Pimco Investment Outlook

This edition of Bill Gross' monthly report may be of interest to subscribers. Here is a section:

First of all the obvious, An investor should own bonds with less duration and shorter maturities when the teeter totter is on the losing end. Admittedly, those with long-term liability structures such as pension funds and insurance companies have to be careful about their underweights but as a rule, less duration should mean more alpha relative to an investor's benchmark as the interest worm turns and the cycle shifts upward.

But riding the bond market seesaw doesn't always mean negative returns, especially when it comes to other "carry" components inherent in fixed income securities. As I pointed out in my August 2013 Investment Outlook titled "Bond Wars" maturity extension is just one of the ways to produce carry and total return in a fixed income portfolio. In addition there are 1) credit spreads, 2) volatility sales, 3) curve and 4) currency-related characteristics that when combined with maturity can produce returns over and above those microscopic Treasury bill rates, and still keep you from "breaking the buck" under a majority of scenarios. On the "down" side of an interest rate teeter totter these carry components can help a portfolio benchmarked to a 5-year duration bond market index float above water and ever enjoy swimming.

In this edition Bill Gross shares our conviction that the secular bull market in bonds is over. However, this represents a significant challenge for investors who have benefitted enormously from a confluence of reliable yields and outsized capital appreciation over the last 30 years. Therefore, while the Fed Funds Rate remains close to zero short dated bonds are likely to continue to be less volatile than their longer-dated peers. However in a rising yield environment achieving a positive return will be a difficult feat for the majority of fixed income investors and will require the type of flexibility described above. (Also see my additional comments of this subject posted on December 30th).

The conclusion many investors who are not obligated to hold bonds have come to us is that the stock market represents the best candidate for an asset class where they can still benefit from capital appreciation and the potential for dividend growth to keep pace with inflation.

