Secular Bull Market Investment Candidates Review January 2021

On November 24th I began a series of reviews of longer-term themes which will be updated on the first Friday of every month going forward. The last was on December 4th.

This month it seems like a particularly good time to think about the long-term because the world has seen a great deal of change in a very short period of time. In December the EU and China signed an investment agreement which many believe is a precursor to a wider trade deal. The UK left the EU in a reasonably smooth manner and the African Continental Free Trade Area came into effect on January 1st.

This week anarchists broke into the US Capitol building, took a lot of selfies and shattered the legitimacy of the populist right wing, from the perspective of just about everyone outside of that group. Almost as an aside, the Democrat Party now have full control of the US government and will therefore have ample potential to increase spending on their priorities.

The US 10-year yield is now above 1% and completing a medium-term base formation. One of the idiosyncrasies of 2020 is that government borrowing costs declined meaningfully even though their total debt ballooned. The only reason that was possible was because interest rates compressed so quickly. The sustainability of government debt is totally dependent on yields staying low; indefinitely. Therefore, the jump above the 1% hurdle is a meaningful event.

The US government expects to run a deficit of more than $2 trillion in 2021 and that was before the election. In order to encourage investors of all stripes to buy the new bonds, they will need some assurance that the Fed will backstop the market.

That’s particularly true as market-based inflation expectations are running at over 2%. At present, the Federal Reserve is intent on avoiding yield curve control but it is hard to imagine how that outcome can be avoided. To successfully sell the bonds which will be issued this year, the Fed will have to buy a significant number of them or yields will rise significantly further.

Albert Edwards, Edward Ballsdon, Jeremy Grantham and others have been very vocal this week in saying we are in a bubble. I agree but that’s not especially helpful. I’ve been of the view that quantitative easing would climax in a bubble for more than a decade. The big question is when will the bubble pop and even more importantly where is the epicentre of risk?

The bull market in the 1990s experienced a deep pull back in 1998s but quickly rebounded and the technology/media and telecoms sectors went wild. That rebound was driven by unusually loose monetary policy. The Nasdaq-100 rallied 353% between the October 1998 low and the March 2000 peak. It was a classic bubbly environment with retail traders ploughing their life savings into IPOs and day trading. Valuations were at extraordinary levels that were totally unprecedented and they kept running higher. New companies were assessed on their “burn rate” as they all raced to spend as much as possible to capture market share on the brand-new internet.

This quote from Scott McNealy, who co-founded Sun Microsystems, is particularly instructive.

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

Today there are 152 US listed companies with market caps in excess of $10 billion which have price to sales rates in excess of 10. The group has a combined market cap of $7.8 trillion. It is reasonable to think that this group of companies is whether the epicentre of risk is focused. Here are some of the most notable examples.

Microsoft (P/S 11.27), Tesla (P/S 28.4), Visa (P/S 17.8), Mastercard (P/S 22.5), Nvidia (P/S 22.1), PayPal (P/S 13.8) Adobe (P/S17.8), Shopify (P/S 57), Zoom Video (P/S 49), Pinduoduo (P/S 30.8), Nio (P/S 32.7), Snap Inc (P/S 35.6), Twilio (P/S 33.4), Crowdstrike (P/S 62.4), Moderna (P/S 179), Ring Central (P/S 31.4), Cloudflare (P/S 60.5).

Bloomberg does not have historical data for price to sales ratios for indices going back to the 1990s but the S&P500’s ratio is much higher than it was in 2000 and the Nasdaq-100’s broke out to new highs over the last year. That also suggests this bull market is much more widely dispersed among large caps than that of the 1990s.

If there is mania evolving in the technology & fintech sectors then it is only a shadow of the size of the bubble in the private equity market. Zero interest rates have created outsized demand for “alternatives” among asset managers. Most pension funds can only invest so much in equities so they boost allocations to alternatives to capture returns in line with Modern Portfolio Theory. The flows into private equity ventures over the last decade have been epic by any measure yet the values attributed to unproven ventures is fuzzy at best.

No one really listens to bears in a big bull market. Their warnings make headlines for a week or two and are then overwhelmed by the cascade of continued good news and ever more enthusiastic bullish forecasts. It is only in retrospect they are deemed prescient.

