Market Know-How

Thanks to a subscriber for this report from Goldman Sachs Asset Management which may be of interest. Here is a section:

We see increasing evidence of economic synchronization across both advanced and emerging markets. Global growth data suggests the expansion could continue for another couple of years.

As the US expansion approaches triple digits (as measured in months), we see more of the same as we look ahead. One way to frame the economic outlook is to model the probability of recession over the next 2 years. Long term averages suggest a 31% recession probability, leaving a more than two-thirds chance that the current US expansion becomes the longest on record.

The sustainability of economic growth is often governed by the availability of labor and

manufacturing capacity. We believe medium-term recession risk is rising in the US as resource utilization pushes above potential and pressures wages higher. We see global advanced and emerging markets forging slightly more runway in the form of additional productive capacity.

&

We believe the macro backdrop remains supportive of risk assets, although full valuation and politics may limit near-term upside and intensify tail risk. We favor equities over credit, credit over sovereign debt, and emerging markets over developed markets.

Here is a link to the full report.

It has been quite some time since the wider investment community has dared to hope that a new period of synchronised global economic expansion is underway but it is looking increasingly likely as Europe emerges from years of contraction, China’s and India’s growth surprises on the upside and the recovery in commodity prices, outside of oil, boosts the fortunes of producers. However, the increasing commonality of global stock markets has been evidence of this trend for much of the last year.

Clicking through the ranks of global equity indices I can count on one hand the number making important new lows but run out of fingers when counting the number making new all-time highs. That alone tells us the global bull market is broad based. It also suggests the expansion is maturing.

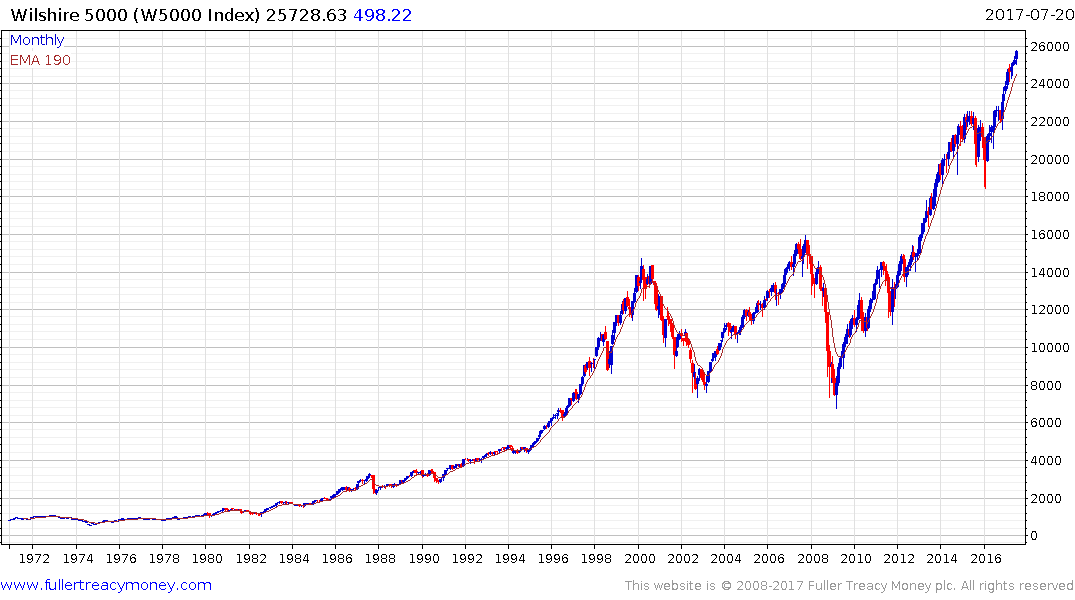

The Wilshire 5000 Index broke out of a 13-year range in 2013 and continues to extend its uptrend. That highlights the broad-based nature of the USA’s outperformance relative to other major global markets. It also suggests it is the market to watch most closely for eventual topping characteristics considering its relative strength and temporal leadership position.

