Pimco-Owned Office Landlord Defaults on $1.7 Billion Mortgage

This article from Bloomberg may be of interest to subscribers. Here is a section:

An office landlord controlled by Pacific Investment Management Co. has defaulted on about $1.7 billion of mortgage notes on seven buildings, a sign of widening pain for the industry as property values fall and rising interest rates squeeze borrowers.

The buildings — in San Francisco, New York, Boston and Jersey City, New Jersey — are owned by Columbia Property Trust, which was acquired in 2021 for $3.9 billion by funds managed by Pimco. The mortgages have floating-rate debt, which led to rising monthly payments as interest rates soared last year.

“We, like most office owners, are addressing the unique and unprecedented challenges currently facing our asset class and customer base,” Justina Lombardo, a spokesperson for Columbia Property Trust, said in an emailed statement. “We have engaged with our lenders on a restructuring of our loan on seven properties within our larger national portfolio. We look forward to a collaborative process yielding thoughtful solutions that reflect current market conditions and best serve the interests of all stakeholders.”

Over the last few months I have been struck by the number of conversations I’d had where investors have been investing in private credit for years already. One way of thinking about it is investment banks are going back to their roots.

When most of the big investment banks were private partnerships, they would provide loans to businesses in need of capital for growth that were not eligible for conventional bank loans. That business has been a major money spinner over the last decade with low rates and ready access to abundant credit.

Another way of thinking about it is there has been an incredible boom in the value of private assets with no pressure to market assets to market. That has encouraged legions of investors into the space from every corner of the financial markets. Private equities returns over the last 40 years had bred large numbers of copycats and they have all done well over the last decade. Rising rates represent challenges for all as refinancing maturity walls approach.

The pervasive sense that private investing is a magic money tree that can’t ever go wrong is a reg flag for me. It suggests that the unlisted sector is the epicentre of risk in this tightening cycle. Savvy investors will have structured deals so they come out on top during bankruptcy proceedings. Everyone else will be taken to the cleaners. That’s bad news for unsophisticated pension funds.

Both Blackstone and Brookfield remain in consistent downtrends.

This article highlighting the commercial property debt issues in Europe and China may also be of interest.

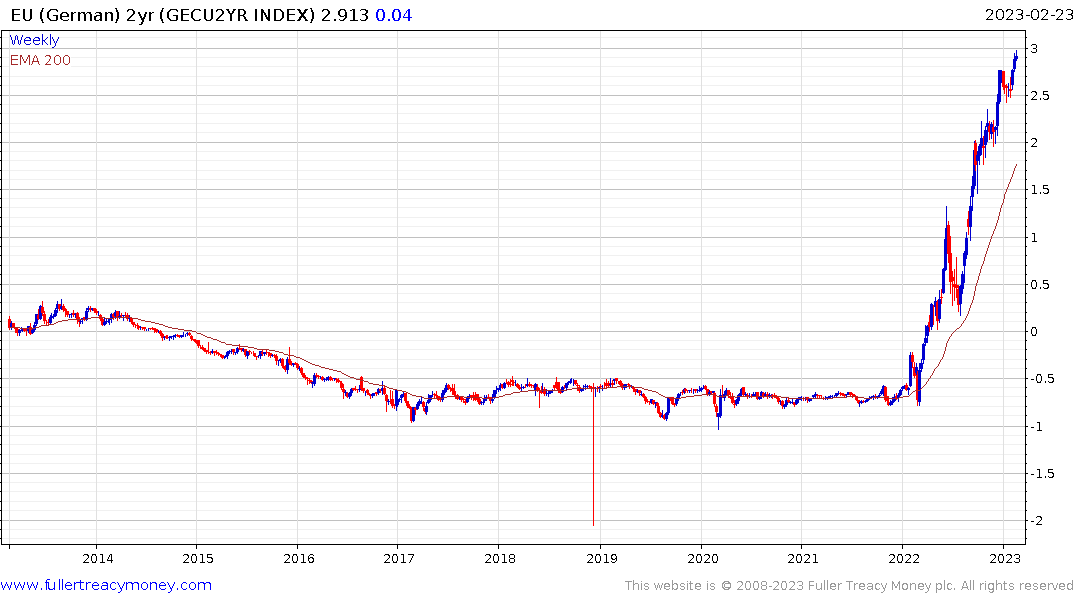

German 2-year yields continue to trend aggressively higher and surpassed 3% this week; having been negative as recently as 10 months ago.

German 2-year yields continue to trend aggressively higher and surpassed 3% this week; having been negative as recently as 10 months ago.