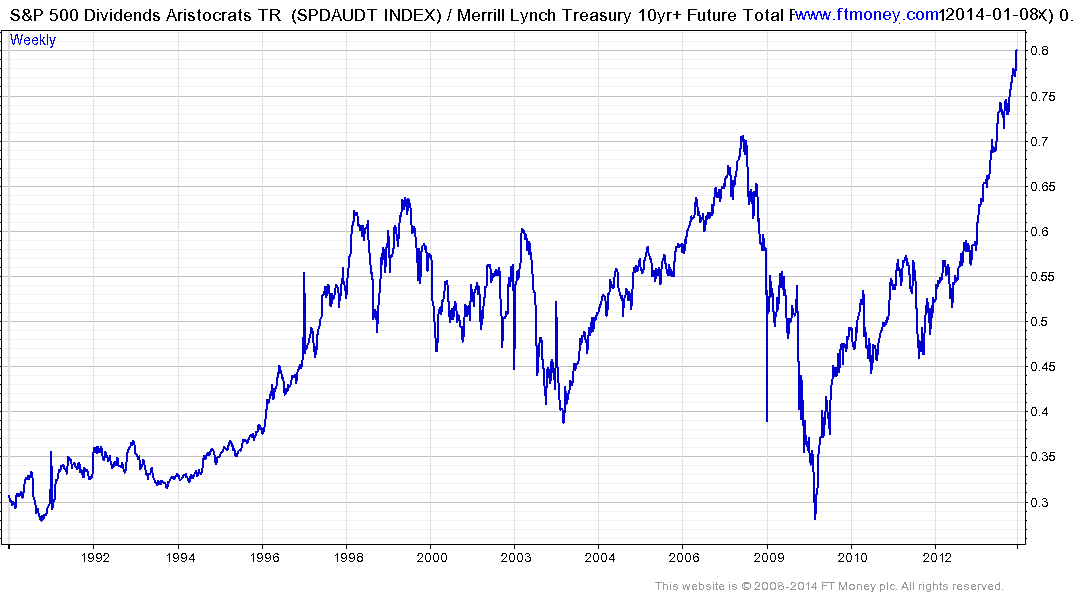

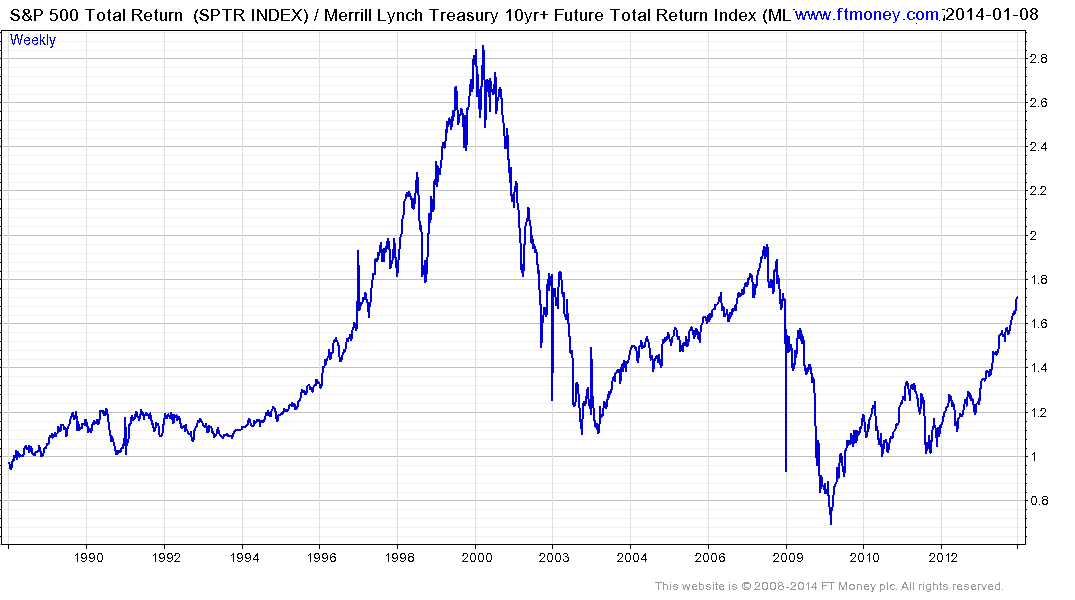

As a benchmark of companies with strong records of dividend increases the performance of the S&P500 Dividend Aristocrats Total Return Index relative to the Merrill Lynch 10yr+ Treasury Total Return Index is instructive particularly when compared to the ratio of the S&P500 Total Return Index relative to the same benchmark.

The former chart demonstrates quite clearly that companies with strong records of increasing dividends are susceptible to occasional deep medium-term pullbacks but also impressive periods of outperformance such as since the 2009 lows. This ratio will be worth monitoring for signs of inconsistency and may act as a lead indicator for a deterioration in the broader stock market.

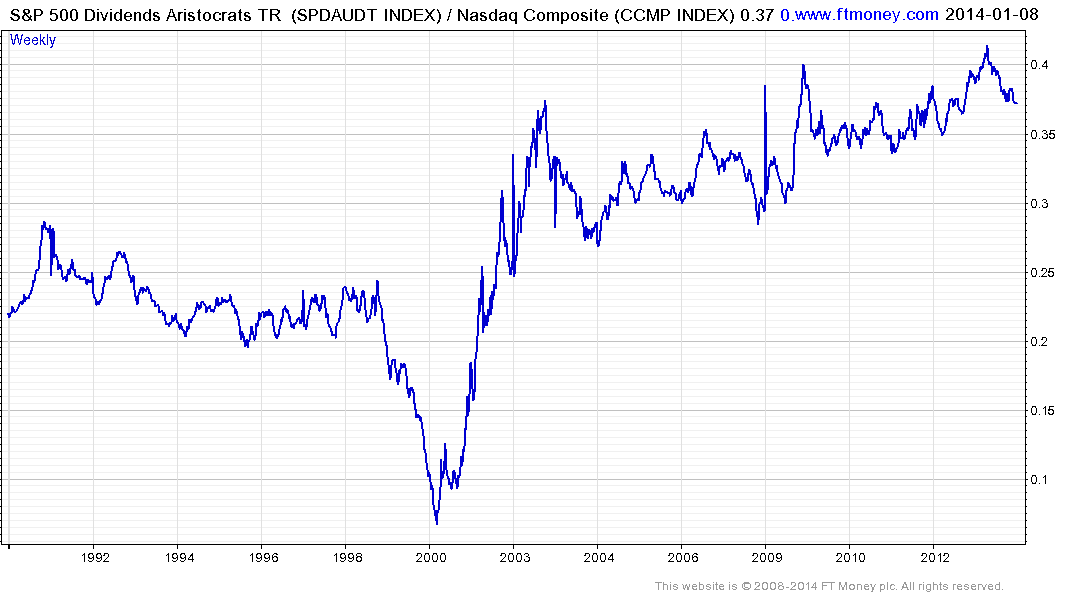

The S&P500 Dividend Aristocrats Total Return Index / Nasdaq Composite ratio is also worthy of mention. If the Dividend Aristocrats can be used as a dividend growth benchmark then we might look to the Nasdaq as a benchmark for growth stocks. Here the outperformance of dividend increasers has been less pronounced and helps to illustrate how successful profligate monetary policy has been in supporting a variety of stock market sectors.

Back to top