The Silver Flash Crash: What Might Have Been at Work

This article by Matthew Ashley for investing.com highlights the surprise at today’s intraday volatility in silver. Here is a section:

One slightly more plausible suggestion has been a sudden liquidity drain that sparked a bout of panic selling. Indeed, markets have been fairly thin over the 4th of July holiday period which could have compounded fears that silver was becoming illiquid in the wake of JP Morgan’s recent acquisitions. This being said, the extent to which JP Morgan has ‘rigged’ silver markets is constantly challenged and courts seem to be unable to agree on if the institution is breaking antitrust legislation.

Stop loss orders have also been fingered as a cause for the sudden rout for all the usual reasons. Specifically, the hitting of numerous stop loss orders in rapid succession could have easily amplified the effects of a sell-off – even if they probably didn’t trigger the downtrend in the first place. Moreover, given that many traders may have been out of action due to the holiday’s in the US, it’s quite reasonable to expect more ‘set and forget’ trades to have been placed than is typical. This would have left the metal more exposed to this type of risk than we would usually expect.

Silver is prone to volatility not least because it is a substantially thinner market than gold which is why we so often refer to it as “high beta gold”. The price fell by almost $2 around midnight UK time when markets are thin before rebounding to almost unchanged. It then traded laterally in an inert manner until an hour before the US open when it traded down from $16 to $15.50 before stabilizing again. That represents substantial volatility but the question is what now?

Generally speaking, flash crashes are traumatic events with anyone who had a stop in the market being punished while those with speculative bids under the market are rewarded. The second order response is to conclude the market is now riskier than it was yesterday. That is particularly true of a market that had previously been trending higher and has a sudden downdraft. Getting a flash crash following a weak period is not quite the same. It suggests that the market was already supply dominated and the abrupt drop catalyzed the thoughts of large numbers of weak holders.

Silver tested its 2015 low near $14 this morning and closed almost a $1.50 above that level. The last time silver posted a similar drawdown was in 2014 and that represented a least a multi-month low and the beginning of the current three-year range. Upside follow through next week would confirm a low of at least near-term significance.

Silver is likely to be influenced by what happens in the gold market which dropped today to break the progression of higher reaction lows evident since December. If an additional test of underlying trading is to be avoided it will need to rally soon.

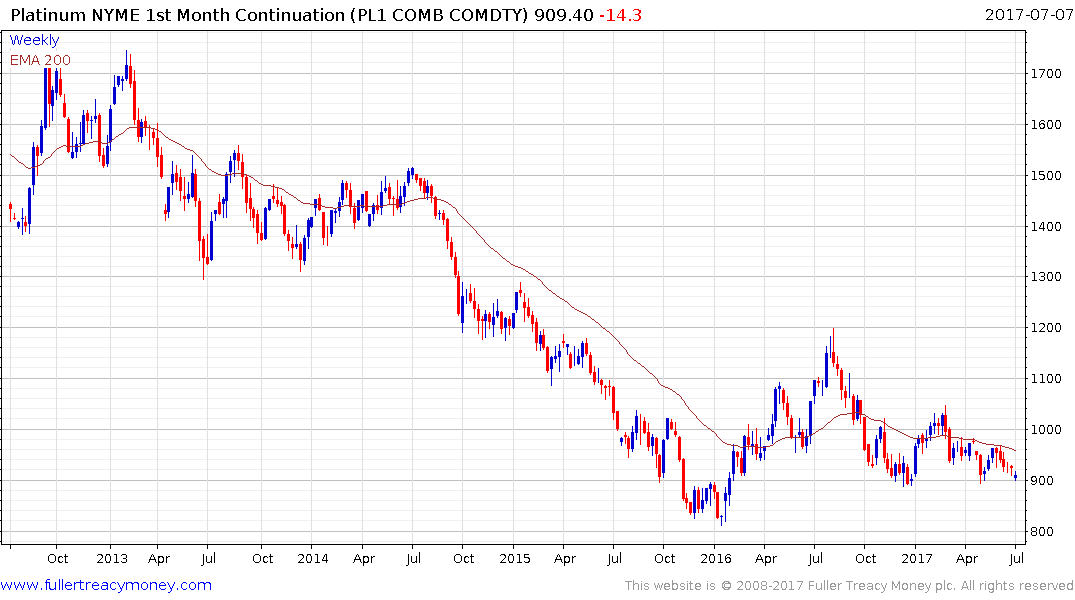

Platinum is back testing the psychological $900 level which has offered support in both December and May. However, a clear upward dynamic will be required to signal a return of demand dominance in this area.

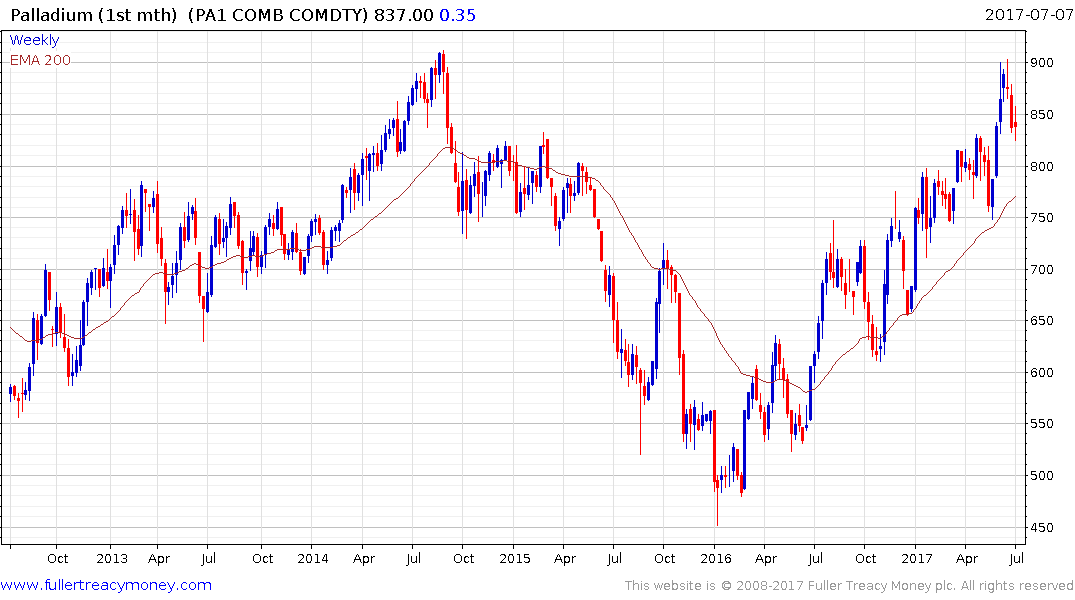

Palladium has been pulling back from the $900 area since early June but a sustained move below the trend mean would be required to question the primary consistency of what is a more than 18-month advance.