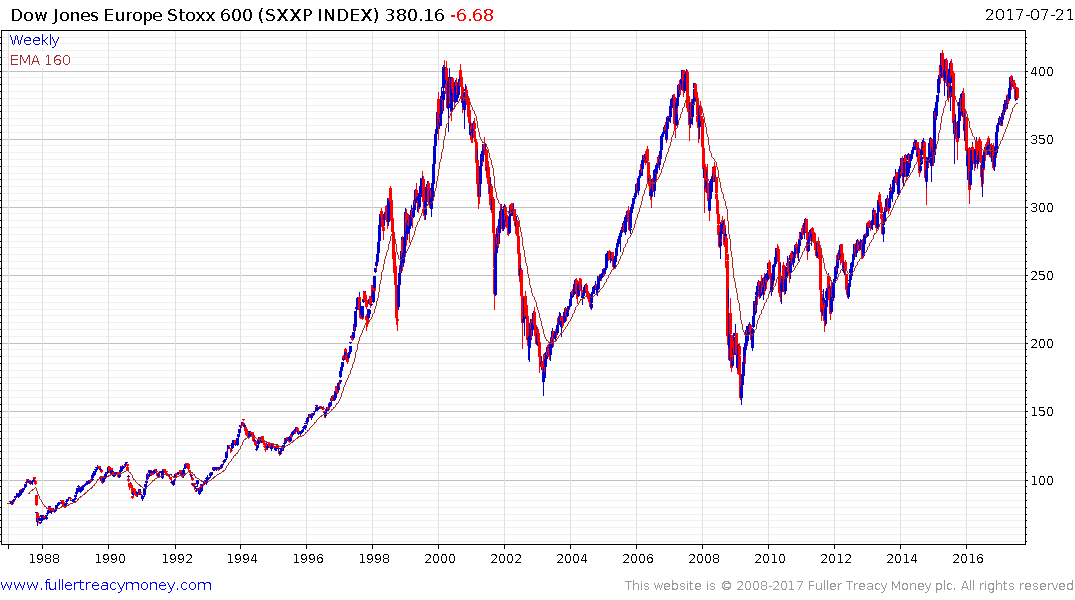

The Dow Jones Europe STOXX Index is testing the upper side of a 17-year range. While Euro denominated, it is heavily influenced by UK companies and the FTSE-100 has already completed its long-term range with a, so far, sustained move above 7000.

Japan’s Topix Index has been ranging below 1750 for 26 years and a sustained move above that level would confirm medium-term bull market characteristics for Japan.

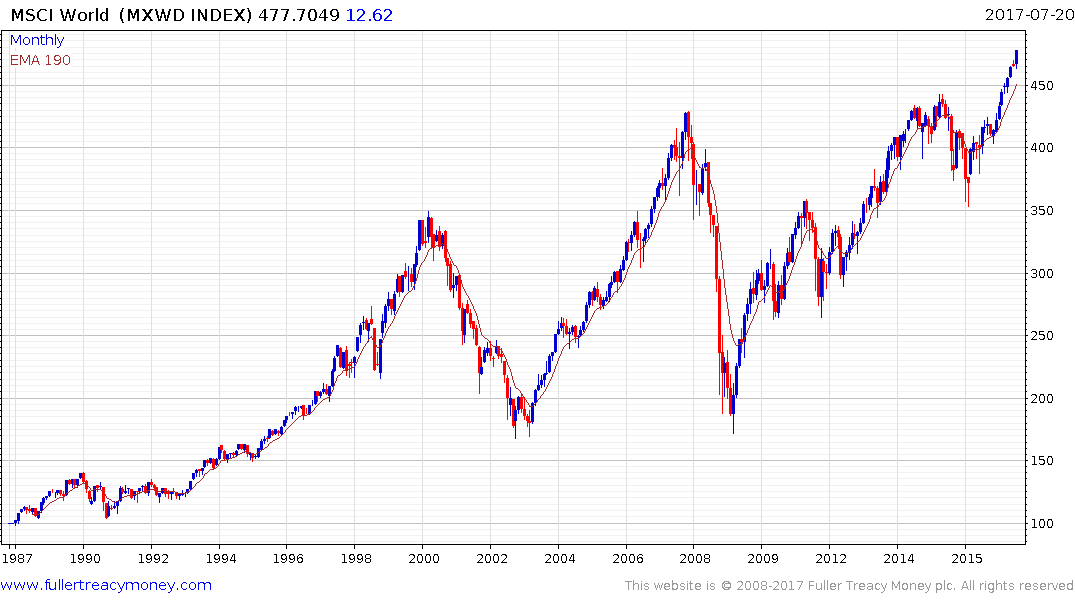

These three indices represent most of the global stock universe while the MSCI World Index broke out to new all-time highs in January.

