Intel Slashes Mobileye IPO Valuation Again to $16 Billion

This article from Bloomberg may be of interest to subscribers. Here is a section:

Despite the drop in valuation, the listing is set to be one of the year’s biggest IPOs. Amid heightened volatility and disappointing debut performances of last year’s listings, IPO volume in the US has plummeted to $22.3 billion this year, compared with $277 billion at this point in 2021, according to data compiled by Bloomberg. Instacart Inc., another highly anticipated IPO, last week cut its valuation for the third time, to $13 billion, and is waiting for the markets to settle before going ahead with a listing. Another deterrent for new listings is the fact that many companies that went public in 2020 and 2021 are trading below their IPO prices.

But some analysts said it was reasonable for Intel to go through with the listing despite the poor market timing. Analysts at Bernstein said Intel likely needs the money it will receive from the deal, “given the way their own business is currently trending.” And Vital Knowledge analysts wrote that the “headline is negative, but keep in mind the $50B valuation was floated back in December, so no one should be shocked that the number is now lower today.” Intel shares were up about 1.4% in early trading in New York.

At present we have straws in the wind but the issues with alternative asset valuations are going to become pressure points for investors over the next couple of years. The LDI debacle in the UK where pensions engaged in financial engineering to avoid leverage rules is the thin end of the wedge.

The reality is QE and the low interest rate environment robbed savers, like pension funds, and forced them to become speculators. At the same time it favoured risk takers and inflated their assets. That allowed both to prosper for a long time but rising rates and tighter liquidity mean the party is over.

Intel paid $15.3 billion for Mobileye in 2017 and has done nothing with it. The IPO gets their money back but not much more. It’s certainly better than taking a loss and the company needs every penny to rebuild its position as a leader in chip manufacturing. IPOing Mobileye might be viewed as a wise move a couple of years from now because at Intel is not taking a loss.

The 60% write down of intangible value is being passed off as a trivial concern. It’s anything but. This report from KKR may be of interest. Here is a section:

This need for change is occurring at a unique moment, as we are now entering a potential macroeconomic and geopolitical regime change that likely warrants a new approach to asset allocation, including shorter duration and greater exposure to Real Assets, we believe. We also see a greater need for these organizations to consider placing a more holistic emphasis on portfolio construction, technological prowess, and risk management. Importantly, in recent years earlier stage, higher Beta, longer duration equity investments led to much of the outsized asset growth in the E&F community; however, it now feels to us that the E&F community is over allocated to this area at a time when both performance and realizations are poised to slow. So, this positioning could prove tricky, as we enter an environment where the traditional relationship between stocks and bonds, and in particular growth stocks, has changed. To this end, now is the time for all of us with ties to the E&F community to take a step back and recognize that, ‘the times they are a-changin’.

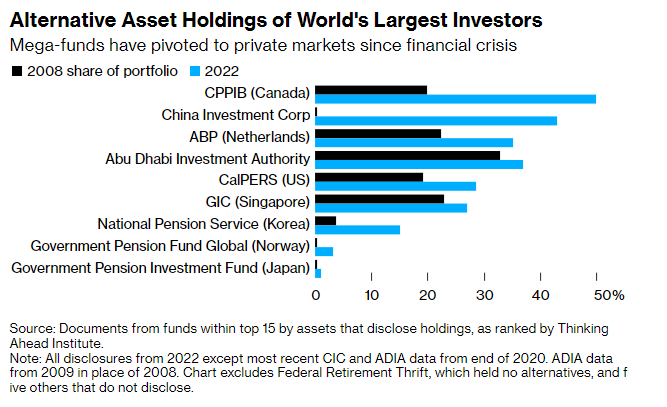

This article from Bloomberg highlights the fact that pension and sovereign wealth fund allocations to alternative assets have surged over the last 12 years. Funds substituted liquidity fuelled returns for illiquid positions. Sovereign wealth funds can put off mark-to-market for a long time but as write-downs pile up that will be increasingly difficult to justify

This article from Bloomberg highlights the fact that pension and sovereign wealth fund allocations to alternative assets have surged over the last 12 years. Funds substituted liquidity fuelled returns for illiquid positions. Sovereign wealth funds can put off mark-to-market for a long time but as write-downs pile up that will be increasingly difficult to justify

For now there is a wall of money still chasing deals. That’s particularly true in renewable energy and grid scale batteries. London property is attracting ample foreign capital following the devaluation of the Pound. That’s covering the fact funds are selling real estate to cover holes in their pensions assets.

Against that background, central banks will need to see evidence of inflation peaking to even consider pivoting. The world is still awash in cash.

Back to top