Pioneer Natural Resources stock jumps after WSJ report of merger talks with Exxon Mobil

This article from MarketWatch may be of interest. Here it is in full:

Shares of Pioneer Natural Resources Co. powered up 6.4% toward an eight-week high, to pace the S&P 500's premarket gainers, after the Wall Street Journal reported that the fracking company has held preliminary talks with Exxon Mobil Corp. over a possible acquisition. Exxon's stock fell 0.9% while futures for the S&P 500 shed 0.5%. ahead of Monday's open. Citing people familiar with the matter, the WSJ report published Friday said the discussions have been informal, but with Exxon flush with cash after recording record profits in 2022, the oil giant has been exploring options. Pioneer Natural's stock has lost 8.9% year to date through Thursday, while Exxon shares have tacked on 4.3% and the S&P 500 has gained 6.9%.

The pace of M&A activity is heating up in the resources sector. Exxon Mobil’s proposed merger with Pioneer suggests the shale oil and gas sector is maturing. The days of the wildcat land grab are over. The resources are well understood and the unique attributes of unconventional supply allow production to be dialled up and down as needed. That is an attractive add on for a global major.

At the same time, Newmont sweetened its offer for Newcrest by around $1.5 billion and Glencore is haggling with Teck Resources shareholders over exposure to carbon emissions and cash components to their proposed deal.

These two deals rank in the top-10 largest ever mining mergers and are happening simultaneously. The Alcan-Rio Tinto, Inco-Vale, Phelps Dodge-Freeport McMoRan all took place in 2007 and were all also in the top-10.

M&A activity does not directly increase supply but often increases debt. That’s not so much of an issue at present because miners are flush with cash. However, the M&A activity does suggest an eagerness to secure access to producing assets ahead of an expected jump in demand.

There are two clear conclusions. The first is this type of activity is typical at the end of an economic cycle because it takes a long time for miners to have both the cash and confidence to make big spending decisions.

The second is there has not been a lot of investment in new supply over the last decade so M&A activity concentrates supply in fewer hands. It suggests oligopolies will be more prevalent whenever demand does ramp higher. The hope is BHP’s acquisition of Billiton in 2001, before the big bull market, is a better comparison.

Exxon Mobil continues to hold the breakout from a 15-year range and confirmed support at the upper boundary in late March. It is certainly being supported by the willingness of OPEC+ to support prices in the $80 area.

Exxon Mobil continues to hold the breakout from a 15-year range and confirmed support at the upper boundary in late March. It is certainly being supported by the willingness of OPEC+ to support prices in the $80 area.

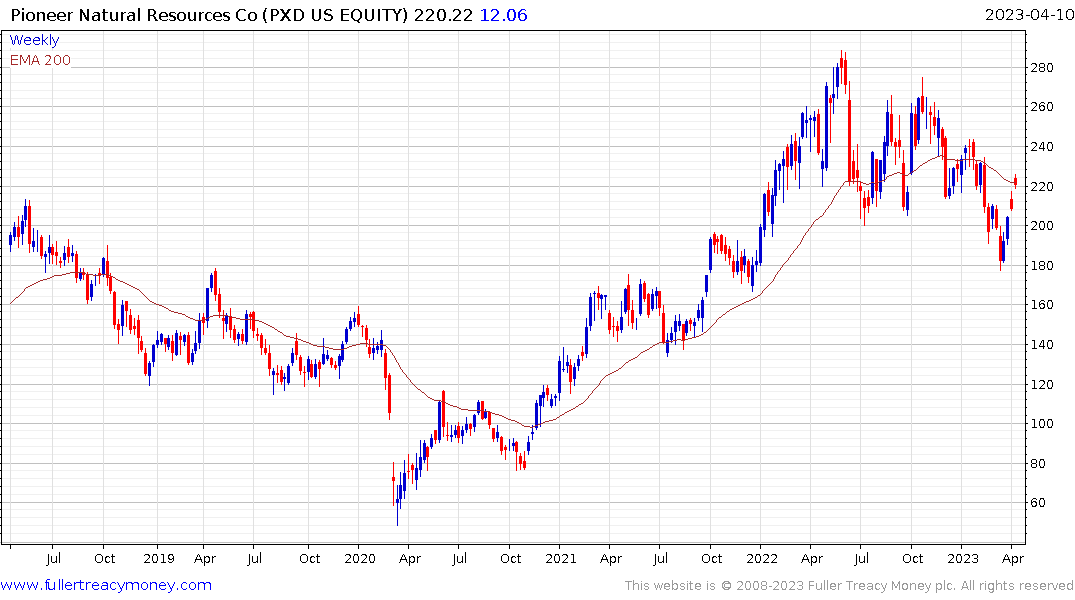

Pioneer is also firming in the region of the upper side of a long-term range.

Pioneer is also firming in the region of the upper side of a long-term range.

Glencore has rebounded to test the region of the 200-day MA and will need to hold the 400p level if the benefit of the doubt is to be given to recovery.

Glencore has rebounded to test the region of the 200-day MA and will need to hold the 400p level if the benefit of the doubt is to be given to recovery.

Teck Resources continues to hold in the region of its 2022 peak.

Teck Resources continues to hold in the region of its 2022 peak.

Newmont continues to firm from the upper side of the 2013-2020 base formation.

Newmont continues to firm from the upper side of the 2013-2020 base formation.

Newcrest gapped higher on the news of the sweetened offer which suggests the odds of its being successful have improved.

Newcrest gapped higher on the news of the sweetened offer which suggests the odds of its being successful have improved.

Importantly for the resources sector, the Dollar continues to weaken. That is supporting the outlook for crude oil, copper and gold.