Email of the day - on the size of the Fed's balance sheet:

Midst all the alarm regarding corona virus, I was surprised that the financial media has paid so little attention to the following: https://thesoundingline.com/feds-balance-sheet-has-shrunk-20-billion-since-the-start-of-january/

If an over-extended was looking for an excuse to correct, surely this was it!

Your comment would be appreciated.

Thank you for this question which may be of interest to subscribers. I covered the topic of balance sheet expansion in the Big Picture Friday audio but I’m happy to revisit the question here.

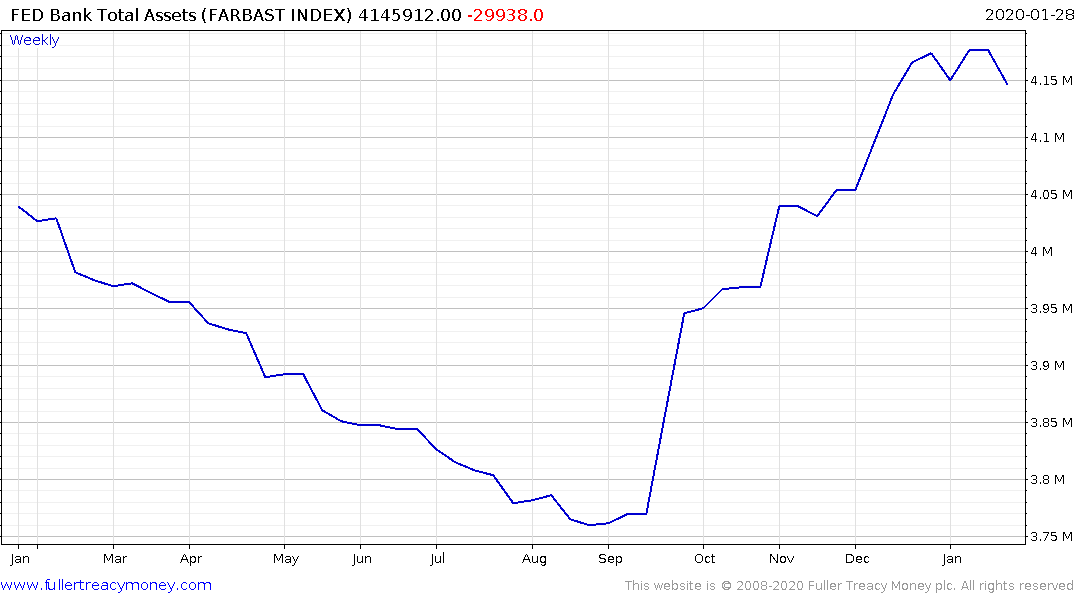

The Fed has added $400 billion to its balance sheet over the last four months by purchasing short-dated Treasuries. That has the same effect on the stock market as the liquidity infusions back in 2017 had. We have just had one of the most inert advances in years where volatility remained low for a prolonged period, just like in 2017.

The quiescence of the market was upset late last week with the coronavirus scare but also by speculation that the Fed is coming close to the end of its stimulus package.

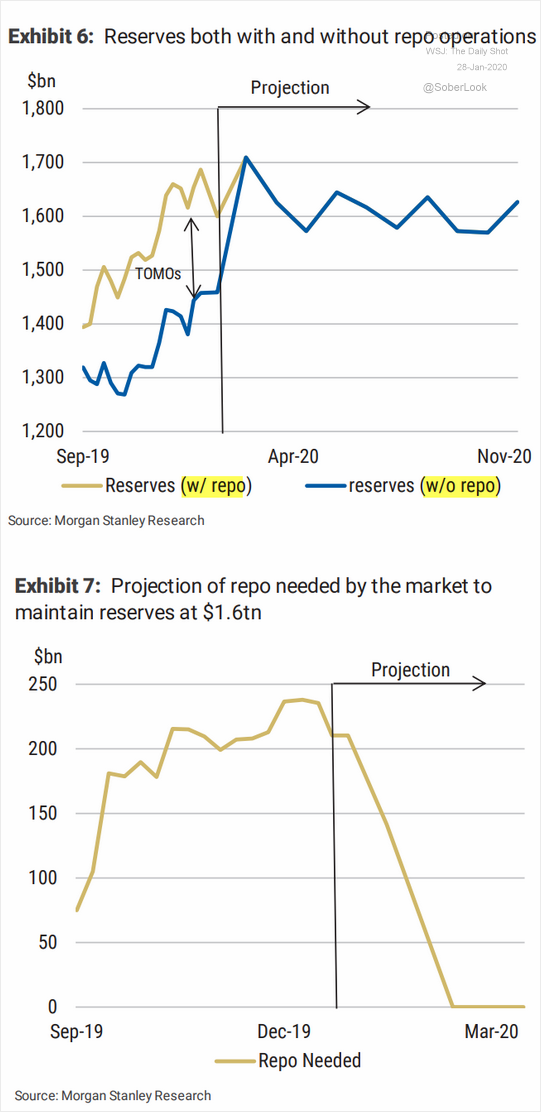

This graphic from Morgan Stanley illustrates the growing consensus among money market operators that $400 billion is close to the limit of what the Fed wishes to add.

The increases in the size of the Fed’s balance sheet stopped at the beginning of the year. The $20 billion reduction unwound the $20 billion added last week. However, the absence of a $100 billion infusion, which characterised the activity from each of the last four consecutive months is probably one of the reasons for increasing sensitivity to bad news the market is currently exhibiting.

The story above about the potential for Chinese stimulus is therefore an important titbit. Capital is both global and mobile. It flows to the most productive or attractive assets internationally. The rebound on Wall Street today suggests investors are giving the benefit of the doubt to continued global stimulus and positive earnings coming through.

Back to top