Petrobras Said to Seek Contract Extensions at Biggest Fields

This article by Sabrina Valle for Bloomberg may be of interest to subscribers. Here is a section:

The licenses include the three biggest producing fields in Brazil - Roncador, Marlim Sul and Marlim - which pumped 27 percent of Brazil’s total oil and natural gas output in May.

Petrobras started in 2012 a program to modernize infrastructure, increase efficiency and reduce operating costs at platforms in the basin to arrest faster-than-expected decline rates in recent years. The company’s overall output has remained stable since 2010 even amid a rapid expansion in the so-called pre-salt region in deeper waters of the South Atlantic.

Petrobras has been producing in Campos Basin since 1977 and its concessions include large areas where it hasn’t done exploration drilling. Petrobras acquired the licenses where it is seeking extensions in 1998 and has full ownership. Campos Basin provides about 70 percent of Brazil’s oil output.

Fields in the Santos Basin pre-salt area hold larger volumes of reserves and are set to surpass the Campos fields in production in the coming years as Petrobras adds platforms.

Petrobras has spent a great deal of money in its attempts to develop the pre-salt deep water fields that will eventually make it one of the most globally significant oil exporters. The fact that Brazil derives much of its electricity from hydro and has the world’s most efficient ethanol production and distribution system means that as oil production is ramped up, the country will benefit from increased revenue and growth in the petrochemical sector.

The shooting down of an airliner over Ukraine yesterday increases the potential that additional sanctions will be imposed on Russia. For Western governments unaccustomed to the Cold War era mentality of the current Russian administration, the actions of the last six months have been a wakeup call. The threat of more aggressive sanctions is very real.

Since Russia is a globally significant commodity producer, any threat to supply can be viewed as a benefit for other commodity producers such as Brazil, Canada and Australia. Of these three Brazil’s currency has steadied following a sharp pullback and interest in the stock market has been reignited.

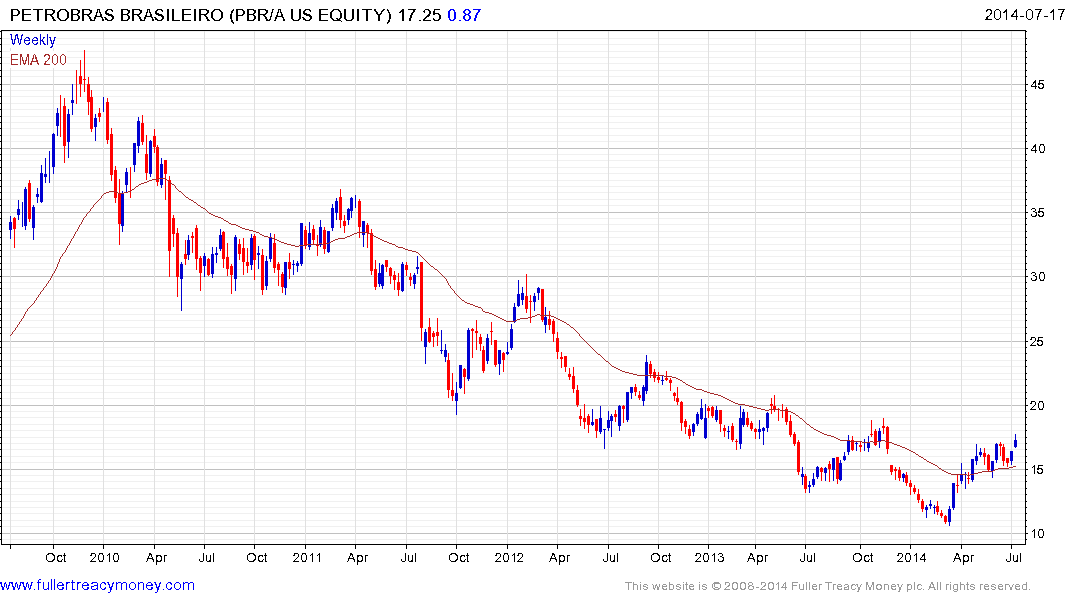

The risk with a company such as Petrobras is that it embarks on another round of capital raising, which would further dilute the equity. The US listed ADR has been ranging above the 200-day MA since April and completed that range today with an emphatic upward break. A sustained move below the MA, currently near $14.50 would be required to question medium-term recovery potential.

VALE continues to firm within its yearlong base.

