Copper rally lifts Antofagasta's profits, up 88% in first half of 2017

This article by Cecilia Jamasmie for Mining.com may be of interest to subscribers. Here is a section:

Chile-focused copper miner Antofagasta Plc. (LON:ANTO) posted Tuesday an impressive 88% jump in earnings during the six months to June 30, thanks to a sustained rally in prices for the metal, which has surged 19% so far this year, as well as cost savings.

The miner, one of the oldest companies listed in London, said earnings before interest, tax, depreciation and amortization, or Ebitda, increased to $1.1 billion in the period, as revenues grew by 42% to $2 billion.

Chief executive Iván Arriagada, who has been at the helm for less than a year and a half, said the improved performance will allow the company to pay an interim dividend of 10.3 US cents a share, up from 3.1 a year ago. This is in line with Antofagasta’s policy of paying out a minimum of 35% of underlying net earnings to investors, he said.

During the expansion phase associated with the commodity boom, miners ploughed their earnings into investment rather than paying dividends. That meant they underperformed the rises in metal prices, particularly in the gold mining sector and left them with no cushion of support when commodity prices peaked.

The process of rationalisation that took place from the 2011 peak also created a new-found respect for dividends and sharing profits with shareholders right across the mining sector. Antofagasta’s commitment to pay out at least 35% of net earnings is just one example of the trend of higher dividends not evident in the mining sector.

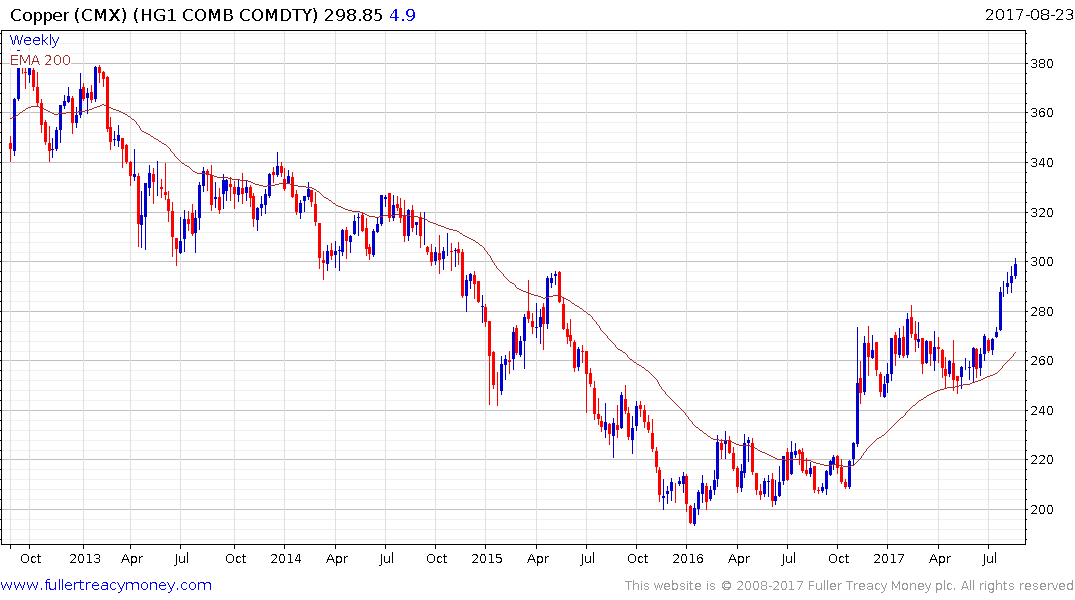

The share is testing the psychological 1000p level while the copper is testing the $3.