Post 19th Party Congress: Xi the King of China

Thanks to a subscriber for this report from APS Insights which focuses on the political machinations that brought Xi Jinping to power. Here is a section:

At the 19th party congress, the GDP growth target of 6.5% was quietly dropped, very likely due to the rising influence of Liu He, a liberal reformist. The focus has now shifted to quality rather than quantity. A decisive role for the market, as well as supply side structural economic reforms, is now written into the Party Constitution.

However, this does not necessarily mean uninhibited economic liberalization and full SOE reform. Xi and his key economic advisors may have made the assessment that the progressive marketization of the economy has reached some sort of equilibrium, where the private sector has already steadily risen to comprise about 70% of the economy, from almost nothing in 1978. That is deemed to be satisfactory. As a result, the state sector’s 30% share is viewed as necessary and critical for “socialism with Chinese characteristics”, playing the crucial stabilizing and strategic roles for both politics and society.

There is also rising confidence that one of China’s greatest sources of resilience is its balanced economic structure. The successful shift to consumption spending, which now contributes to about two-thirds of overall growth since 2013, has further boosted government confidence because the contribution of net exports has averaged zero since 2013. This point, however, is not well appreciated outside China.

Here is link and a section from the full report.

At the 19th party congress, the GDP growth target of 6.5% was quietly dropped, very likely due to the rising influence of Liu He, a liberal reformist. The focus has now shifted to quality rather than quantity. A decisive role for the market, as well as supply side structural economic reforms, is now written into the Party Constitution.

However, this does not necessarily mean uninhibited economic liberalization and full SOE reform. Xi and his key economic advisors may have made the assessment that the progressive marketization of the economy has reached some sort of equilibrium, where the private sector has already steadily risen to comprise about 70% of the economy, from almost nothing in 1978. That is deemed to be satisfactory. As a result, the state sector’s 30% share is viewed as necessary and critical for “socialism with Chinese characteristics”, playing the crucial stabilizing and strategic roles for both politics and society.

There is also rising confidence that one of China’s greatest sources of resilience is its balanced economic structure. The successful shift to consumption spending, which now contributes to about two-thirds of overall growth since 2013, has further boosted government confidence because the contribution of net exports has averaged zero since 2013. This point, however, is not well appreciated outside China.

I’ve been travelling to China on at least an annual basis since 2005 but it is only in the last 18 months that the pace of social change has been noticeable. Everyone is used to going to China and marvelling at the infrastructure but the social change underway with the birth of a consumer culture and domestic services industry represents a massive change for China.

The administration must have felt forced into its stimulus in 2009 when its export markets collapsed with the credit crisis, then the Eurozone’s sovereign wealth crisis, then the collapse of the commodity complex. They understood that China could not hope to achieve its long-term goal of global economic power by only relying on exports. It needed a domestic consumer market and now it has one.

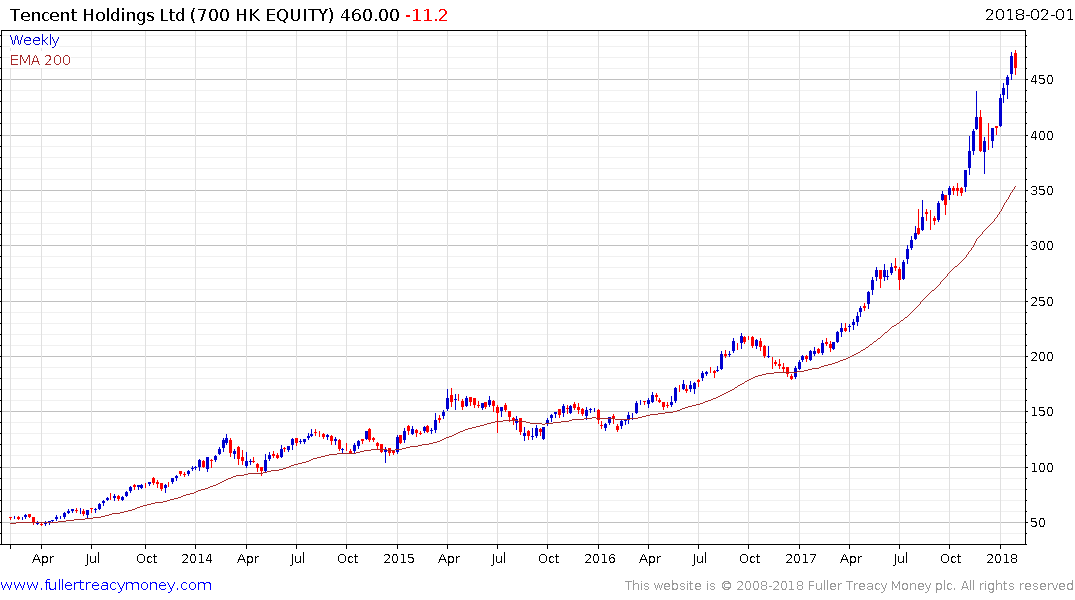

Tencent has paused over the last few sessions above the HK$450 area. While still quite overextended relative to the trend mean there has been an absence of clear downward dynamics. Anyone monitoring the consistency of the chart will have to now ask whether the larger pullback in December was the trend loss consistency at the penultimate high. Certainly the risk of mean reversion has increased.

JD.com hit a new high last week and paused this week but a sustained move below the trend mean would be required to question medium-term scope for additional upside.