Behind China's Bond Selloff, a Risky Twist on the Repo Trade

This article by Shen for the Wall Street Journal may be of interest to subscribers. Here is a section:

As much as 12 trillion yuan ($1.73 trillion) in bonds—or 19% of the country’s $9 trillion bond market—could be subject to such repurchase agreements, according to an estimate by Shui Ruqing, president of bond clearing-house China Central Depository & Clearing Co., cited last month in China’s influential Caixin Magazine. Traders say the deals are so opaque that even estimates are hard to make.

Banks sometimes use the “dai chi” agreements to move risky assets temporarily off their books during earnings periods or audits, the people said. Brokers like Sealand typically use them to borrow quickly and flexibly—leveraging their investments many times over, they said.

Until last year, Chinese financial regulators had largely ignored the practice, beyond saying they opposed it during a bond-market crackdown in 2013. But the informal nature of dai chi also meant the trades could be difficult to enforce when conditions worsened.“Because it’s not really an official business, agreements aren’t legally binding,” said the executive who had bought bonds from Sealand.

Sealand’s problems became apparent on Dec. 15, when the southern China-based company announced that two of its traders had forged dai chi agreements worth 16.5 billion yuan ($2.4 billion), a move that market participants interpreted as meaning the broker didn’t intend to honor the deals.

The amount was more than five times what Sealand had declared in its Sept. 30 financials as its financial assets under official repurchase agreements, and more than seven times its disclosed bond-holdings.

Here is a link to a PDF of the article.

China has developed extraordinarily quickly from a closed backwater into a massive financially significant hub. While the pace of development has been blistering the evolution of regulatory standards of governance has been much more moderate. The single party system where cronyism, nepotism and the modern equivalent of simony combine to ensure just about anything is permissible, provided your social standing is within the correct circle, and only exacerbates the situation.

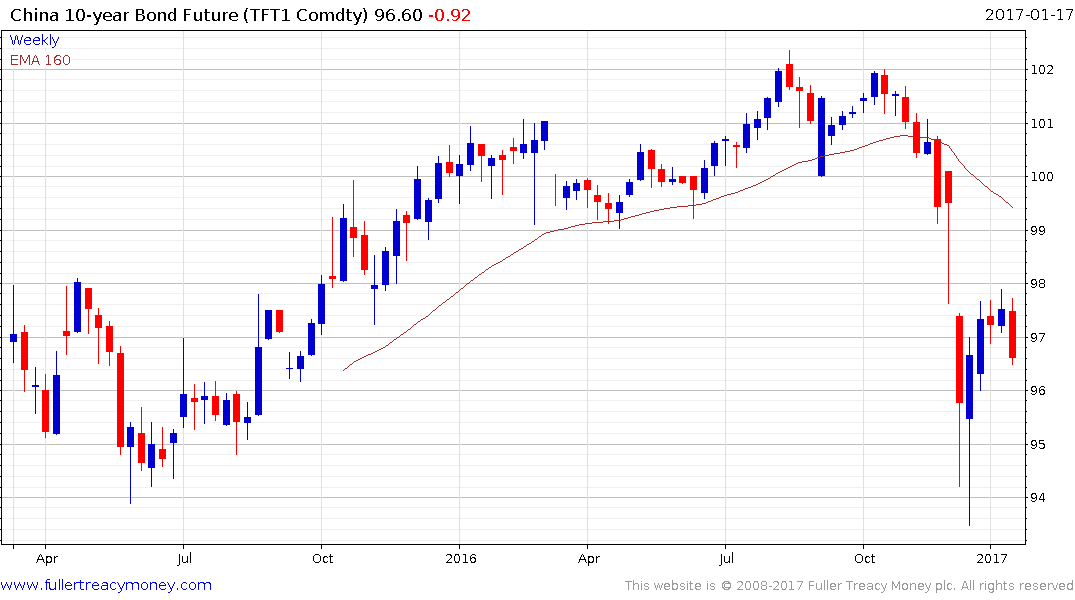

Chinese 10-year government bond futures pulled back very sharply in late November before bouncing from mid-December on central bank intervention. The big question at this stage is to what extent the Chinese administration will wade in if/when prices retest the December low. Government borrowing costs are a non-trivial consideration so the integrity of the bond market is likely of considerable concern.

A broader question is whether the pick-up in the pace of the Yuan’s downtrend was a symptom of increased attempts to shore up the government bond market late last year. Slowing the pace of the yuan’s decline is expensive yet balancing the need for supporting the bond market with attempts to retard the pace of capital leaving the country represents a delicate balancing act.

.png)

The FTSE China A600 Banks Index continues to hold a progression of higher reaction lows and bounced over the last three week from the region of the trend mean. A sustained move below 12,800 would be required to question potential for continued higher to lateral ranging.

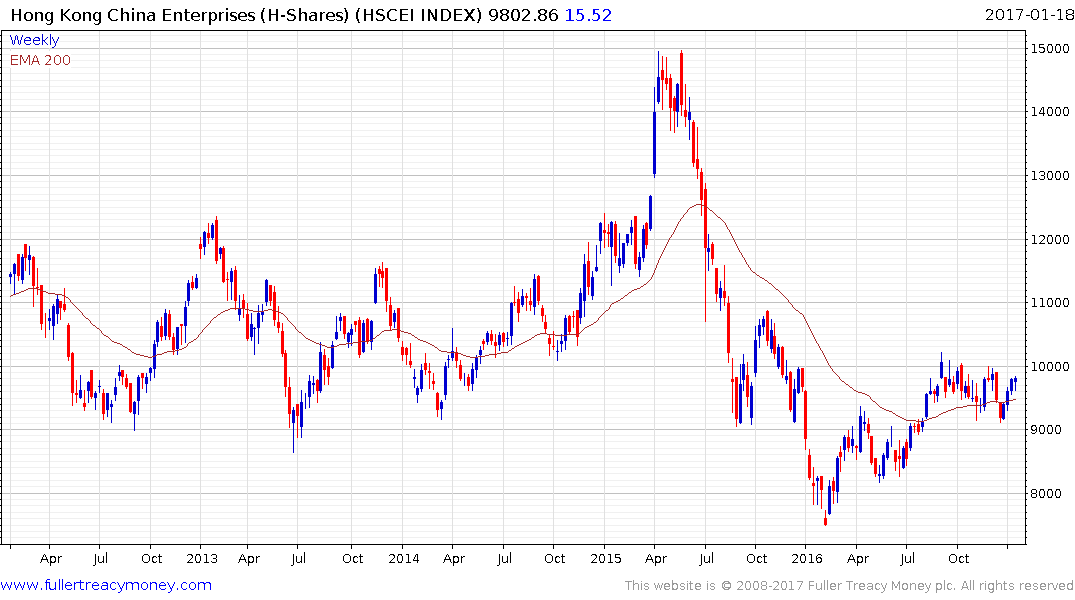

The Hong Kong listed China Enterprises Index (H-Shares) has rallied over the last three weeks to challenge the progression of lower rally highs in evidence since September. A sustained move above the psychological 10,000 will be required to signal a return to demand dominance beyond what has so far been short-term steadying.