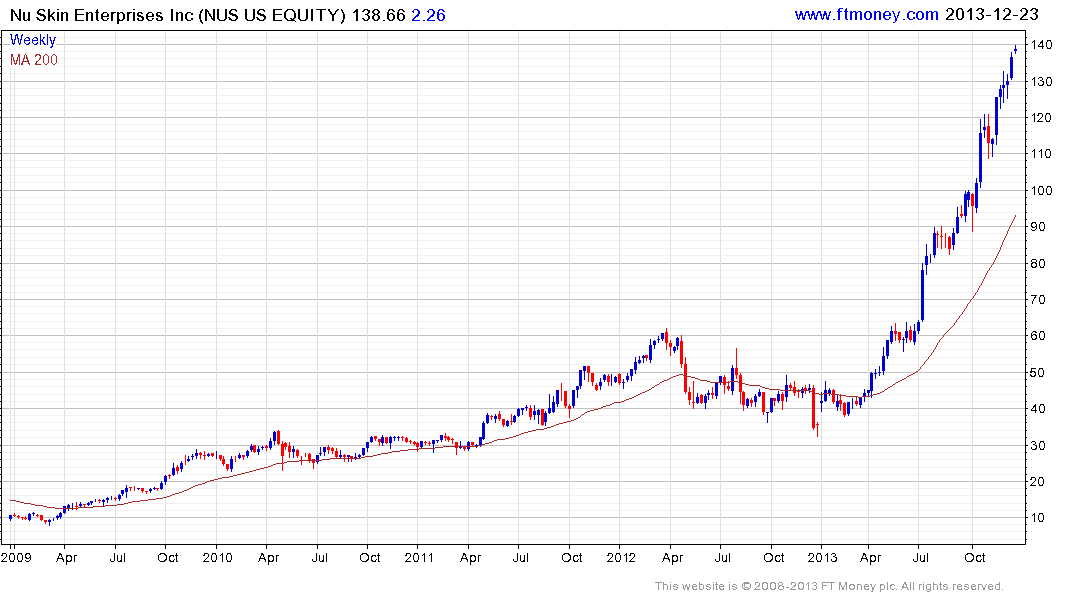

I clicked through the constituents of my Autonomies Favourites section this morning to get a feel for how the sector is performing. A number of shares such as NuSkin Enterprises continue to extend their advances but are becoming increasingly susceptible to mean reversion. On the other hand, a considerable number are now either finding support in the region of their respective 200-day MAs or just breaking out to new highs.

As a seasonal favourite Tiffany caught by attention. While the broad luxury goods sector has been mostly rangebound for the last 18 months, Tiffany is now completing its consolidation and a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

In the technology sector, Oracle hit a medium-term peak in 2011 and spent more than two years ranging. It rallied this week to break out to new recovery highs.

The automobile sector has also been resurgent. Greatwall Motors is notable for finding support this week in the region of the 200-day in what is otherwise a reasonably consistent but steep advance.

In the robotics sector Fanuc has been ranging with a mild upward bias for more than two years, but surged to new highs last week and a break in the medium-term progression of higher reaction lows would be required to question medium-term scope for additional upside.

Back to top