PGMs: Rhodium The Come Back Kid

Thanks to a subscriber for this report from Bloomberg which may be of interest to subscribers. Here is a section:

Alongside subdued supply growth, the PGM sector enjoys strong demand side trends. Indeed palladium and rhodium are closely tied to the fast growing gasoline markets of the US and China. Increased gasoline penetration in Europe will also skew upside risks to palladium demand in the event of an eventual recovery in European demand. However, of the group, China is set to be the major driver of tightening physical fundamentals across the PGM sector and specifically palladium and rhodium. This will be driven by efforts to balance the growth in car ownership with combating the country’s pollution problem.

We estimate that the combination of low car penetration compared to other more developed markets and increasing emission standards will mean China will be the largest single source of increased autocat demand for palladium, rhodium and even platinum between now and the end of the decade. Figure 6 shows that between 2013 and 2020 global palladium demand growth for autocats will rise 2,166,000 ounces of which China will represent just under 1,000,000 or 44%. The equivalent figures for platinum and rhodium are 23% and 30% respectively.

While inventories are high across the PGM complex, market deficits over the coming years alongside increased ETF inflows will push inventory to consumption ratios down to critically low levels. Last month in the Commodities Quarterly report we attempted to establish which markets would experience significant inventory drawdown in response to market deficits and at what point inventories would hit levels that could trigger a more rapid appreciation in PGM prices. We showed that platinum inventories would only fall to 2007 levels by the end of the decade, but depending on ETF flows and how tightly this metal is held, the physical squeeze could occur as soon as next year. For palladium, inventories were estimated to drop to 2001 levels by 2018, but if ETF flows continued then physical tightness could start to take hold in 2016. A similar timeframe was seen for the rhodium market.

However, we find that ETF flows have been relatively modest into the rhodium market up until now. Indeed compared to market size and above ground inventories, there remains considerable room for more inflows if the platinum and palladium markets are a guide, Figure 9. Indeed the rapid price gains in palladium will increase the attractiveness of rhodium added to which rhodium is the most effective PGM at treating NOx emissions.

Here is a link to the full report.

The platinum group metals (PGMs) have been subject to a great deal of variation in their performance over the last couple of years as the mixed picture on global economic growth, excess supply, South African labour relations and the unfolding Russian situation have come to bear on the respective fundamentals of the metals.

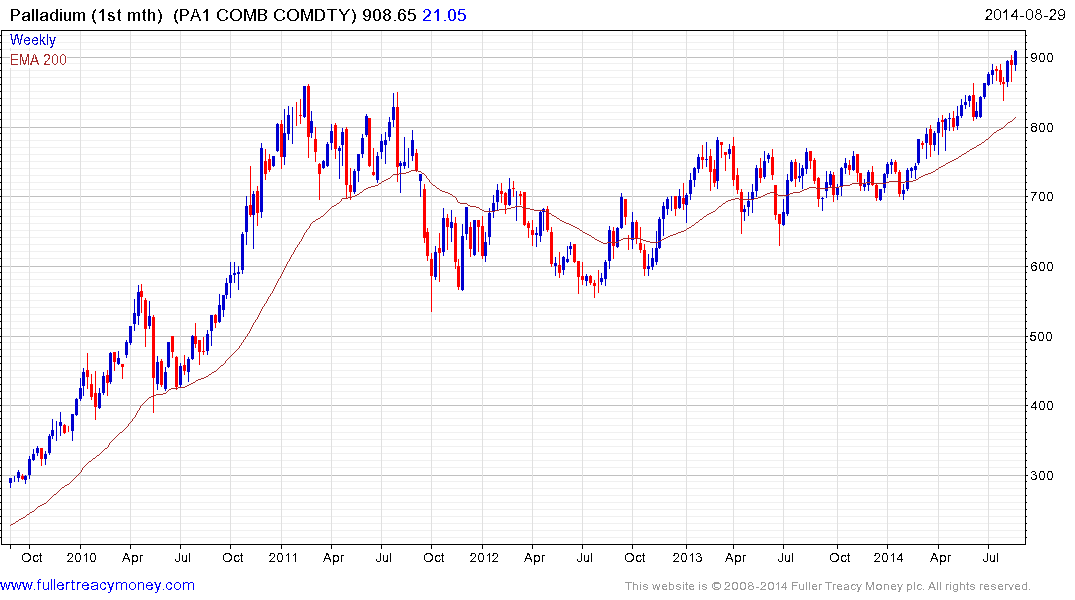

Palladium remains the clear outperformer and remains in a relatively consistent uptrend. The progression of higher reaction lows remains intact as it moves through the round $900 level and a sustained move below $865 would be the minimum required to question the consistency of the advance.

Platinum has been ranging mostly above $1400 since 2011 but the amplitude of the congestion area contracted from 2014 and it encountered resistance near $1500 in July, before dropping to break what had been a progression of higher reaction lows evident since January. It is currently retesting the $1400 area and will need to hold this week’s lows if potential for higher to lateral ranging is to be given the benefit of the doubt.

Rhodium is often used in jewellery as an anti-tarnish material for silver and is the plating used to give white gold its extra white finish, but its use in catalytic converters could represent a major demand driver. The db Physical Rhodium ETC was launched in 2011, has $122 million in assets but is not particularly liquid. It surged in July to break the progression of lower rally highs that has been in place since inception and is currently consolidating that gain. It will need to find support in the region of the 200-day MA to demonstrate demand is returning at progressively higher levels.