Platinum Outshines Palladium on Prospect of Europe Diesel Demand

This article by Luzi Ann Javier for Bloomberg may be of interest to subscribers. Here is a section:

“Car sales are one of the strongest indicators of consumption of raw materials,” said Peter Thomas, a senior vice president at Zaner Group in Chicago, citing the one to two ounces of platinum or palladium that goes into each vehicle.

“You’ve also got a lot of window dressing going on,” with traders selling palladium to book their gains for the year, and buying platinum, he said.

Palladium, used mostly in pollution-control devices for gasoline engines, has led gains in precious metals this year by climbing 48 percent. It surpassed the price of platinum in September for the first time since 2001. Gold has gained 9.9 percent in 2017, while silver increased 1.4 percent.

Supply of platinum will trail consumption by 275,000 ounces in 2018, after being largely balanced this year, the World Platinum Investment Council forecast in November. Mine closures in the second half of this year will have a larger impact on production next year, it said.

Platinum has been priced as if diesel cars are going to be discontinued tomorrow. The reality is somewhat different since European consumers pay some of the highest prices for gasoline in the world and diesel cars are both more efficient and last longer. Despite projections for increased electric vehicle use from the 2020s, and more stringent emissions testing, diesel cars are still likely to be in demand for at least the next few years.|

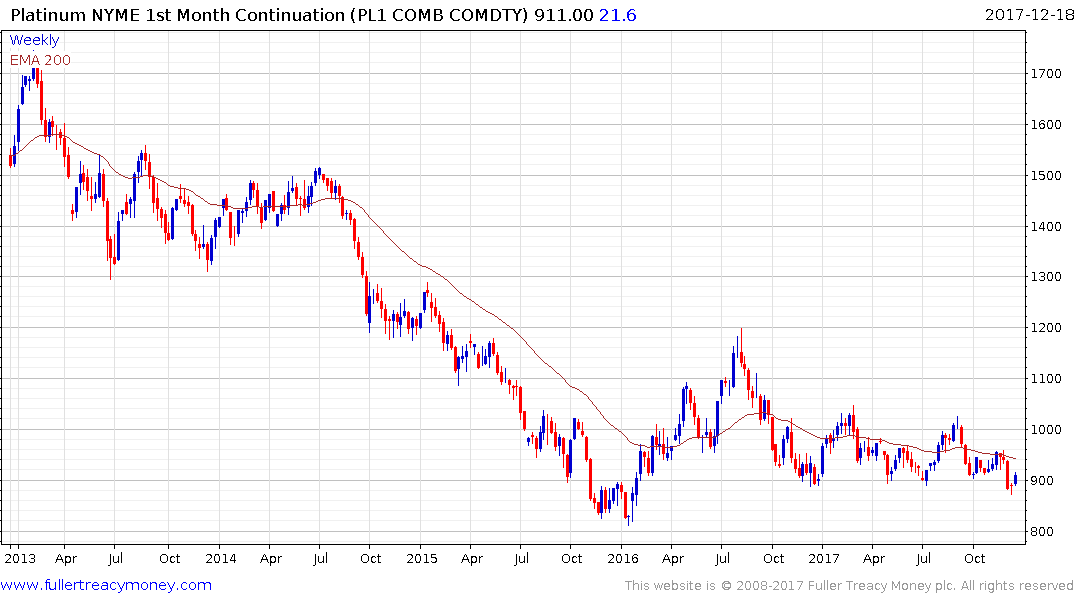

Platinum pushed back above the psychological $900 area today and a sustained move below last week’s low of $872 would be required to question potential for some additional upside.