PMIs and Earnings Will Ultimately Determine the End of the Correction

Thanks to a subscriber for this report from Morgan Stanley which may be of interest. Here is a section:

Here is a link to the full report and here is a section from it:

However, the S&P 500 is currently diverging from the deceleration we have already seen in the Mfg PMI to date. If we're right about PMIs falling further over the next few months, stocks still have material downside before this correction is over. This is very much in line with our outlook that tightening financial conditions with decelerating growth leads to falling valuations, particularly when the starting point is so high. The good news is that a good chunk of the de-rating has already happened at the individual stock level, even if the de-rating hasn't yet begun for the broader index. While we have been surprised/wrong at how well the index has held up in the face of so much damage to other asset prices and other mounting evidence, this relationship with the PMI appears to be a smoking gun if it starts to fall more meaningfully.

In addition to PMIs, we track earnings revision breadth closely as a gauge of growth acceleration/deceleration. It also has a high positive correlation vs. stock prices. In this case, the S&P 500 is trading in line with the current earnings revision breadth. While our work suggests the risk is to the downside for earnings revision breadth, it bears close watching as a possible offset to falling PMIs. In this regard, earnings revisions and PMIs will be more important than the direction of interest rates from here, in our view.

There has been a great deal of commentary in the financial media about deteriorating breadth in the stock market and how the average stock has corrected significantly while the mega-caps have supported the stock averages.

The S&P500 Equal Weight/S&P500 ratio topped out in early 2017. It accelerated lower during the pandemic before staging a particle recovery in 2021. A sequence of lower rally highs has been evidence since June. That nine-month downtrend will need to be broken to signal to broad breadth recovery. Nevertheless, it is difficult to justify panicking about this ratio. Both the equal weight and regular S&P500 indices are still trending higher.

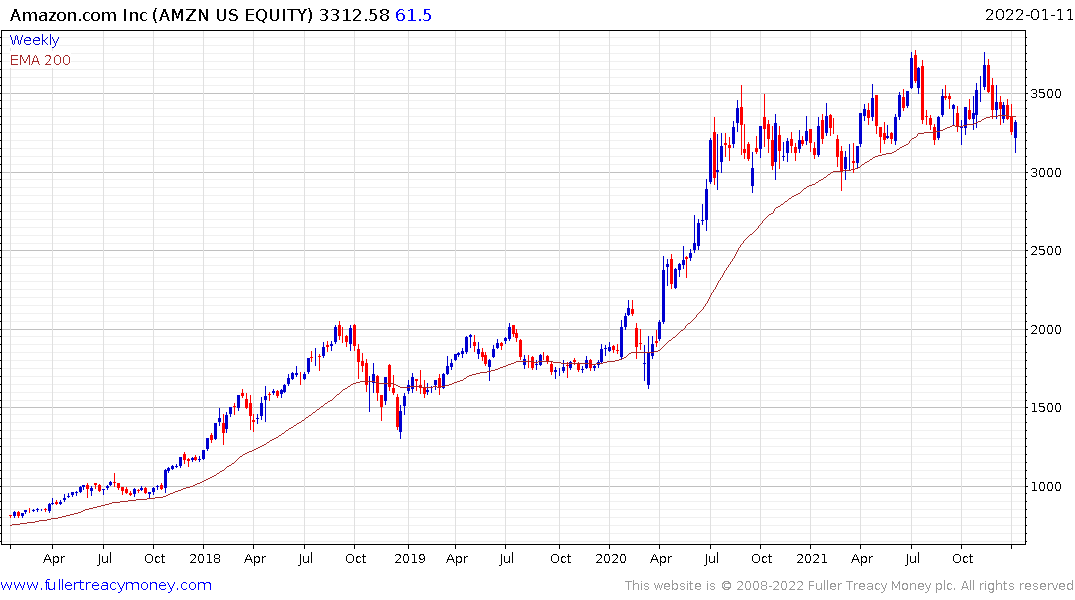

Meanwhile, Amazon’s failed break below $3200 should help lend support to risk appetite.

The Russell 200 is also attempting to build support at the lower side of its range.