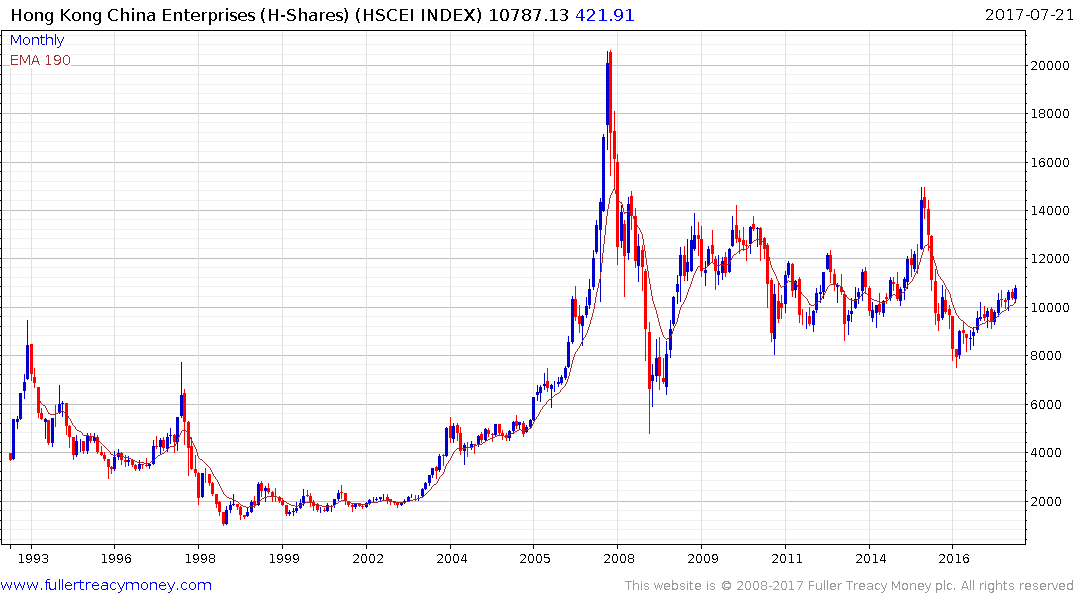

China’s Hong Kong listed H-Share Index (China Enterprises Index) has been ranging in a volatile manner since the 2007 blowout and collapse but is currently rallying from the lower side.

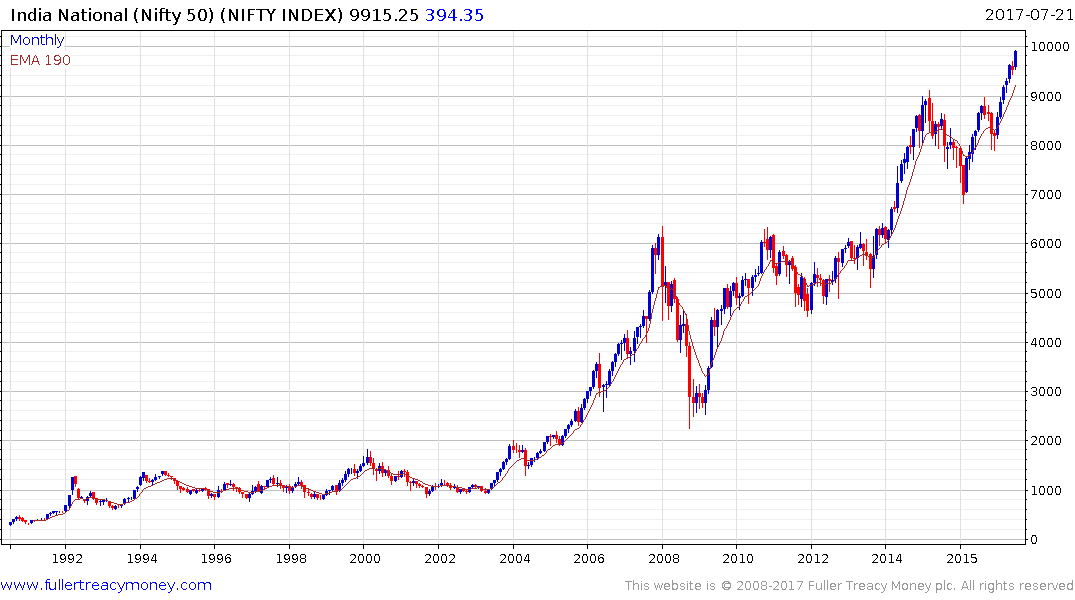

India’s Nifty Index is testing the psychological 10,000 level but that is following a clear breakout from a two-year range and the Rupee breaking its downtrend.