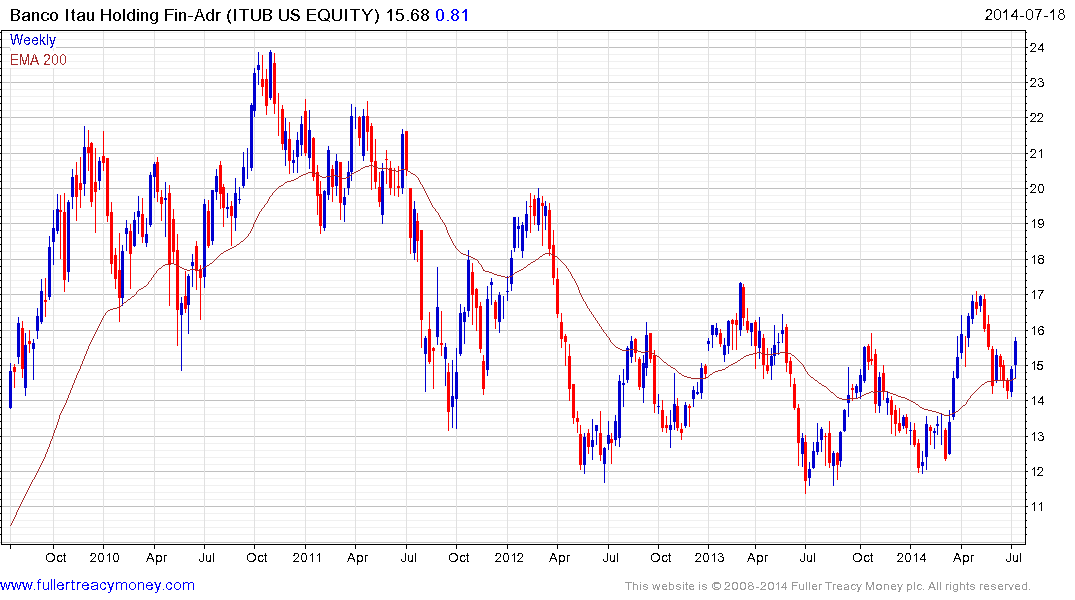

Itau Unibanco has rallied to test the upper side of a two-year base.

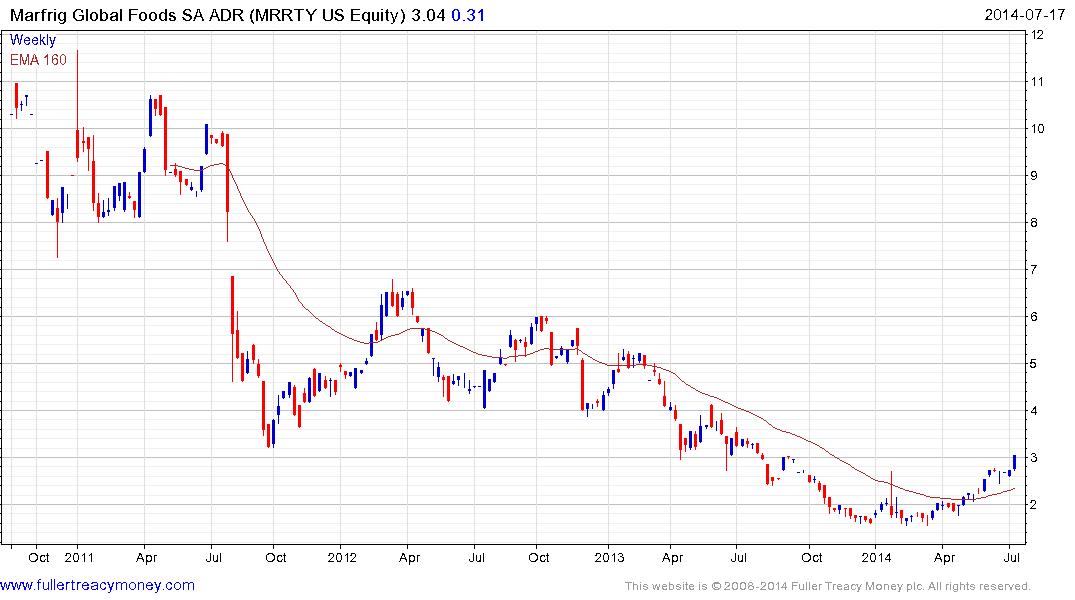

Marfrig is a globally significant meats company. The share bottomed earlier this year and continues to extend its rebound. A sustained move below the 200-day MA, currently near $6.79 would be required to question medium-term scope for additional upside.

Back to top