Email of the day on the Service

I have been a subscriber for just over 30 years, and in that time, I can't recall many times when a clear and concise analysis of economic and political conditions was as important as it is today. You are doing a wonderful job at keeping the collective informed, allowing us to see a broader picture than our individual biases might otherwise give us. Thanks so much!

And

Congratulations our last subscriber commentary was exceptional. You have done wonders for my confidence and ability to help my clients. Keep up the good work. Best wishes

Thank you both for your kind words and it is enormously gratifying that subscribers find value in the Service. That’s particularly true for veterans who have been with us for decades. Given both the demand and positive response for a reasonably succinct list of thematic investments that cover the prevailing market outlook, I’ll review the list on at least a monthly basis. The first Friday of the month which would coincide with the Big Picture Long-Term audio/video makes sense to me.

I strongly believe that within six months most of us will be getting back to the daily routine of work, play and family life we are accustomed to. However, there is one big change in how global investors view the world. The realisation is dawning that heavily indebted countries have no intention of paying back the money borrowed to deal with the pandemic through fiscal austerity. That’s going to be the basis for how markets evolve for years to come.

Fiscal austerity would result in revolutions so there is no way that can be risked. Most countries had a taste of what violent protest might look like during the lockdowns. The fiscal austerity needed to pay back the debts would be so deflationary that no government would survive it. That only leaves open two other possibilities, default or devalue.

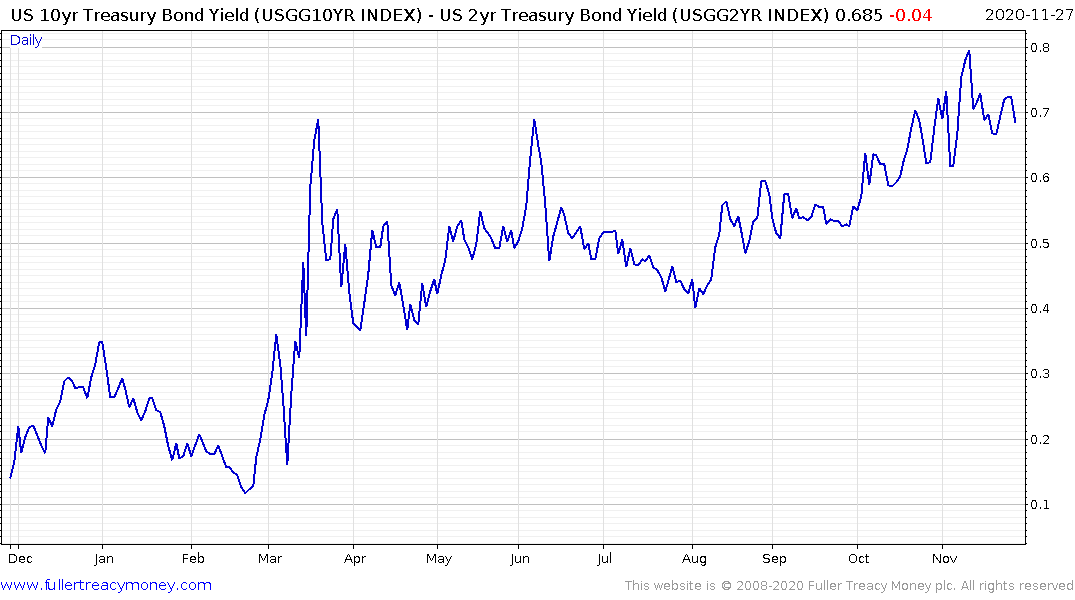

No country that controls the issuance of its own currency and which can issue debt in that currency will ever default in the traditional sense. Therefore, currency devaluation is default by a thousand cuts. They are likely to go for reflation at all costs first and debt monetisation will fund it. Given the size of the debts they have no choice than to go for broke. The first step on that path is yield curve control. There is no way higher long-term yields can be tolerated without a massive uptick in growth and inflation.