Fed on Track for Rate-Hike Downshift After Cool Inflation Data

This article from Bloomberg may be of interest to subscribers. Here is a section:

The Federal Reserve is on track to downshift to smaller interest-rate increases following a further cooling in US inflation, though it’s likely to keep hiking until price pressures show more definitive signs of slowing.

Philadelphia Fed President Patrick Harker, speaking Thursday morning shortly after the Labor Department’s release of consumer price data, said rate hikes of a quarter-percentage point “will be appropriate going forward,” following bigger increases throughout most of 2022. Harker’s comments echoed remarks a day earlier from Susan Collins, his counterpart at the Boston Fed.

Consumer prices rose 6.5% in the 12 months through December, marking the slowest inflation rate in more than a year. So-called core inflation, which excludes food and energy, was up 5.7% over the same period, the smallest advance in a year. Both figures matched median forecasts.

“The trend in services inflation seems to be abating. That’s what the Fed will be looking at in today’s report,” said Thomas Costerg, a senior US economist at Pictet Wealth Management in Geneva, Switzerland. “At the margin, this means an increased probability of a 25-basis-point rate hike on February 1st.”

The bond market is already looking ahead to when the Fed will be cutting rates so it is quite possible the next rate hike will downshift from 50 to 25 basis points.

That less aggressive pace of tightening is rapidly removing the primary bullish support for the Dollar Index which continues to extend its decline.

That continues to support gold which is trending back to test the upper side of the medium-term range near $2000.

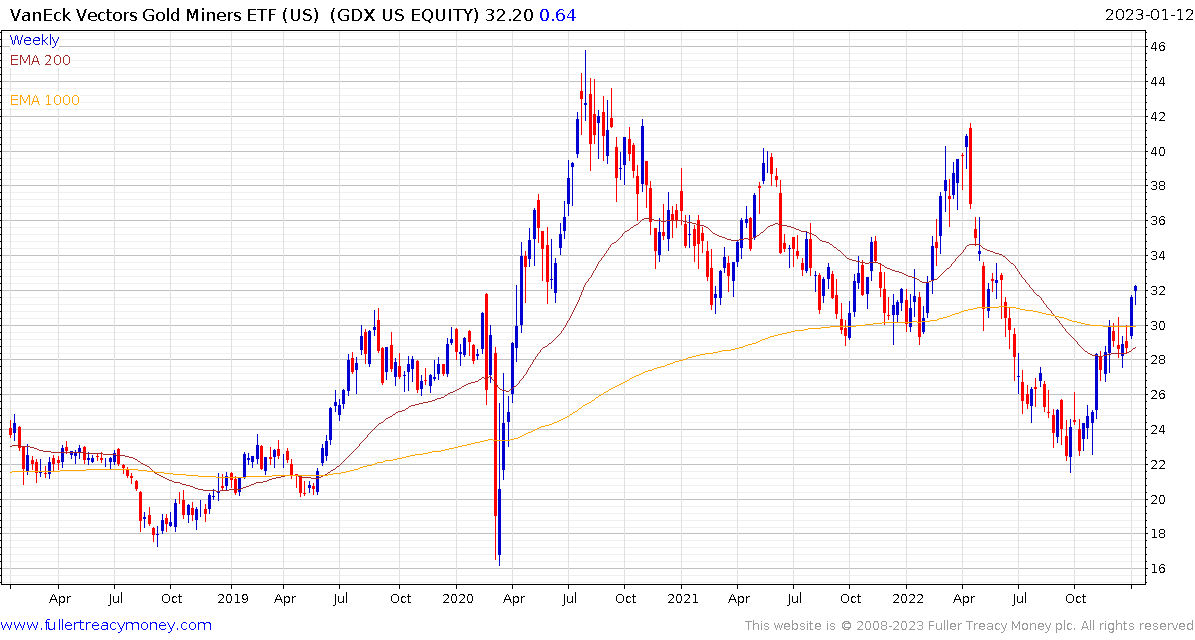

The VanEck Vector Gold Miners ETF is pulling away from the $30 area and the region of the trend mean. It has significant catchup potential as gold prices rise.