Fed Hikes Rates 75 Basis Points, Intensifying Inflation Fight

This article from Bloomberg may be of interest to subscribers. Here is a section:

Federal Reserve officials raised their main interest rate by three-quarters of a percentage point -- the biggest increase since 1994 -- and signaled they will keep hiking aggressively this year, resorting to drastic measures to restrain the rampant inflation they failed to forecast.

Slammed by critics for not anticipating the fastest price gains in four decades and then for being too slow to respond to it, Chairman Jerome Powell and colleagues on Wednesday intensified their effort to cool prices by lifting the target range for the federal funds rate to 1.5% to 1.75%.

They projected raising it to 3.4% by year-end, implying another 175 basis points of tightening this year.

The median official saw a peak rate of 3.8% in 2023, and five officials forecast a federal funds rate above 4%; the median projection in March was for 1.9% this year and 2.8% next. Traders in futures markets were betting on a peak rate of about 4% ahead of the release.

The Fed reiterated it will shrink its massive balance sheet by $47.5 billion a month -- a move that took effect June 1 -- stepping up to $95 billion in September.

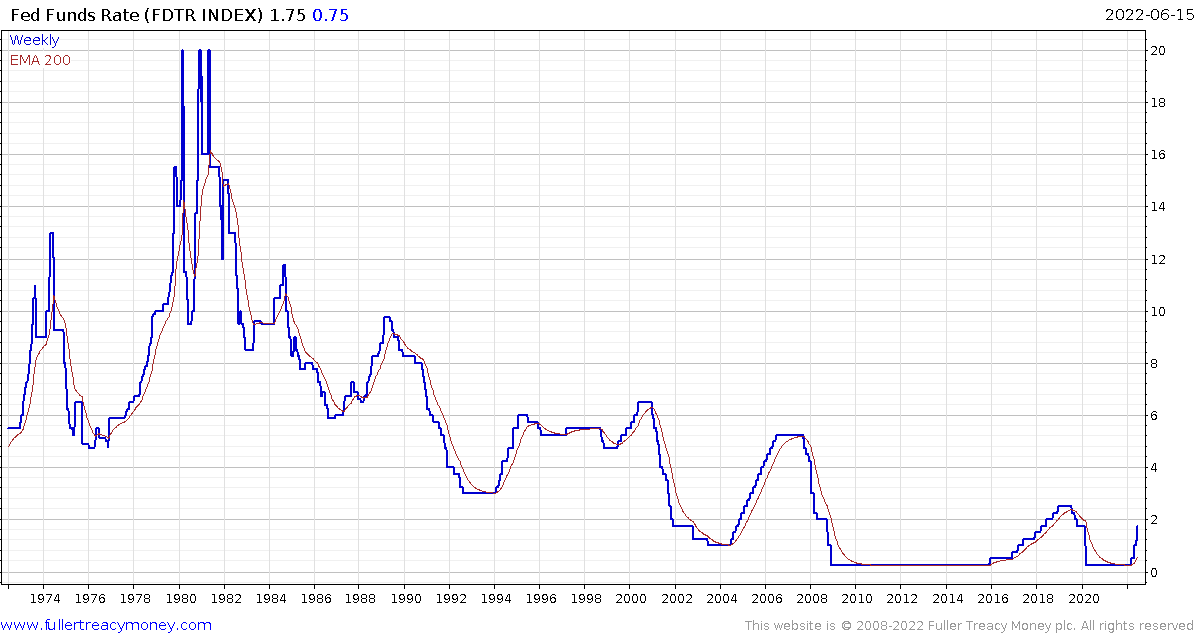

The Fed expects to raise rates above 3% by the end of the year. That’s a higher high. The only time the Fed Funds rate posted a higher high in the past was in 1999 and it was quickly reversed. This time around, the big question is how long that level will be sustained and where the next low will be.

The Fed has a dual mandate to control inflation and pursue full employment. Based on that fact alone they have relatively free rein to raise rates until unemployment rises. Stocks and bonds have pulled back sharply and retail sales were way below forecasts today.

Negative growth in the first quarter was attributed to “technical factors” like inventory liquidation. Target’s warning early this week that it has overordered, the surge in fuel, food and electricity suggest the GDP figure at the end of the month could be ugly.

The US economy is coasting along the edge of a recession. That implies the Fed may find it much more difficult to get to its expected rate level. The stock market steadied today on the expectation the Fed is doing enough to control inflation. Gold also rebounded from the $1800 level. The base case remains the Fed will relent from aggressive hiking at the first sign of stress in the employment market.