Cathie Wood has done a wonderful job of becoming the biggest bull in this bull market. She has been an unrelenting bull of Tesla and has been the most accurate forecaster of the share’s price because she has been willing to make bets way beyond the consensus. Her firm ARK Investments has come from nowhere to host one the best performing tech ETFs in 2020.

When there is a preponderance of willing buyers there will be even more willing sellers. That’s how tops eventually form. Softbank’s Vision Fund learned a hard lesson with WeWork and is planning on a swathe of IPOs in 2021. The fund is expecting to list Auto1, ByteDance, Coupand, Didi Chuxing, PolicyBazaar and Tokopedia this year.

Meanwhile other big IPOs in the works include Robinhood, Roblox, Affirm, Sofi, Coinbase, Bumble, Petco, UIPath, AppLovin, Instacart, ThoughtSpot, Oscar Health, Nextdoor, Ascensus,

Private companies are now selling after a long period of resisting the urge to list. The private equity sector plays an important part in those deliberations because they were happy to bid up values in successive funding rounds while the companies were private. If they are now willing to sell, that marks an important departure.

The performance of new listing on their 1st day or trading one of the most attractive things for any investor and the evolution of SPACs means 1st day pops are almost assured. At present the performance of IPOs on their first day of trading is improving but it is not year on par with either the number of performance of the late 1990s.

The most important thing about identifying a bubble is to understand that the market can remain irrational for an indeterminant amount of time. Money supply and interest rates are the fuel for speculation. Without them the bubble can’t continue to inflate. When coupled with an environment where supply has increased, any meaningful contraction in money supply will have a significant impact on valuations for all financial assets. That’s why the jump in interest rates is so important.

However, we are not yet at a point where liquidity conditions are tightening. High yield spreads were at another new reaction low today. The trend in Goldman Sachs Financial Conditions Index is almost identical.

The Fed and other central banks are perfectly aware of the concerns of bond market investors and they are also aware of the fears of investors about an inflating bubble. Therefore, they are unlikely to announce significant additional support measures until there is a catalyst to do so.

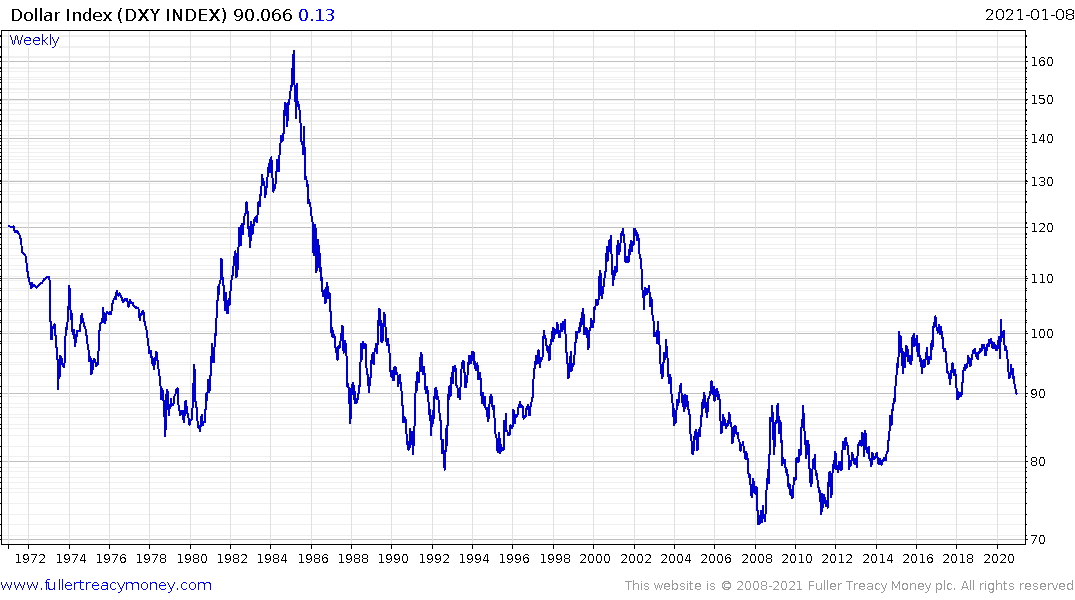

Higher yields are helping to stabilise the Dollar Index as it firms from the region of the 2018 lows. The primary bearish argument against the Dollar is based on excess supply because of monetary and fiscal profligacy. Until that is delivered the Dollar can unwind its short-term oversold condition.

