Email of day on gold

What strikes me and many other observers is that Gold is down by 1.5% to 1785 cash (just before Nov. contract expiry date…) but GDX and GDXJ are UP by 0.4% and 0.9%!

Silver is DOWN by 3% (just before Nov. contract expiry date…) while Silver miners SIL is also slightly UP!

As miners normally lead for me the dichotomy between metals and miners is probably due to the bullion banks trying to push down prices for the (RECORD!) deliverable contracts (they are short Gold by about USD 35bn!) and will allow metal prices to rise next week

If so, then this then be in tune with your Nov. 26 turn-around/bottom +- 1-2 trading days for the 10 and 20 day cycles.Thinking about undoing my residual hedge via JDST before markets close early today….

What is your view on the above?

I much wonder if your bottom-fishing orders for PM’s were triggered today – but I suppose you want to get in at prices closer to 1700 for gold…

Thank you for this question and for pointing out this divergence between gold and gold mining stocks. The proximity of the expiry of gold contracts is relevant not least because of demand for physical metal. It is well within the realm of the possible to think enterprising institutional traders might like to see a lower price ahead of delivery.

This article from Sprottmoney.com may be of interest. Here is a section:

Your key takeaway? A year-to-date total of 215,114 deliveries means that the depositories of the COMEX have been forced to deliver more gold in the first eleven months of 2020 than they had in the entire five-year period 2015-2019.

And now the final delivery month of December looms, and it is typically the busiest "delivery month" of the calendar year.

As I type this on November 18, there are still 247,965 Dec20 contracts still open. Of course, the vast majority of these will be closed and/or rolled into Feb21 or Apr21 before the contract goes off the board and into delivery next Friday. However, there will very likely again be a significant number of contracts remaining open as December begins, ostensibly "standing for delivery". But how many?

With just seven trading days left before First Notice Day, the amount of Dec20 contracts still open is close to the amount of Aug20 contracts left open on the same date in July and about 20,000 contracts higher than the amount of Jun20s remaining open on this same date in May. So, will we see another 50,000+ contracts being delivered in December? That certainty seems likely. If so, another 50,000 deliveries next month will bring the year-end total to near 265,000 contracts or a whopping 825 metric tonnes. That's more than the entire official gold holdings of Japan (765.22 mts), the Netherlands (612.45 mts) or India (557.79 mts)!

I am in danger of being too greedy but my orders have not been triggered just yet and are unlikely to be unless we get an overshoot on the downside. Meanwhile I continue to hold my trading position which is in the red at present and am considering adding to my investment in miners.

The price is somewhat oversold in the short term but a clear upward dynamic will be required to pressure the shorts and signal a return to demand dominance.

The Dollar Index broke downwards to a new closing low today. All other factors being equal, that’s positive for gold.

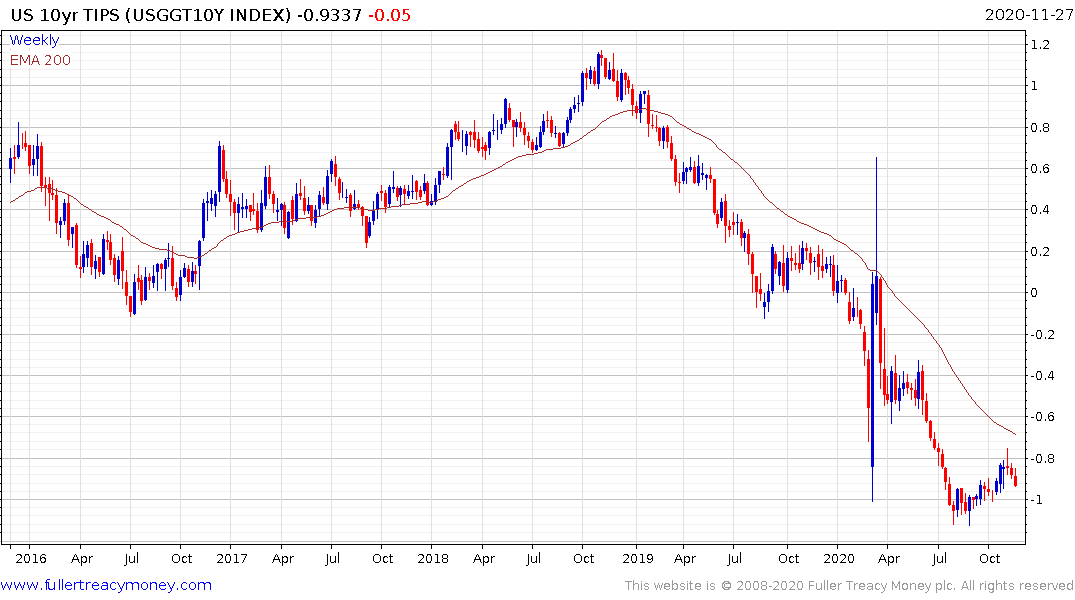

10-year TIPS yields are also pulling back suggesting ample demand for inflation protection in what is a relatively illiquid portion of the Treasury markets.