Email of the day on silver's contango

I am asking why the next expiry in Silver futures is so much higher than it seems to me than in the past, is it simply because rates are higher?

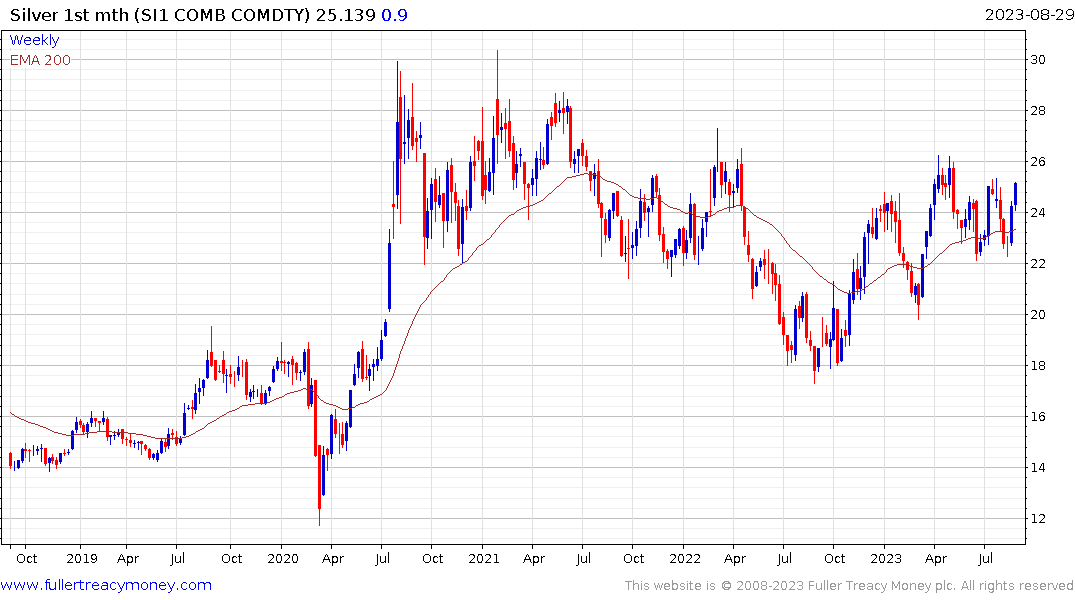

Thank you for this question. You are correct the spread between the 1st and 2nd month contracts is wider than at any point since the 2020 panic of 2007. Interest rates do tend to affect the cost of margin which is reflected in the contango. Volatility and the extent of hedging activity are additional considerations.

Silver continues to extend its rebound despite the contango which suggests traders are willing to ignore roll costs. That probably because the on the run future is the December expiry.

Silver continues to extend its rebound despite the contango which suggests traders are willing to ignore roll costs. That probably because the on the run future is the December expiry.

Silver broke its medium-term downtrend in April and continues to consolidate mostly above the 200-day MA. It is now approaching the July peak near $25.50 and a sustained move above $26 will be required to confirm a return to medium-term demand dominance.

Silver broke its medium-term downtrend in April and continues to consolidate mostly above the 200-day MA. It is now approaching the July peak near $25.50 and a sustained move above $26 will be required to confirm a return to medium-term demand dominance.

Gold continues to extend its rebound from the region of the 200-day MA. A clear downward dynamic would be required to check momentum.

Gold continues to extend its rebound from the region of the 200-day MA. A clear downward dynamic would be required to check momentum.

The Dollar Index has failed to sustain moves above the 200-day MA on two separate occasions this year. Today’s decline opens up potential for another failed upside break. Downside follow through tomorrow would increase scope for at least a retest of the 100 level.

Silver is currently leading gold. That’s a clear signal we are in the 2nd psychological perception stage of the precious metals bull market. When interest in the sector picks up traders look for higher beta plays. Favouring silver is a way of doing that because it is a much smaller market than gold. By the time the trend peaks, silver is likely to be at new all-time highs.

Back to top