ECB to Blame for Surge in U.S. Yields? Timing Is Suggestive

This article by Christopher Anstey for Bloomberg may be of interest to subscribers. Here is a section:

One school of thought says that shifting perceptions about the European Central Bank’s policy outlook had a significant role to play in the surge in U.S. Treasury yields that began in September and picked up speed last month, roiling global stocks.

Behind the argument is the observation that ECB policy has had much more impact on markets than the Federal Reserve’s. That’s because ECB bond purchases were so large that they exceeded the net issuance of respective government bonds -- unlike the Fed. That pushed European investors into other markets, such as Treasuries. One estimate has them buying more than a trillion euros ($1.2 trillion) of foreign bonds since ECB QE began.

ECB’s importance popped up on Treasuries traders’ radar screens last June, when President Mario Draghi gave what were perceived to be hawkish remarks at the Sintra confab, sending yields climbing round the world. In the fall, expectations grew that the ECB would announce a taper of its purchases. Yields started jumping in mid-October, when Bloomberg reported the ECB was thinking of halving its QE program.

And traders may want to set a reminder for the minutes of the ECB’s January meeting. Last month’s release said policy makers were open to tweaking their policy guidance given a strengthening economy. Later in January, news came that ECB policy makers were favoring a short taper to bring an end to QE.

Those January indications coincided with a surge in yields that’s continuing to affect markets, with 10-year U.S. touching their highest since 2014.

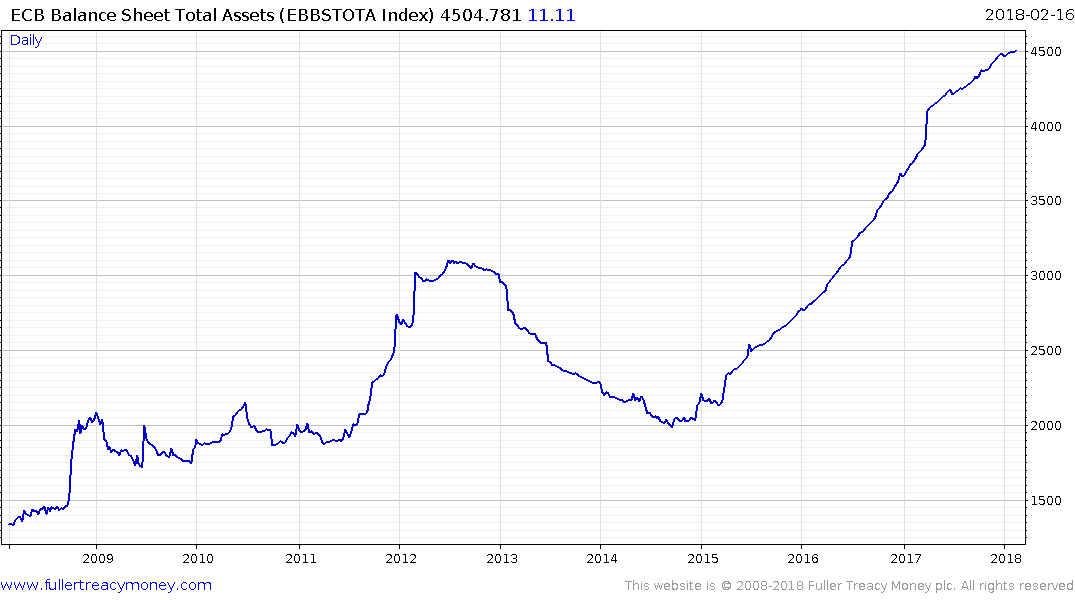

The ECB’s balance sheet has risen from €2 to €4.5 trillion since late 2014 and it remains on an upward trajectory. The rise of populist parties as well as the surprise success of Macron in France can all be levelled at the shifting of private sector debts onto sovereigns and the fiscal austerity demanded by creditors to pay those debts down. The deflationary effects that set off resulted in the ECB feeling they had little choice but to pursue extraordinary monetary accommodation.

€2.5 trillion is still a lot of money, even after all the printing that has gone on globally over the last decade and the eventual removal of this massive source of fresh liquidity will have knock-on effects for the global markets. As I have been saying in the subscriber’s audio for years, capital is both global and mobile. There has been substantial leakage from the Eurozone and it stands to reason that the US Treasury market has been a beneficiary despite the implied currency risk.

Here is a section from CNBC’s report on the ECB Minutes:

"The language pertaining to the monetary policy stance could be revisited early this year as part of the regular reassessment at the forthcoming monetary policy meetings... However, it was concluded that such an adjustment was premature and not yet justified by the stronger confidence," the bank said in the minutes.

Treasuries were steady today following the ECB’s reluctance to accelerate tapering. The ECB will be buying €30 billion a month until September so the first rate hike will probably be sometime in 2019. Investors are now looking out two years, with the expectation that monetary largesse is likely to be over by then, which is affecting how prices are being calculated now.

The Euro steadied today near the lower side of its short-term range and a sustained move below $1.20 would be required to question medium-term scope for continued upside.