Fed Hits Stocks but the Larger Risk Remains Earnings, Not Rates

Thanks to a subscriber for this report from Mike Wilson for Morgan Stanley. Here is a section:

Here is a link to the full report and here is a link to it:

Earnings are the bigger risk for stocks from here…Almost all of the weakness for stocks during 1H22 was due to the Fed and tighter financial conditions. The 2H outcome will ultimately be determined by earnings expectations for next year, in our view. As a result, equity investors should be laser focused on this risk, not the Fed, particularly as we enter the seasonally weakest time of the year for earnings revisions, and inflation further eats into margins and demand.

...And leading earnings indicators point to weakness ahead... We remain focused on the spread between forward sales growth and rate of change on PPI and the spread between nominal GDP growth and wage growth. Both indicators suggest margin pressure and earnings growth risk ahead. This view is confirmed by our leading earnings model, which projects a steep fall in EPS growth over the next several months. A key input to this model is the ISM manufacturing PMI, and leading regional Fed manufacturing surveys point to continued downside in the ISM PMI. The rate of change on earnings revisions breadth also leads forward EPS growth and points to growth downside as well.

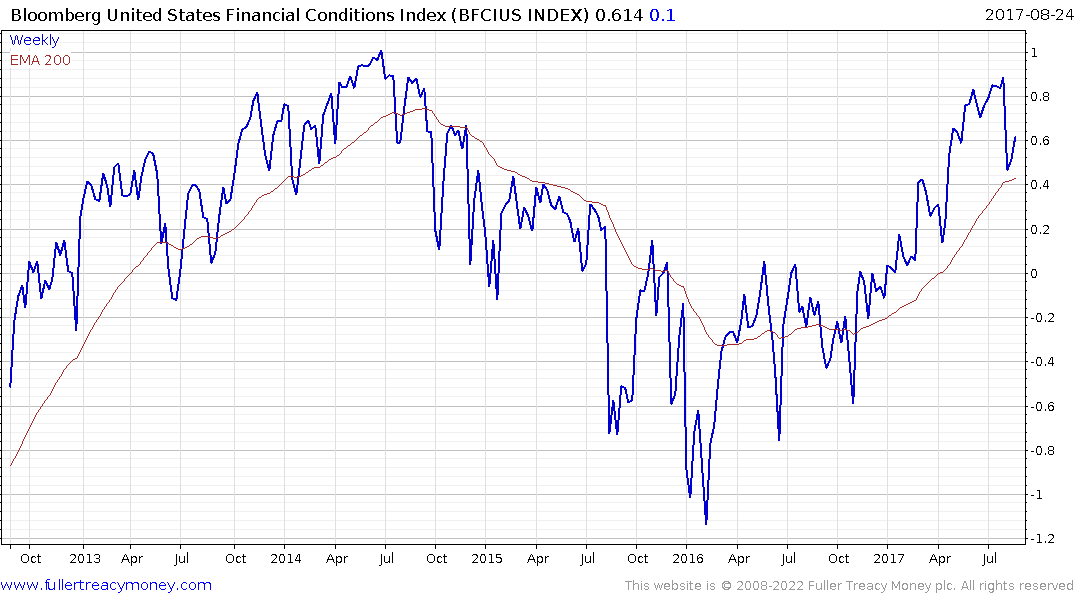

Stock prices are a major component of how financial conditions are measured. That is a less well understood characteristic of what is often considered a fixed income dominated metric. The challenge at present is the Fed is deliberately targeting the excess liquidity that is supporting demand and consumption.

The Fed put has been the rallying call for buy-the-dip investors for fourteen years. At every hint of trouble in the stock market, the Fed rode to the rescue with lower rates and abundant liquidity. Now there is just cause to believe we have the opposite condition, a Fed call. Whenever stocks rebound on the belief the Fed is going to relent, they get beaten back down. At the very minimum, the S&P500 will need to sustain a move above the 200-day MA to confirm a return to demand dominance.