PGIM Sees No-Brainer in Betting Against Another Fed Pivot Trade

This article from Bloomberg may be of interest to subscribers. Here is a section:

Investors counting on a Federal Reserve pivot any time soon are bound to get burned again, according to PGIM Fixed Income.

“We’ve seen this movie time and time again,” said Greg Peters, co-chief investment officer at the Newark-based firm, in an interview. “The market gets hyped up on different narratives between inflation releases. I’ve been surprised by it, and we’ve been using it as an opportunity to sell into.”

The firm, which manages assets of $790 billion, sold US Treasuries after a rally earlier this week sparked by speculation the Fed was about to turn more dovish. The market move proved short lived, backing its view that there’s still not enough evidence to suggest policy makers will rein in aggressive interest-rate hikes.

The speculation -- fueled by a smaller-than-expected rate hike in Australia -- drove action across global markets in the first two days of this week, driving down two-year Treasury yields by nearly 30 basis points at one point to below 4%.

Neel Kashkari, who has historically been viewed as a dove, was quoted today as saying "more work to do" on bringing down inflation, and is "quite a ways away" from being able to pause its aggressive interest-rate hikes.

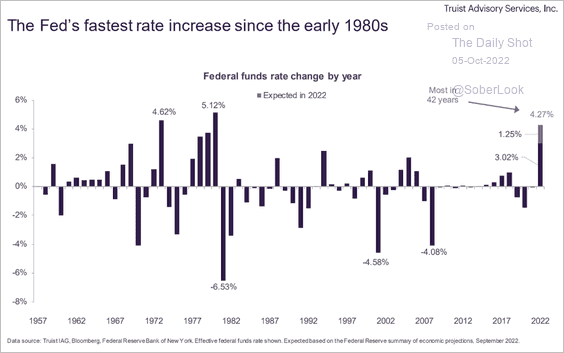

This graphic illustrates how this hiking cycle is similar to the 1974 episode. Prior to the energy crisis, rates had been cut and only began to increase modestly in 1973. In 1974, as inflation ramped higher, rates jumped by 4.62%. The rationale for a pivot stems from the lived experience of the last couple of decades and the response to the end of the oil embargo in 1974, which temporarily eased inflation pressures.

This graphic illustrates how this hiking cycle is similar to the 1974 episode. Prior to the energy crisis, rates had been cut and only began to increase modestly in 1973. In 1974, as inflation ramped higher, rates jumped by 4.62%. The rationale for a pivot stems from the lived experience of the last couple of decades and the response to the end of the oil embargo in 1974, which temporarily eased inflation pressures.

Rates fell between mid-1974 and late 1976 but this easier policy laid the ground for inflation to spike into the end of the decade. That resulted in the infamous response of Paul Volcker to hike rates to 20%.

I have a lot of sympathy with the view the Fed will be constrained from hiking rates into positive real rate territory because economic pain will appear well before that happens. However, they will continue to raise rates until some evidence of demand rolling over is obvious. That’s unlikely until unemployment begins to rise and rents begin to come down.

The decline in month over month house prices is faster than before the credit crisis so that should feed through in rents eventually. The passthrough mechanism will be heavily influenced by supply of rental units.

The decline in month over month house prices is faster than before the credit crisis so that should feed through in rents eventually. The passthrough mechanism will be heavily influenced by supply of rental units.

10-year Treasury yields remains in a consistent uptrend and bounced this week from the psychological 3.5% level. A sustained move below that area is the minimum required to signal a return to demand dominance.

10-year Treasury yields remains in a consistent uptrend and bounced this week from the psychological 3.5% level. A sustained move below that area is the minimum required to signal a return to demand dominance.

The Dollar Index also continues to bounce from the psychological 110 level. Neither of these charts is signalling the Fed is ready to pivot at the November meeting.

The Dollar Index also continues to bounce from the psychological 110 level. Neither of these charts is signalling the Fed is ready to pivot at the November meeting.

