Fund Manager's Diary March 9th 2022

Thanks to Iain Little for his latest note which may be of interest. Here is a section:

Third, fixed income markets, largely reward-free risk pre-Ukraine, now face a further knock-out blow. The pressure for rate rises justified by existing 5%+ inflation will be ramped up by the commodity scarcity from sanctions on 12% of the world’s oil production and much of its strategic metals. Add a negative credit effect on bond yields derived from civil unrest in countries relying on imported wheat to feed youthful, volatile populations; Ukraine, at 30% of global total, is the world’s largest supplier. The only cure is a lighter hand on the rate rise tiller from central banks now wary of recession 12-18 months from now. This contradiction is negative for long rates.

Here is a link to the full report.

With a supply shock, the only way to control inflationary pressures is by either quickly solving it or cutting demand. Companies are pulling out of Russia every day. The Russian government is putting together plans to take over abandoned positions in domestic companies. Russian billionaires are being both sanctioned and censured in almost every OECD market. We are not going back to normal anytime soon; if ever. The repercussions of this economic, financial, business, and social unwind are only beginning to be felt.

That suggests the supply shock element is not going to be fixed in the short term. The only way to bring down inflation will be to cut demand. That’s a recipe for lower growth. The US economy has high employment and the Federal Reserve has stated in plain English inflation is due to excessive demand. In normal circumstances that would imply significantly higher rates.

The challenge now is the sheer volume of outstanding debt and its short duration means there is a constant need to refinance. 5-year yields are rallying in a dynamic manner and remain in an exceptionally consistent uptrend. High inflation and slowing growth are the ingredients for stagflation. In that environment inflation hedges like physical assets tend to do best.

Gold is pausing in the region of the psychological $2000 level. This does not look like more than a pause. Gold shares tend to move with a lag relative to gold and are now playing catch up. The Van Eck Vectors Gold Miners ETF has broken the 18-month downtrend and is back in recovery mode.

Gold is pausing in the region of the psychological $2000 level. This does not look like more than a pause. Gold shares tend to move with a lag relative to gold and are now playing catch up. The Van Eck Vectors Gold Miners ETF has broken the 18-month downtrend and is back in recovery mode.

The NYSE Arca Gold BUGS Index / Nasdaq-100 ratio is firming from the lower side of its base formation.

The NYSE Arca Gold BUGS Index / Nasdaq-100 ratio is firming from the lower side of its base formation.

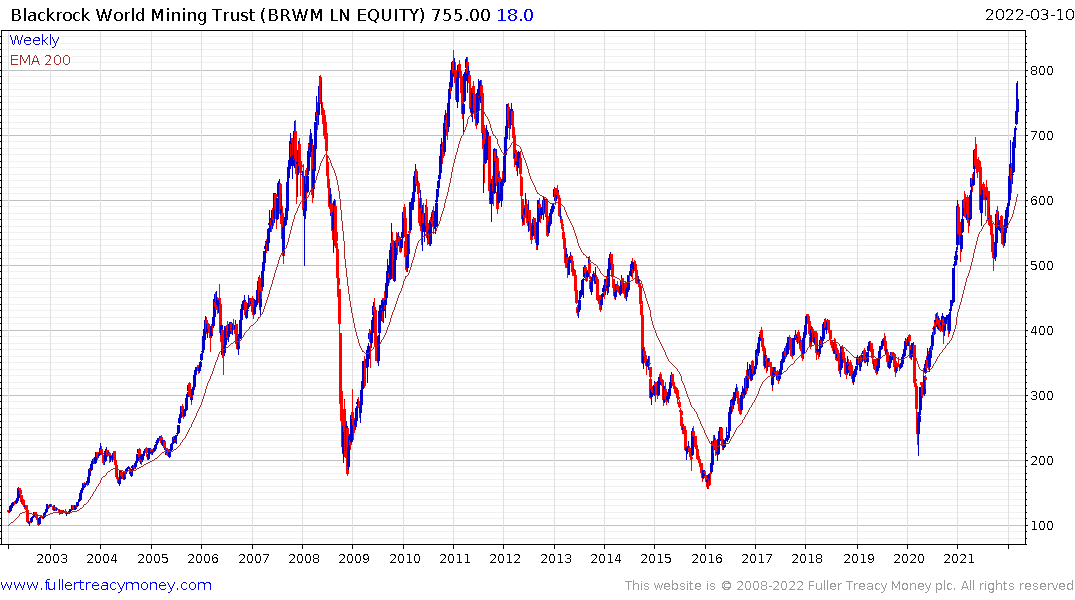

The Blackrock World Mining Trust is back testing the highs from 2008 and 2011. It’s short-term overbought so some consolidation would be unsurprising but the odds are that it will sustain a breakout to new highs as stocks catch up with the performance of their respective product offerings.

The Blackrock World Mining Trust is back testing the highs from 2008 and 2011. It’s short-term overbought so some consolidation would be unsurprising but the odds are that it will sustain a breakout to new highs as stocks catch up with the performance of their respective product offerings.

The LME Metals Index has clearly broken out to new all-time highs and a sustained move back below 4000 would be required to question the new bull market hypothesis.