Housing Tumbles Down Under as Soaring Borrowing Costs Take Toll

This article from Bloomberg may be of interest to subscribers. Here is a section:

In Australia, where the pace of housing declines has eased, the outlook for mortgagees is similarly tough: borrowing capacity has fallen and monthly repayments have surged. In addition, a large chunk of loans that were fixed at record-low rates during the pandemic are due to roll over in 2023 at a much higher rate.

With the full impact of past hikes yet to be felt, rates still rising and the economy set to weaken, there’s likely still some way to go before prices bottom, said Shane Oliver, chief economist at AMP Capital Markets in Sydney.

Given expectations that rates will rise higher in both countries, some economists see home values dropping more than 20% from their peaks.

Rolling fixes is likely to be a major topic of conversation in Australia, Canada, and the UK in 2023. The impending step higher in mortgage payments for millions of consumers is the central dilemma for their respective central banks. They need to raise rates to try and tackle inflationary pressures but every hike makes the problem of consumer debt sustainability worse.

The Australian property sector has grown enough that it now commands its own sector within the ASX. It is almost entirely comprised of REITs which are dependent on values remaining high and interest rates lows. Every constituent is in negative territory this year apart from Vicinity Centres.

The Australian property sector has grown enough that it now commands its own sector within the ASX. It is almost entirely comprised of REITs which are dependent on values remaining high and interest rates lows. Every constituent is in negative territory this year apart from Vicinity Centres.

Goodman Group, the largest constituent, is currently testing resistance in the region of the 200-day MA and the medium-term sequence of lower rally highs.

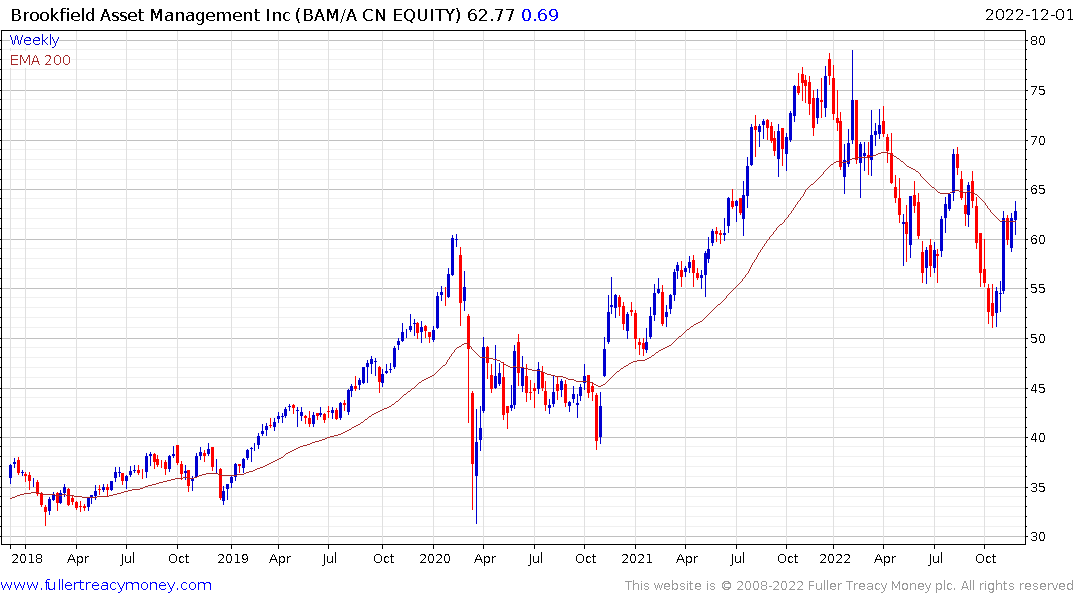

Canada’s Brookfield Asset Management has a similar pattern.