Moreover, the boom from tax revenues will soon end, not least because a lot of the gain was from capital gain taxes as investors sold highly appreciated stock. This article from back in June originally appeared in the Wall Street Journal and may also be of interest. That suggests spending plans will need to be curtailed which will be an additional drag on the economy.

.png)

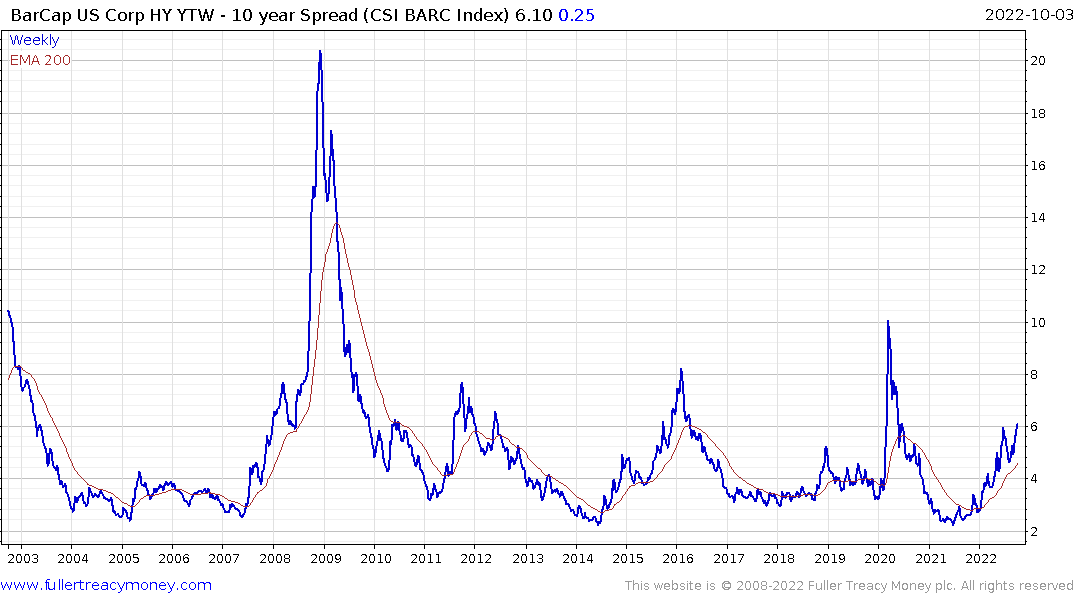

High yields spreads are marching higher and the 10-2-year yield curve spread is as inverted as it was in early 2000. Both of these charts are lead indicators for additional stress in the stock market.

The TED spread is the difference between 3-month LIBOR and the 3-Month Treasury bills. It is still within its base formation which highlights the positive influence of a standing repo facility is supplying money markets with ample liquidity.

The TED spread is the difference between 3-month LIBOR and the 3-Month Treasury bills. It is still within its base formation which highlights the positive influence of a standing repo facility is supplying money markets with ample liquidity.

A topic of conversation I have not seen discussed elsewhere is the values ascribed to Tier 1 capital. Typically, this equates to share capital and the value of whatever reserves the bank retains. Government bonds have experienced a steep decline this year and bank stocks are down about a third from the January peak. Without a recovery in bond prices, banks will have to reduce the quantity of money available for loans which is also sharply deflationary.

A topic of conversation I have not seen discussed elsewhere is the values ascribed to Tier 1 capital. Typically, this equates to share capital and the value of whatever reserves the bank retains. Government bonds have experienced a steep decline this year and bank stocks are down about a third from the January peak. Without a recovery in bond prices, banks will have to reduce the quantity of money available for loans which is also sharply deflationary.

The only reasonable conclusion is a Fed pivot will be in response to a major growth scare/recession and not before.

The only reasonable conclusion is a Fed pivot will be in response to a major growth scare/recession and not before.