Pipeline Giant Kinder Morgan Rebounds After Cutting Dividend

This article by Joe Carroll for Bloomberg may be of interest to subscribers. Here is a section:

The dividend reduction will keep enough of the cash generated from operations in-house to help the company retain its investment-grade credit rating, Kinder Morgan said in the statement. Retaining cash also will forestall any need to issue new shares to raise capital through at least 2018, the company said.

“We applaud the strategy of cutting to the point that prevents the need for capital funding through 2018,” Jefferies LLC analysts said in a note to clients.

The Houston-based company raised its capital budget for growth projects by 20 percent for 2016 to $4.2 billion, Chief Executive Officer Steve Kean said Wednesday during a conference call with analysts. The company’s spending plan for next year assumes an average oil price of $50 a barrel.

Kinder Morgan directors set the new dividend at 50 cents to achieve a yield that would be above the average of the companies in the Standard & Poor’s 500 Index, Kean said.

The company “anticipates enough retained internally generated cash flow to fund all of the required equity contribution projected for 2016 and a significant portion of its debt requirements,” according to the statement.

This week has been marked by major commodity related companies cutting or eliminating dividends. This is a necessary step in rehabilitation for the sector following what has been a steep pullback in the price of the products they sell or, in the case of pipelines, transport.

MLP pipeline companies have the fact that regardless of price energy companies will still need to get their products to market. The bearish argument rests on the fact that many companies have high debt burdens which are now being picked apart by investors.

Kinder Morgan has a debt to assets ratio of 49.2%. The share hit a low near $15 yesterday and bounced on news it will be retaining more of its earnings to avoid share dilution. Potential for a reversionary rally has increased and a sustained move below the $15 area would be required to question that view.

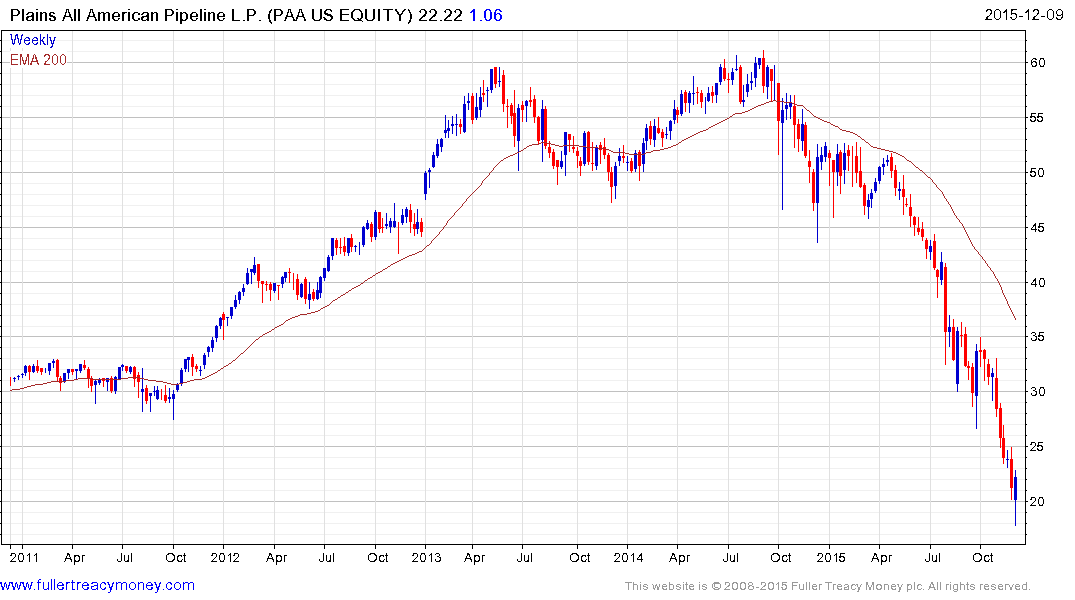

Plains All American Pipeline has very similar valuations and also fell by approximately 60% this year. The share also bounced over the last two days but is now testing the short-term progression of lower rally highs and will need to sustain a move above $25 to break that sequence.

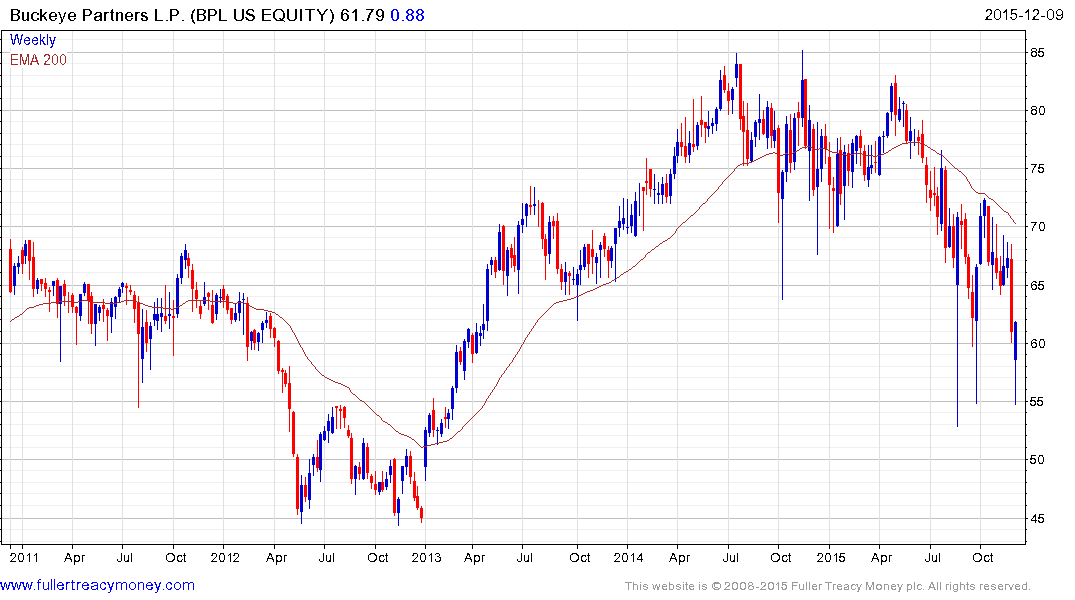

Buckeye Partners has a debt to assets ratio of 44% and bounced over the last two days from the region of the August and September lows.