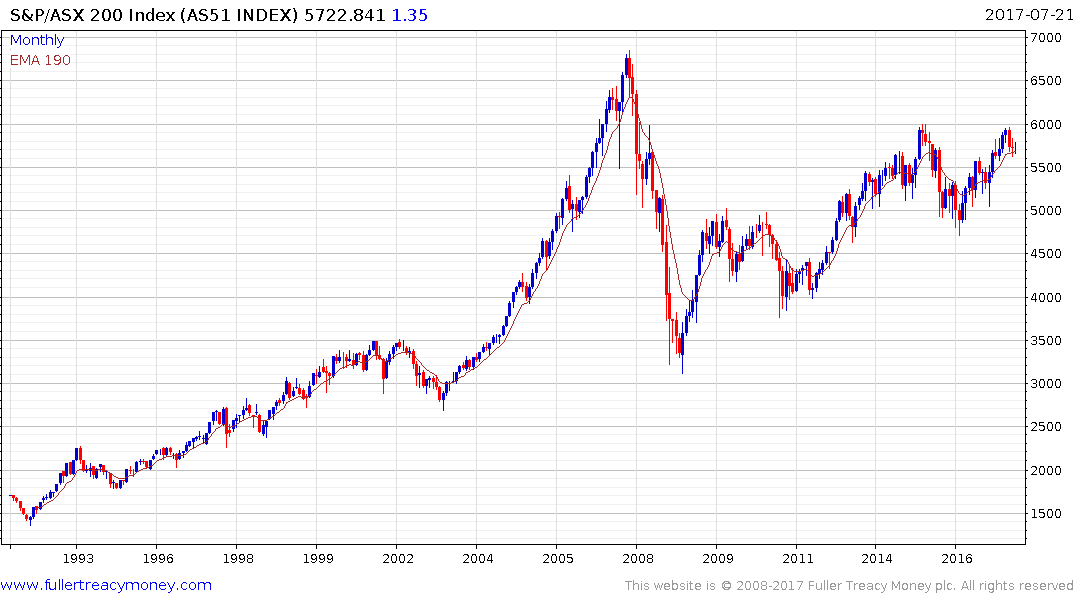

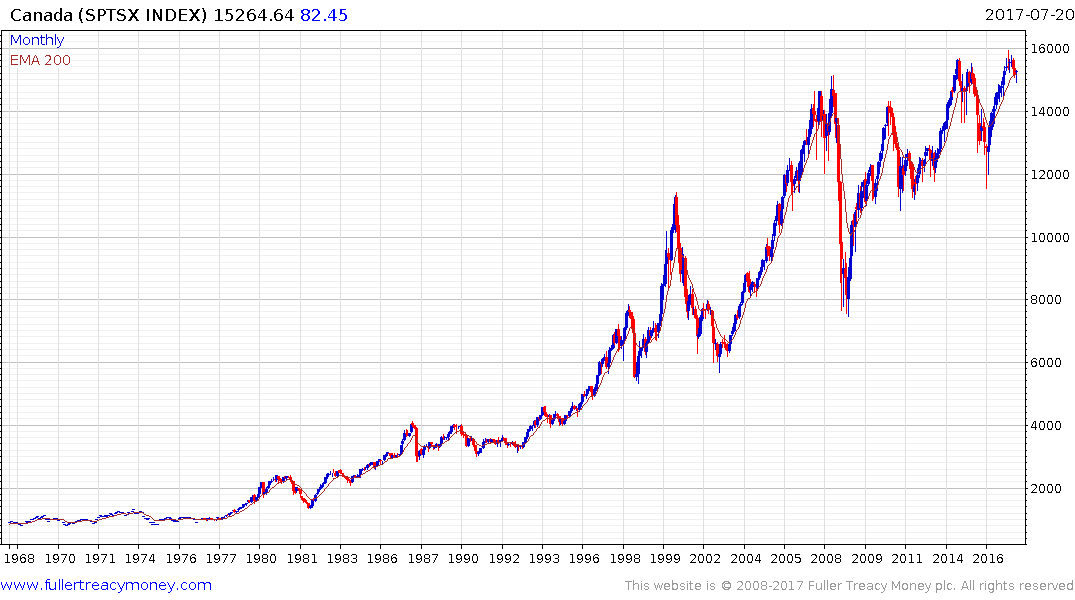

As two of the largest developed market commodity exporters both Australia’s S&P/ASX200 and Canada’s S&P/TSX Composite Index are trading in the region of their respective 200-day MAs.

Russia’s CRTX Traded Index remains heavily influenced by oil and fell back from the region of the trend mean this week.