BoC to Walk, Not Run, Toward 2022 Rate Hike

This article from Bloomberg may be of interest to subscribers. Here is a section:

Faster-than-expected job gains have been the main risk to our call that the BoC would slow-play rates liftoff. The blockbuster November report showed employment rose by 154k, more than four times as fast as the consensus expectation.

Even allowing for some reversal in contact-sensitive industries in the winter months, the remaining gap to the pre-pandemic trend has closed quickly. We estimate the economy was about 70k jobs short of the pre-pandemic employment rate in November, as shown in the chart above.

However, we expect communications may stress inflation numbers are still tracking in line with the October MPR, giving the BoC some space to gauge virus risks ahead of the January

meeting.

Firmer Inflation + Labor Gains = Hike Bets

Our policy dashboard below shows inflation well above the midpoint of the BoC’s target range of 1%-3%. Activity on a GDP basis was recovering through October, financial conditions are easy, and the U.S. recovery is still on track. As a result, market participants are pricing in more than five 25-basis point

hikes in 2022.

As hikes approach, the 2-year/10-year yield curve has flattened by about 75 basis points since April. That suggests market participants do not expect the central bank to get much beyond the peak of the last hiking cycle, which topped out at 1.75%.

Canada’s labour market is further along in its recovery than the USA so it makes sense to expect the BoC to raise rates first. It stands to reason that the market reaction to that event will be closely watched as a potential lead indicator for how investors will greet rate hikes elsewhere.

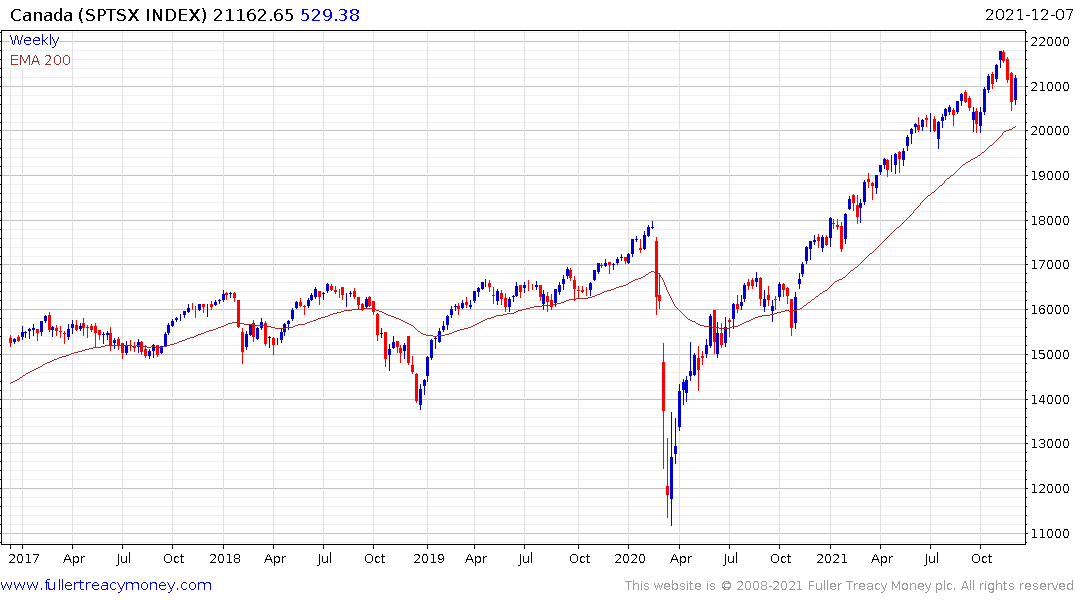

The S&P/TSX Index continues to trend higher in a reasonably consistent manner and is currently firming from the region of the trend mean to sustain the sequence of higher reaction lows.