Bretton Woods III

Thanks to a subscriber for this report from Zoltan Pozsar for Credit Suisse. Here is a section:

Here is a link to the full report and here is a section from it:

Western central banks cannot close the gaping “commodities basis” because their respective sovereigns are the ones driving the sanctions. They will have to deal with the inflationary impacts of the “commodities basis” and try to cool them with rate hikes, but they will not be able to provide the outside spreads and won’t be able to provide balance sheet to close “Russia-non-Russia” spreads.

Commodity traders won’t be able to either. Remember that Glencore rose from the ashes of Marc Rich + Co, and with Switzerland along with the sanctions, Swiss-based commodity traders will think twice about arbitraging the spreads.

But the PBoC can…

…as it banks for a sovereign who can dance to its own tune. To make things more complicated, China is probably thinking deep and hard about the value of the inside money claims in its FX reserves, now that the G7 seized Russia’s.

The PBoC has two “geo-strategic” = “geo-financial” options…

…sell Treasuries to fund the leasing and filling of vessels to clean up subprime Russian commodities. That would hurt long-term Treasury yields and stabilize the commodities basis and would give the PBoC control over inflation in China, while the West would suffer commodity shortages, a recession, and higher yields.

Yuck.

That can’t be good for long-term Treasury yields.

The PBoC’s second option is to do its own version of QE – printing renminbi to buy Russian commodities. If so, that’s the birth of the Eurorenminbi market and China’s first real step to break the hegemony of the Eurodollar market. That is also inflationary for the West and means less demand for long-term Treasuries.

Yuck.

That can’t be good for long-term Treasury yields either.

The FRA/OIS spread is widening in a dynamic manner. That’s a symptom of emerging stress in the funding markets. It’s another piece of the global financial plumbing that is flashing yellow.

If it trades above 50, it will be flashing red. That would force central banks to flood the market with liquidity to backstop banks where margins calls are going unanswered. That’s negative for the Dollar and it is susceptible to at least some consolidation from its currently overbought condition.

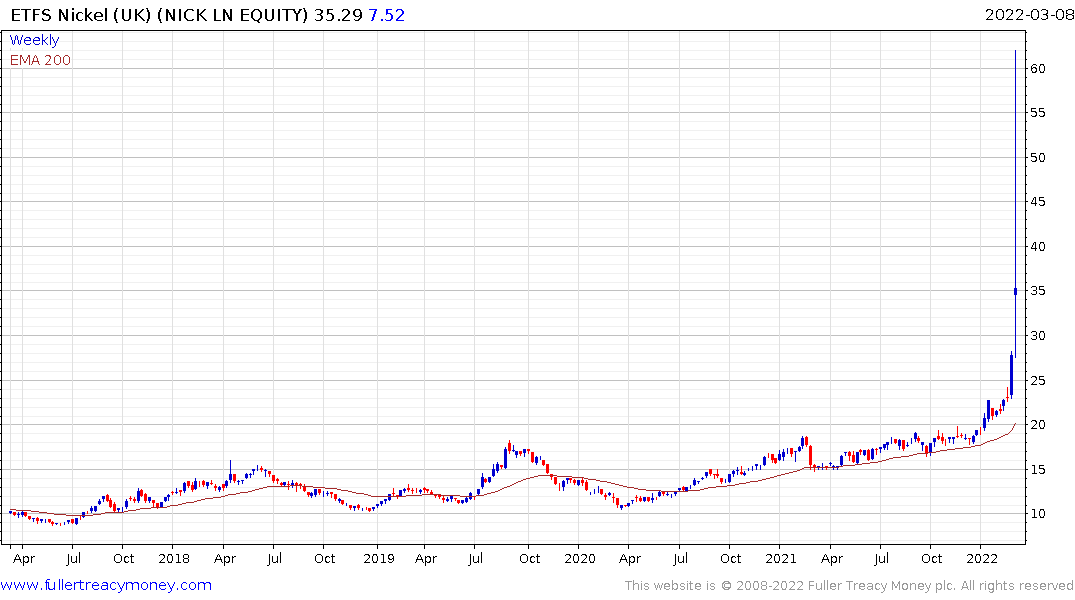

Today’s intraday surge in nickel prices shut down trading on the LME as Xiang Guangda, the father of pig nickel refining, lost billions on his short hedges. The Wisdomtree 3X short ETF was wiped out.

Today’s intraday surge in nickel prices shut down trading on the LME as Xiang Guangda, the father of pig nickel refining, lost billions on his short hedges. The Wisdomtree 3X short ETF was wiped out.

This is the first of the big liquidity issues arising from the surge in commodity prices as consumers are blocked from buying Russia’s production. The Netherlands also announced today it issued bills to relieve repo market stress in the domestic market.

The above explanation of the four kinds of money is particularly relevant. If China chooses to deploy its reserves or balance sheet to soak up available supply it will indeed create an alternative funding mechanism to run in parallel to the Eurodollar system. It would create not only a Eurorenminbi but a Petrorenminbi since any deal would likely insist Russia accept Renminbi in payment.

That would represent a massive step forward for internationalizing the currency. It would create an alternative financial pole for flows and pressure the Dollar lower.

That’s another reason why gold remains firm. It jumped to test the all-time peak today and is a hard fungible asset in a time of polarisation between money centres.

That’s another reason why gold remains firm. It jumped to test the all-time peak today and is a hard fungible asset in a time of polarisation between money centres.