I remain of the view that this is likely to be little more than a reversion towards the mean. The long-term outlook remains for a downtrend to a new all-time low, sometime in the mid-2020s, so any rally can be viewed as a shorting opportunity.

The challenge for gold is that it tends to be even more sensitive to money flows. With even a hint of Dollar strength today, the price pulled back sharply. Precious metals, and commodities generally, are much more volatile than other asset classes. The metal has been resurgent over the last couple of years but is still in a medium-term correction in the region of the all-time peak. It pulled back to test the 200-day MA today.

Both silver and platinum also pulled back sharply. Gains in precious metals tend to occur all at once and are often followed by lengthy periods of ranging. They tend to try the patience of investors but nothing has occurred to question the medium-term bullish outlook. The trajectory of debt and the growing trend of global competitive currency devaluation will remain significant tailwinds for years to come.

.png)

The elephant in the room is bitcoin and the cryptocurrencies sector. It is a wholly new market in more ways than one. The most important of which is that it started out as a retail investment mania and is evolving into an institutional investment mania. Leaders tend to lead in both directions and bitcoin has been the best performing asset class since the lows in 2008 by a wide margin.

The most bullish boosters of the market will argue that it has the potential to solve just about any problem and, at some point, its promise will be realised. That’s the lesson from all big bull markets. The promises are delivered on, just not in the timeframe traders expected. For example, the promise of personalised medicine, made during the 1990s, is a lot closer today but is still in the pipeline.

The cryptocurrency market’s market cap exceeded $1 trillion this week. The primary consistency characteristics are that following medium-term peaks bitcoin finds support in the region of the 1000-day MA. Today’s that’s at $8000.

After the peak we have seen a number of medium-term ranges that have last from between 2 and 3 years with breakouts occurring after the cyclical halvening events.

The most consistent thing in any trend tends to be size of the reactions. During the bull market in 2017 reactions of 40% were normal. During the current move, with much higher prices, reactions have been limited to 20%. A reaction of more than 20% held for more than a few days will be required to signal a peak of more than very short-term significance.

There is also some evidence that as institutional participation grows, bitcoin’s correlation with other assets will increase. For example, it peaked a month ahead of the S&P500 in early 2018 and bottomed two days ahead of it in March 2020.

It is reasonable to assume that bitcoin has been a major beneficiary of low interest rates and abundant liquidity. Together with Tesla it has been a lightning rod for speculative flows. When its consistency changes it will be a warning sign that the liquidity of the wider market is also changing.

With all this talk of bubble and late-stage activity it is worth considering that not everything is in a bubble. Valuations remain attractive in the world’s highest growth markets which also have the best demographics.

It’s no great mystery where the growth of the future is likely to originate. The primary benefit of emerging markets is they have the opportunity to learn from previous success stories without having to reinvent the wheel. As the Dollar subsides, the relative attraction of non-Dollar denominated markets is burnished.

The UK, Europe, Japan, Taiwan, South Korea, Vietnam, Thailand, Indonesia, Singapore, India and China breaking out of long-term ranges on a constant currency basis.

Brazil and Mexico are also firming. The biggest change that has occurred in these markets over the last few months is they have able to rally without relying on a weak domestic currency.

The Continuous Commodity Index has now also completed a six-year base formation.

With news that the Pfizer vaccine is effective against the new strains of the coronavirus that emerged over the last month, the rush to inoculate as many people as possible will only become more urgent.

Meanwhile, the determination of politicians, everywhere, to fund reflation and pioneer a Green New Deal is fuelling mass speculation in renewable energy. Solar, wind and hydrogen remain among the best performing sectors on bets the world’s major economies are going to follow through on multi-trillion Dollar spending programs.

The cannabis sector has completed its base formation this week on expectations of an easing of the Federal prohibition in the USA.

Base formation completions generally signal te beginnings of new bull markets. Historically high valuations and exagerated uptrends are generally warnings to be wary of trend endings.

The conclusion is clear. There is clear evidence a mania is evolving but there is no evidence it has reached its peak. With global markets breaking out of extremely lengthy long-term ranges, we might be waiting awhile for the tighter monetary policy necessary to prick the bubble.

Back to top